Chicago Board of Trade Market News

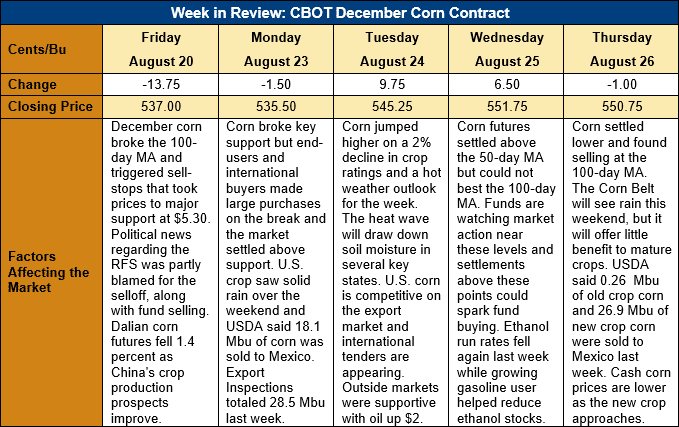

Outlook: December corn futures are 13 ¾ cents (2.6 percent) higher this week after the market rebounded from heavy selling pressure late last week and on Monday. The market briefly broke a major technical support level on Monday, but end users and international buyers stepped up on the break and forced a settlement above that point. That, combined with export sales and growing odds of a La Nina weather event this fall, sparked short covering and fund buying that led the market higher this week.

The latest weather outlooks increasingly call for a La Nina weather event to develop and last through fall/winter 2021/22. This would be the second La Nina in as many years and could once again cause production issues in South America. Typically, La Nina brings drier than normal weather to Argentina and parts of Brazil, a trend that was certainly on display this past growing season. Consequently, analysts are already bracing for smaller crops from Argentina and possibly Brazil for the 2021/22 marketing year. While this outlook is far from certain, the market is wary of any production-cutting event given the already tight world ending stocks forecast by USDA’s August WASDE. One caveat to the La Nina outlook, however, is that current weather models suggest the event will not be as strong as in 2020, which may reduce possible crop impacts.

U.S. corn conditions declined again last week as heat, especially above-average nighttime temperatures, work against the crop. The U.S.-average corn rating was 60 percent good/excellent, down 2 percent from the prior week. The ratings were also down from last year (69 percent) and the five-year average of 66 percent good/excellent. The heat is also accelerating the crop’s maturity, with 41 percent of the crop dented, up 19 percent from last week and above the five-year average of 38 percent. Finally, USDA reported an increase in sorghum conditions following showers across the southern Plains and the good/excellent rating rose 2 percent from last week to 62 percent.

The weekly Export Sales report saw a continuation of the seasonal decline in old crop sales while exports were down slightly (8 percent) from the prior week at 0.76 MMT. Old crop exports are up 57 percent at 66.172 MMT, versus USDA’s August WASDE forecast of 70.488 MMT for the 2020/21 marketing year. Old crop bookings (exports plus unshipped sales) are up 58 percent YTD at 70.342 MMT and total 99.77 percent of USDA’s most recent forecast.

New crop (2021/22) corn export sales rose 34 percent from last week and totaled 684,000 MT. Outstanding new crop export sales total 19.28 MMT, up 58 percent YTD.

From a technical standpoint, December corn futures breached major technical support at $5.30 on Monday but settled 5 cents above that level. The settlement above the support points suggests trade below was a false signal, a fact that this week’s export sales and end-user buying seems to confirm. Traders are watching how the contract behaves near the 50- and 100-day moving averages and a settlement above both is likely to prompt some funds to become buyers again. A settlement above these levels (the 100-day moving average settled at $5.54 ½ on Thursday) could take the market higher to its trading range high near $5.94 ½. Major support still lies at $5.30, and all indications are that December corn will continue to trade this wide range heading into the North American harvest.