Chicago Board of Trade Market News

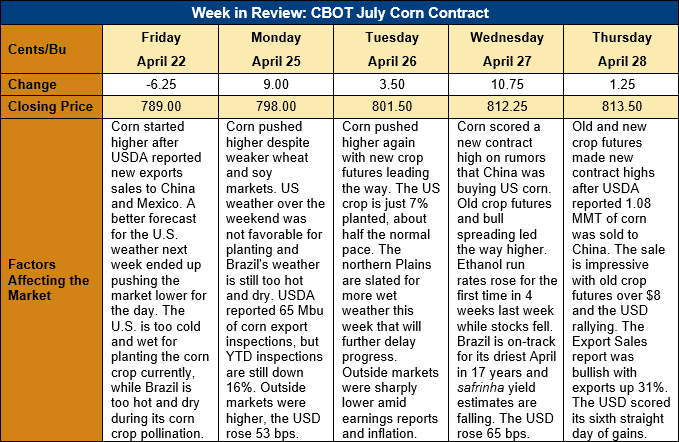

Outlook: July corn futures are 24 ½ cents (3.1 percent) higher this week and posted a new contract high on Thursday. USDA’s report on Thursday of 1.08 MMT of corn being sold to China helped push futures higher, as did a bullish Export Sales report. The market has also been adding “weather risk” premiums in light of cool, wet conditions in the U.S. that are delaying planting progress and the intensifying drought affecting Brazil’s safrinha crop.

U.S. farmers planted 7 percent of their expected 2022 corn crop through Sunday, roughly half of last year’s pace and the five-year average progress rate. Cool, wet weather, particularly in the northern Plains and western Corn Belt has delayed fieldwork to date and the two-week outlook offers little relief. Of note is the fact that Illinois’ corn planting is 12 percent behind its average rate and Indiana and Iowa lag their normal pace by 6 and 5 percent, respectively.

The Brazilian safrinha corn crop is approaching its peak pollination period with dry, warmer-than-average weather forecast for the central and northern part of the country. Brazil is on-track to experience its driest April in 17 years with the drought especially notable in the state of Mato Grosso. Mato Grosso produces approximately 45 percent of the country’s safrinha crop and 35 percent of Brazil’s total corn production, according to data from CONAB. The drought has prompted private analysts to start paring back yield and production forecasts. The USDA’s April WASDE estimated the Brazilian corn crop at 116 MMT, but private estimates are now ranging from 112-115 MMT.

U.S. corn export sales were essentially steady with the prior week (down 1 percent) with exporters reporting 0.866 MMT of net sales. Weekly exports increased 31 percent to 1.562 MMT and brought YTD exports to 38.132 MMT, which is down 8 percent from this time last year. YTD corn export bookings total 57.515 MMT, down 15 percent.

From a technical standpoint, July corn futures are rallying from a mild pullback that occurred late last week. The brief decline in values attracted end-user and importer buying that helped create this week’s push to new contract highs. Funds continue to add to their already large long position in corn and have been active buyers on breaks. July corn has trendline and psychological support near $8.02, followed by long-term trendline support at $7.49. There’s an old traders’ saying that “new highs beget new highs”, and this week’s rally looks like corn may follow that advice and continue grinding higher.