The COVID-19 pandemic is changing the markets and our working situations on a day-to-day basis – but what is not changing is the U.S. Grains Council’s commitment to you, our members’ valued customers.

The Council’s staff worldwide are committed to providing you the service and market information you have come to expect from us during this time. While we are teleworking, we remain ready to assist you and encourage you to contact us as issues or questions arise.

The Council wishes all our customers around the world good health and safety during this trying time.

Chicago Board of Trade Market News

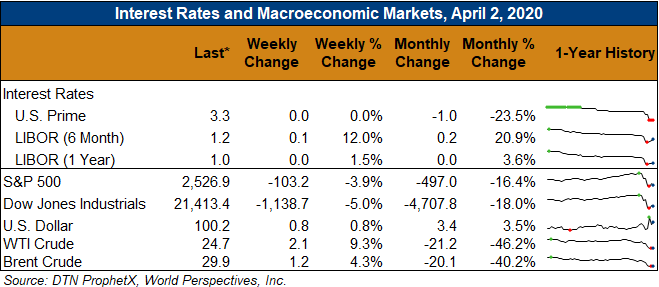

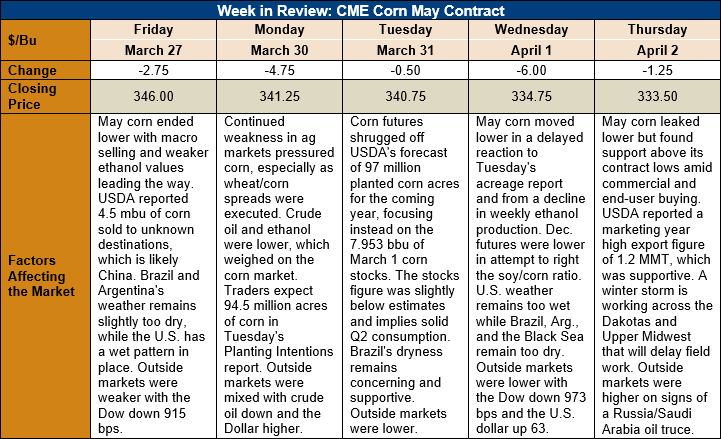

Outlook: May corn futures are 12.5 cents (3.6 percent) lower this week following USDA’s Planting Intentions and Grain Stocks reports. The planting figures surprised many in the market with a forecast of 97 million planted corn acres for 2020. If realized, that figure will be 7.29 million acres (8 percent) above the 2019 acreage. The report was initially viewed as a bearish surprise, which has led to pressure on December futures this week.

While the acreage figure was bearish, USDA’s quarterly Grain Stocks report was more supportive for the market, especially nearby futures. The report featured March 1 stocks of 7.95 billion bushels of corn, which was down 8 percent from the prior year. On-farm storage totaled 4.45 billion bushels, a decrease of 13 percent from the prior year. As a percent of total stocks, on-farm storage reached 54 percent, down from 60 percent in the 2019 report. That later figure suggests that the strong cash basis levels of this spring were the result of tighter overall supplies, not just slower farm sales.

The weekly Export Sales report featured 1.162 MMT of gross corn sales and 1.075 MMT of net sales this week. The net sales figure was down from the prior week but was overshadowed by a 49 percent weekly increase in corn exports. USDA reported exports of 1.258 MMT – a marketing year high – which brings YTD exports to 18.306 MMT. YTD bookings now stand at 31.907 MMT, down 26 percent from this time last year.

Cash corn values are lower across the U.S. this week with the average basis level remaining steady at 25 cents under May (-25K) futures. Basis has been steady since last week, despite a 4 percent decrease in cash corn prices. Barge CIF NOLA values are down slightly this week as logistics improve while FOB NOLA offers are steady amid a pickup in international demand. International buyers are accelerating purchases after the corn market’s recent move lower.

While corn prices have been steady, sorghum values have not. Strong international demand has continued to pull spring export offers for the product sharply higher, with FOB NOLA offers hit 180 cents over May corn futures (180K) this week. Last week, FOB NOLA offers were 145K. FOB Texas gulf prices have increased substantially as well, hitting 160K this week.

From a technical standpoint, May corn futures have moved closer to their contract lows but have uncovered strong commercial and end-user buying as they near that point. This has kept the market from posting new contract lows and is turning the market into a sideways trading pattern, rather than a trend lower. December futures have moved lower following USDA’s 2020 acreage forecast but posted a technical “hook reversal” on Thursday, which may signal buying interest/market strength returning. Looking forward, the acreage figure was bearish, but USDA has a tendency to lower its planted area forecasts in later reports. This has many in the industry thinking that the 97-million-acre forecast is the largest that will be predicted this year. Consequently, there is growing sentiment that December futures may have overshot their true value to the downside.