Chicago Board of Trade Market News

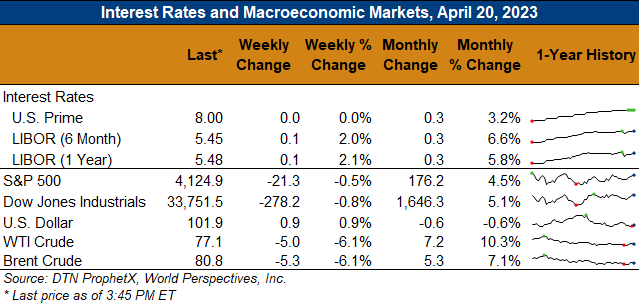

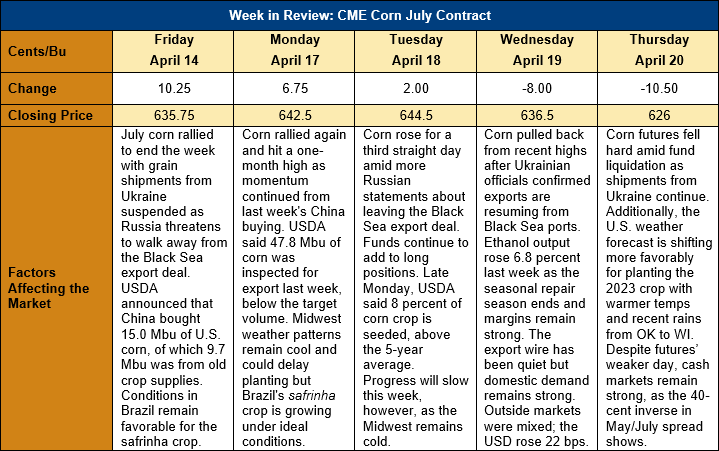

Outlook: July corn futures are 9 ¾ cents (1.5 percent) lower this week after losses on Wednesday and Thursday erased the prior three days’ gains. Concerns about global grain supplies increased late last week after Black Sea shipments of Ukrainian grain were suspended amid conflict between Ukrainian officials and Russian inspectors. That helped corn and other grain markets rally into the weekend, but this week’s resolution of the issues and resumption of shipments has pushed futures lower. Fundamental inputs remain light for now with the biggest factors still being old crop exports and the weather forecast and planting efforts for the new crop.

A big focus for the market right now is the U.S. spring weather outlook and how it could impact the corn planting effort. Currently, eight percent of U.S. corn has been seeded so far, with nearly all the progress in the southern U.S. This pace is slightly above the five-year average for mid-April of 5 percent and is a new five-year high. The current weather forecast, however, calls for cooler temperatures across the Midwest this week and next that will delay soil warming and possibly planting. Currently forecast precipitation levels do not look like they will hinder fieldwork, however, and recent model runs have been shifting slightly drier (i.e., more favorable for planting) in the 10-15-day outlook. Typically, cool and wet weather in the spring creates significant planting delays but the current outlook for cool but (mostly) dry weather suggests delays for the 2023 crop could be minimal.

U.S. corn export sales are following their seasonal pattern and fell from last week’s volume as gross sales totaled 0.635 MMT. Exports are heading into their seasonal peak and were up 42 percent from the prior week with 1.298 MMT shipped. YTD exports now total 22.59 MMT (down 38 percent) while YTD bookings (exports plus unshipped sales) total 38.051 MMT (down 33 percent). YTD bookings account for 81 percent of USDA’s projected exports with roughly four and a half months left in the marketing year.

U.S. cash corn prices and basis remain strong across the Midwest with demand from the ethanol sector increasing as the seasonal maintenance shutdown period ends. Ethanol output rose 6.8 percent last week and the weekly corn grind was 2.2 Mbu above the volume needed to keep pace with UDSA’s latest use projections. In response, corn basis is averaging 30 cents over July futures (30N) this week, down slightly from the prior week but well above the -20N recorded this time last year.

July corn futures again found technical resistance at the 100-day moving average ($6.45) this week and that pressured values in late-week trade. The contract is, however, still trending higher with trendline support at $6.22, which is where Thursday’s lows were posted. If the supporting trendline holds heading into the weekend, the market will likely continue to move higher and re-test the 100-day MA. Conversely, a break below the trendline would suggest futures are entering a sideways trading pattern. Funds remain long corn but have recently been paring back position sizes amid more favorable spring weather outlooks.