Chicago Board of Trade Market News

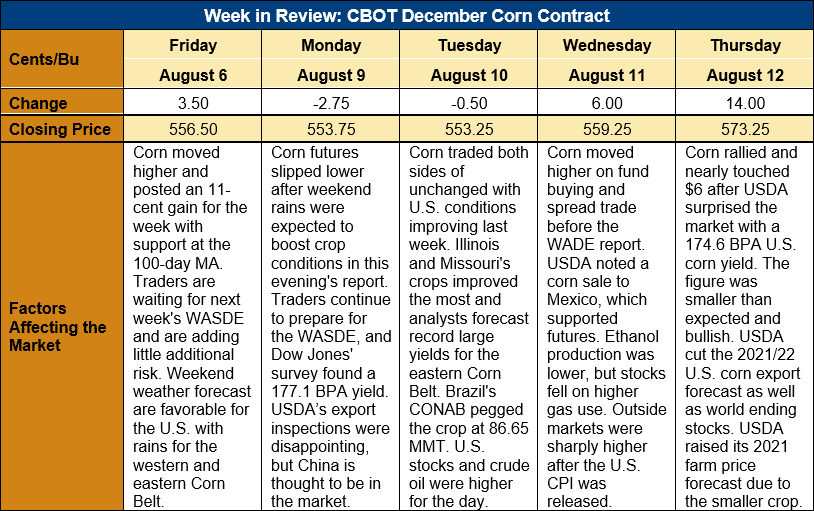

Outlook: December corn futures are 16 ¾ cents (3.0 percent) higher after the market traded sideways all week before rallying sharply after the August WASDE was published. December futures came within 5 ½ cents of the $6.00 mark on Thursday after USDA surprised the market with smaller U.S. yield and production estimates and a tighter global corn outlook. Futures pared gains heading into the close, however, and the December contract settled on the high end of its late-July/August trading range.

Divergent weather conditions for corn crops in the eastern and western U.S. prompted analysts to predict lower yields for western states and near-record yields for areas in the east. Analysts were correct in this approach but underestimated the magnitude of both western crop losses and eastern record yields. USDA forecast record large yields for Illinois, Indiana, and Ohio, but those records were offset by sharply lower production for the Dakotas and Minnesota. Minnesota’s corn yield was forecast down 13 percent from 2020 while USDA said North and South Dakota’s yields could fall 23 and 18 percent, respectively.

In total, USDA estimated the 2021 U.S. average yield at 10.965 MT/ha (174.6 bushels/acre), up 1.5 percent from 2020 but down 2.7 percent from the July estimate. USDA pegged the 2021 U.S. corn crop at 374.67 MMT (14.750 billion bushels), up 4 percent from 2020 but down 3 percent from the agency’s July forecast. USDA’s yield and production estimates were below analysts’ pre-report estimates.

Other notable adjustments to the U.S. corn balance sheet was an increase in 2020/21 ending stocks, due to a lower export forecast for that year. For the new crop (2021/22) USDA lowered feed use due to smaller production and left ethanol use unchanged. The agency lowered the U.S. corn export forecast by 2.54 MMT (100 million bushels), which was a move analysts did not anticipate.

Ending stocks for 2021/22 are forecast at 31.548 MMT (1.242 billion bushels) up 11 percent from 2020/21 levels but down 13 percent from the USDA’s July forecast. The ending stocks-to-use ratio is 8.4 percent, down from the July estimate of 9.6 percent. The tighter carry out prompted USDA to increase the average farm price to $5.75/bushel.

Internationally, USDA cut its forecast of the 2020/21 Brazilian corn crop by 6 MMT from the July report to 87 MMT, due to the drought and frost challenges the safrinha crop faced. The agency also cut Brazil’s export forecast by 5 MMT to 23 MMT and lowered ending stocks, leaving a 5.4 percent stocks-to-use ratio (down from 5.9 percent in July). USDA did not make any changes to Argentina’s 2020/21 corn production forecast but increased the country’s export program 1 MMT.

For the 2021/22 marketing year, USDA decreased world corn production by 8.7 MMT to 1,186 MMT due to smaller U.S. and EU production. The agency increased production prospects for Ukraine, Russia, and Canada, however. USDA lowered world corn imports by 3 MMT and reduced 2021/22 global carry-out 6.5 MMT to 284.6.

Beyond the corn market, USDA increased its projection of the 2021/22 U.S. sorghum crop after raising the 2021 yield forecast 3 percent to 4.446 MT/ha (70.8 bushels/acre). USDA boosted the sorghum crop to 10.389 MMT (409 million bushels) and increased feed and export use by 15 and 3 percent, respectively. Sorghum ending stocks for 2021/22 grew 6 percent from the July estimate and 38 percent from 2020/21 to 0.457 MMT (18 million bushels). USDA increased the average farm price for sorghum 15 cents/bushel to $6.15.

From a technical standpoint, December corn futures have found strong support at the 100-day MA during the past 2 weeks and that point is increasingly important for technical trade. Thursday’s post-WASDE rally sent the market above trendline resistance at $5.78 and the rally triggered buy-stops as it passed that level, $5.80, and $5.90. The market could not continue the rally much above $5.90, however, and profit taking eventually pushed the market well off the day’s highs. December futures settled at $5.73 ¼ – the trading range high formed by the 21 July daily high. The market’s inability to settle above this level or trendline resistance may indicate a return to a sideways trading pattern. The fact futures rallied so sharply on Thursday, however, highlights the market’s upside potential and sharply higher days are seldom bearish.