Chicago Board of Trade Market News

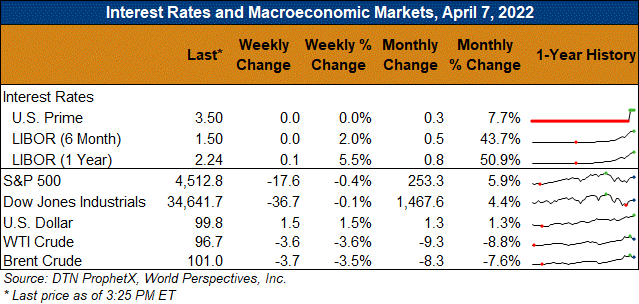

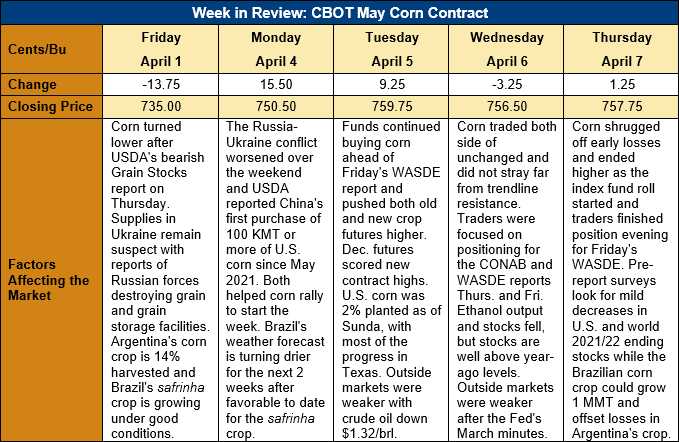

Outlook: May corn futures are 22.75 cents (3.1 percent) higher this week after Monday and Tuesday saw strong fund buying and a somewhat delayed reaction to last week’s USDA reports. U.S. export activity has picked up again this week, which helped support early-week trade. Futures trading volume slowed down Wednesday and Thursday, however, as traders prepared for the CONAB and USDA WASDE reports. The index fund roll also started on Thursday, which started to influence spread trade.

The market is looking forward to USDA’s April WASDE, which will offer updated old crop demand estimates. On average, analysts expect world 2021/22 corn ending stocks to be steady/down slightly from March at 300.7 MMT. In the U.S., analysts are looking for a 1.02-MMT (40-million-bushel) reduction in old crop ending stocks, based on the data from the March Grain Stocks report. Pre-report expectations suggest recently favorable conditions for Brazil’s winter corn crop (safrinha) could push production from that country 1 MMT above the March estimate to 115 MMT. Conversely, Argentina’s crop is expected to fall 1.1 MMT to 51.9 MMT. Overall, however, the report is largely expected to confirm the status quo, and major adjustments will likely wait until May, when USDA issues its first look at new crop fundamentals.

The USDA’s first Crop Progress report of the year found 2 percent of the U.S. corn crop is seeded to date, in-line with the average pace for this time of year. Most of the planting effort has been conducted in the southern part of the U.S. (Texas, Louisiana, and Georgia, among others) so far, as is typical. USDA noted 13 percent of the sorghum crop and 5 percent of the barley crop were also seeded and both figures were near their respective five-year averages.

U.S. corn export sales rebounded from last week with exporters reporting 0.782 MMT of net sales (up 23 percent week-over-week). Weekly exports fell 13 percent to 1.633 MMT, putting YTD exports at 33.81 MMT, down 6 percent. YTD corn export bookings (exports plus unshipped sales) are down 18 percent at 54.44 MMT but account for 85.7 percent of UDSA’s current forecast with five months left in the 2021/22 marketing year.

From a technical standpoint, old crop futures are grinding sideways with choppy, low volume trade. New crop futures rallied and posted new contract highs earlier this week based on the smaller-than-expected corn acreage estimate from the Prospective Plannings report. Bear old crop/new crop spreading has been a popular trade this week which has helped tighten the inverted forward curve. Commercials remain active buyers on breaks while funds continue to hold a historically large long position in corn and other CBOT ag products. This, combined with fundamental uncertainty over the South American crops, impacts of the Russia-Ukraine war, and the U.S. acreage mix will likely keep markets interesting heading into summer.