Ocean Freight Markets and Spreads

Ocean Freight Comments

The early and abundant rains across Panama have recharged Gatun Lake. The lake is a reservoir for the Panama Canal locks to flush vessels across the isthmus, connecting the Atlantic and Pacific Oceans. With a replenished Gatun Lake the Panama Canal Authority will boost daily transit slots by one to 36 by September. The Authority has all but proclaimed canal operations as normal. This is good news ahead of the Northern Hemisphere’s fall crop harvest and “traditional” export season that generally runs October through December.

The Houthi’s terrorist organization is losing ground to the U.S. and coalition forces. The forces continue to destroy drones and missiles of the Houthis operating in the Red Sea and around the Arabian Peninsula. There have been no confirmed successful attacks by the Houthis for about three weeks. Vessel owners and operators, and shippers remain wary of returning to the shorter Red Sea route between Asia and Europe until the coalition force assures safe passage and the Houthis are marginalized.

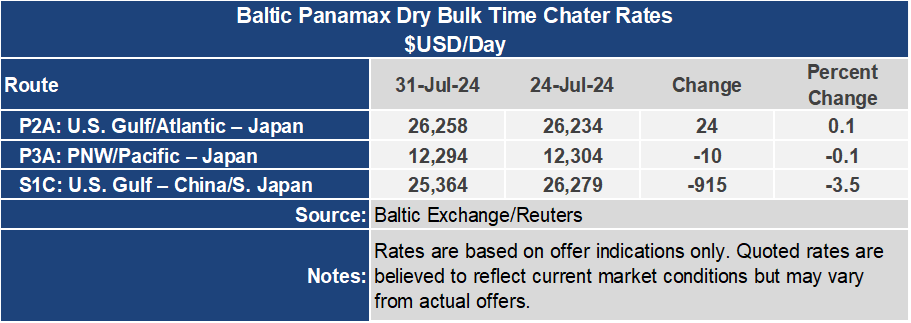

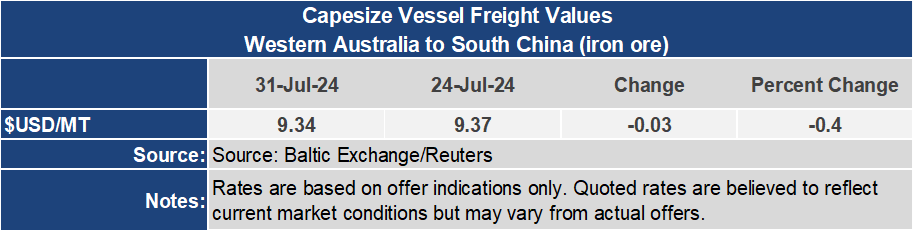

The Baltic Dry Index gave up more ground this past week, dropping 8.4% of 156 points to an index of 1,708. Compared to one year ago the BDI is 52% higher this year. The Capesize market pulled the BDI lower, dropping 15.2% or 426 points to a three-month low of 1,808, and is 31.5% higher than one year ago. The Panamax and Supramax markets tried to hold on but felt peer pressure dropping 1.5% and 1.6%, respectively, for the week. The BPI ended the week at 1,739 and is 60.7% above the index level one year ago. The BSI ended the week at 1,363 and is 94.7% above levels one year ago. The smaller vessel sizes are trying to hold ground maintaining their lofty levels over the year. However, dry bulk ocean freight rates are holding a rangebound trajectory, not really breaking out one way or another.

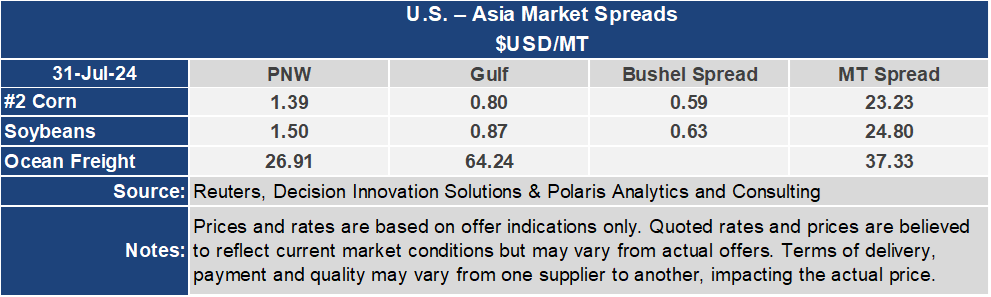

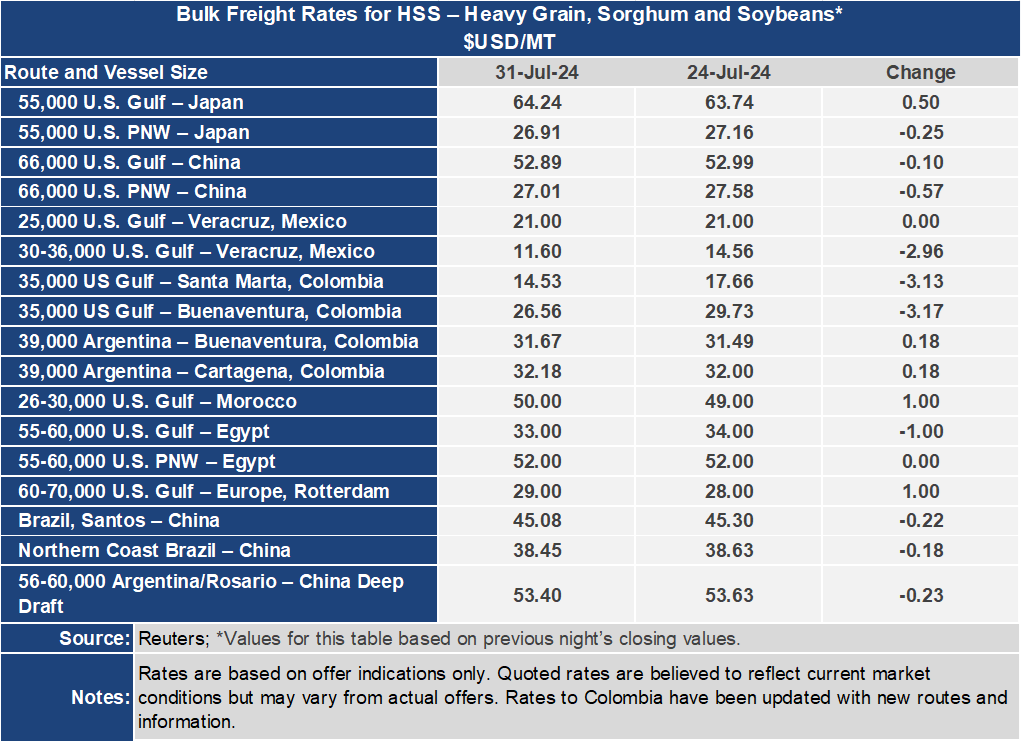

The U.S. Gulf to Japan route was up $0.50 per metric ton on the week to $64.24 per metric ton while the route from the Pacific Northwest lost $0.25 per metric ton to $26.91 per metric ton. The spread between these two routes widened 2.1% or $0.75 per metric ton to $37.33 per metric ton. This is the widest this spread has been since April of this year. Last week the grain routes from the U.S. Gulf to Mexico and Colombia were firmer but this week made an all stop and reversed course. The Gulf to Veracruz rate dropped $2.96 per metric ton while to Buenaventura, Colombia dropped $3.17 per metric ton to $26.56 per metric ton.