Chicago Board of Trade Market News

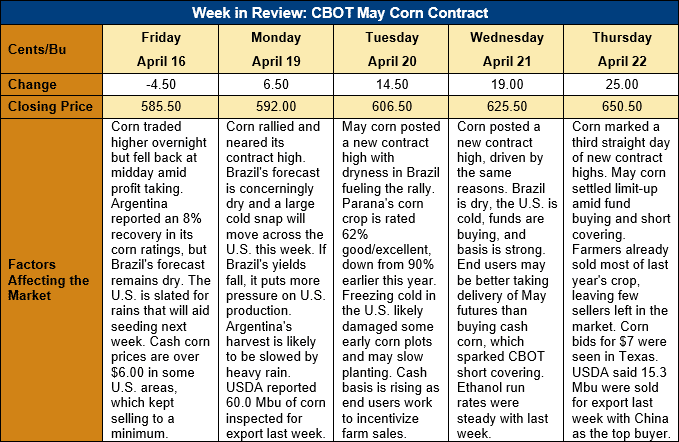

Outlook: May corn futures are 65 cents (11.1 percent) higher this week and posted a new contract high of $6.50 ½ on Thursday afternoon. Funds have been large net buyers this week and short traders have been forced to cover their positions, further fueling the rally. U.S. cash basis and prices remain historically strong, which has supported bull spreading in corn futures and short covering ahead of first notice day for May futures. Fundamentally, weather concerns for the U.S. and Brazil have also prompted buying as production risks increase for both countries.

This week’s corn market rally was partly sparked by continued dry weather forecast for Brazil heading into May. The Brazilian safrinha crop was planted later than usual and has since been subjected to dry conditions, particularly in Southern Brazil. Earlier this week, the state government of Parana, Brazil said 62 percent of the crop was rated good/excellent, down from 90 percent earlier in the crop year. Weather forecasts continue to call for dry weather across southern and parts of central Brazil into early May. The dry forecast comes as much of the crop will enter the key yield-defining pollination stages. May also marks the start of Brazil’s dry season, which suggests opportunities for drought-reversing rains may be more limited.

U.S. cash corn prices and basis levels remain historically strong. The average basis bid hitting -8K (8 cents under May futures) this week, down 1 cent from last week but above the -66K registered this time last year. In some areas, basis levels are event stronger and Central Illinois basis is reported to be bid 35-40 cents over May futures this week.

The strong basis is creating conditions where some end-users would be better off to stand for delivery in May futures than buy corn in the cash market. This is making short sellers nervous and prompting them to exit their position before first notice day on 30 April. This, combined with small or nonexistent farm/commercial selling, has created a large rally in May corn futures with relatively limited trading volume. Bull spreading has also been a dominant feature of the CBOT this week.

Funds were closely watching these developments and quickly emerged as strong net buyers this week. Tuesday’s push to a new contract high set up a bullish technical outlook, and Wednesday’s settlement above $6.00 only strengthened the view. Thursday marked the third consecutive day of new contract highs and the market settled at its limit bid (the highest price allowed for the day by the CBOT). Funds are thought to hold a record large long position in the corn market currently, and Friday’s Commitment of Traders report from the CFTC will give some insight into managed money traders’ position.

Technically, charts remain solidly bullish for May and July corn with momentum indicators trending higher amid pushes to new contract highs. The Relative Strength Index does not indicate the markets are overbought and end-user pricing/technical support continues to “scale up”. Both are signs that the rally is likely to continue. On the long-term weekly continuous active contract chart for corn futures, the next technical resistance level is $6.83 ½ – the 17 June 2013 weekly high. Thursday’s settlement above $6.50 means the market has cleared one more hurdle on its possible ascent to this next resistance level.