Chicago Board of Trade Market News

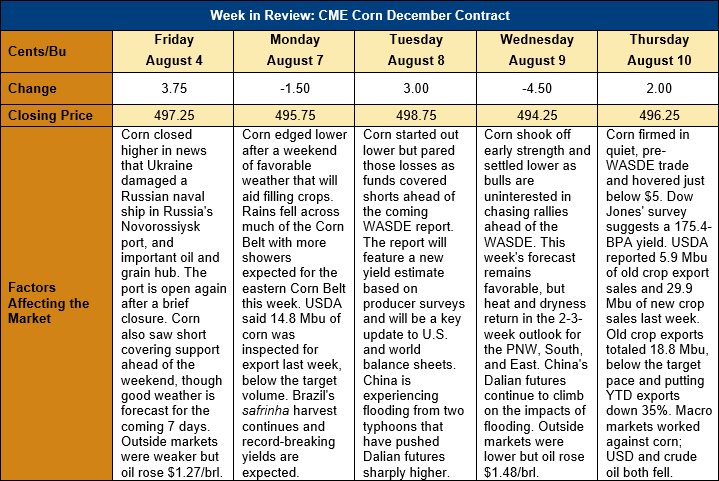

Outlook: Corn futures are 1 cent (0.2 percent) lower this week as the market has turned sideways heading into the August WASDE. After the selloff of two weeks ago, markets have since done little with uncertainty as to the impacts of early hot, dry conditions versus favorable late-season weather. USDA will make an attempt to answer this question on Friday, 11 August with its corn and soybean yield estimates that will be based on large-scale producer surveys.

Heading into the August WASDE, analysts pre-report expectations suggest that USDA is likely to lower the U.S. corn yield from 11.147 MT/ha (177.5 BPA) to 11.015 MT/ha (175.4 BPA), with the lowest estimate coming in at 10.827 MT/ha (172.4 BPA). Combined with the 94-million planted acre estimate, analysts are looking for production of 284.221 MMT (15.126 billion bushels), which would be just shy of the 2016/17 record. Given expectations for the smaller crop, analysts are predicting 2023/24 ending stocks of 55.35 MMT (2.179 billion bushels), which would be down 4 percent from the July WASDE’s forecast and up sharply from the 35.562 MMT (1.4 billion bushels) predicted for 2022/23.

The favorable turn to the U.S. weather in recent weeks has allowed crop conditions to recover. On Monday, USDA said that 57 percent of corn was rated good/excellent, up 2 percent from the prior week. Ninety-three percent of the crop is silking and 47 percent has reached the dough stage with 8 percent starting to dent. These development metrics are all in-line with year-ago and five-year average levels.

Export demand for U.S. corn remains strong with buyers following their typical, seasonal switch to booking new crop positions this time of year. Old crop export sales last week totaled 181.9 KMT and shipments fell 24 percent to 478.4 KMT, which put YTD exports at 37.349 MMT (down 35 percent). New crop export sales rose 117 percent from the prior week to 758 KMT and put YTD outstanding new crop sales at 5.947 MMT (down 26 percent).