Ocean Freight Markets and Spreads

Ocean Freight Comments

The Houthis continue their attacks on vessels sailing through the Red Sea, the Gulf of Aden, the Arabian Sea, and the Indian Ocean. The attacks by the Houthis are on vessels heading to Israel. In the meanwhile, Iran’s Revolutionary Guard seized an MSC containership in the Strait of Hormuz late last week, hours ahead of Iran’s direct attack on Israel. The Somali pirates remain active trying to show their capability and importance to be part of the action. The Persian Penisula is fraught with uncertainty and risk. Vessel owners and operators are monitoring the situation closely, discussing war risk options with their insurance providers while using alternative routes to connect Asia and Europe and other routes. The freight markets have adjusted to the alternative routings with freight rates stabilizing. The Houthis and Iranians vow to continue their terrorist attacks until Israel enters a cease-fire or Gaza is freed.

Water levels are a concern on the Parana-Paraguay River System in Argentina. The levels have fallen to less than one meter at the Port of Villeta, which was more than five meters one year ago. Waterborne equipment is being light-loaded, impacting flows to the export market.

In the United States water levels in the Mississippi River have recovered from last year’s low water conditions. The industry together with the U.S. Army Corps of Engineers and U.S. Coast Guard are monitoring seasonal highwater conditions, that so far, have been manageable. Navigation on the Mississippi River has full draft capabilities.

The water levels of Panama’s Gatun Lake remain steady at 80.2 feet as of April 17 and are expected to maintain this level until late May. Panama’s rainy season starts in May and continues through November. A possibility of a La Nina could mean Panama will break out of its drought situation. The variable fresh water surcharge is 3.27%. Gatun Lake is a critical storage basin for water used to lock vessels across the Canal Zone between the Atlantic and Pacific Oceans. Dry bulk vessel transits are unchanged with one or two per day. The Panama Canal Authority is allowing up to 27 vessels to transit the isthmus each day, down from 36 normally.

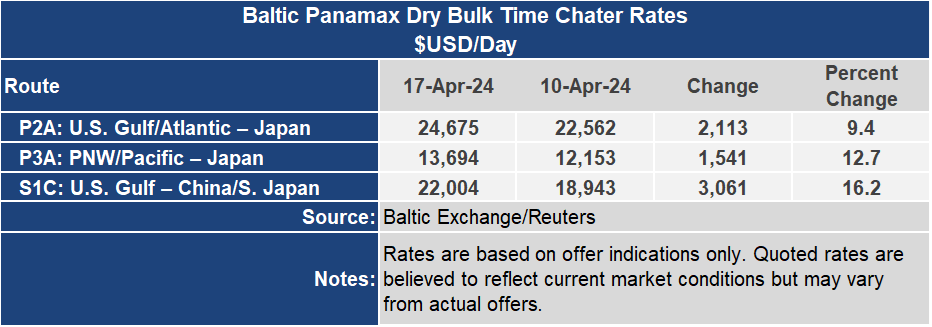

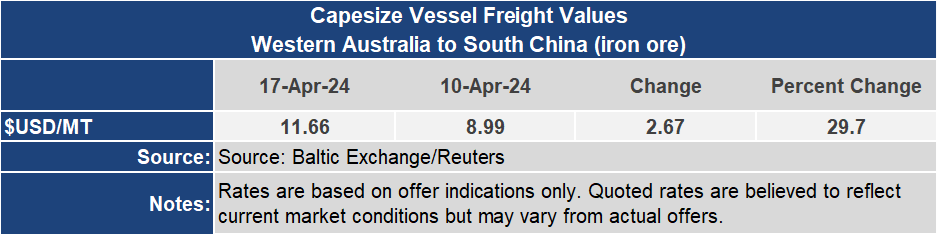

The Baltic Dry Index turned positive this week after falling for three consecutive weeks. The dry sector is being supported by improved demand for Capesize and Panamax vessels. The Panamax sector is firming on improved grain shipments out of South America that more than offset weakened mineral exports from the same region. The BDI gained 257 index points or 16% for the week to 1,844. The BDI was at its highest level since March 27, 2024. The Baltic Panamax Index ended the week 11% higher to 1,805 while the Baltic Supramax Index was up 6% to an index of 1,337.

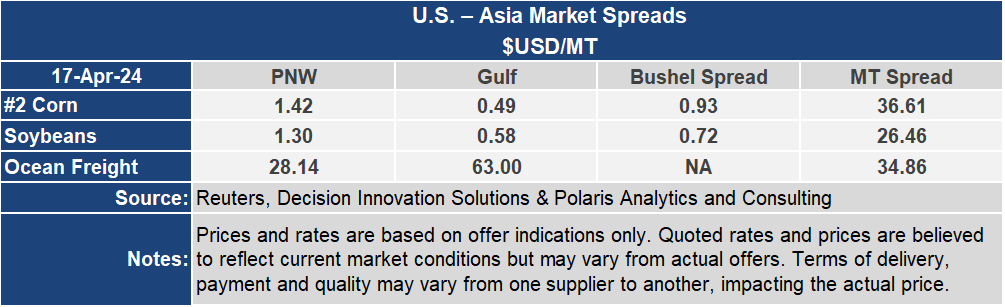

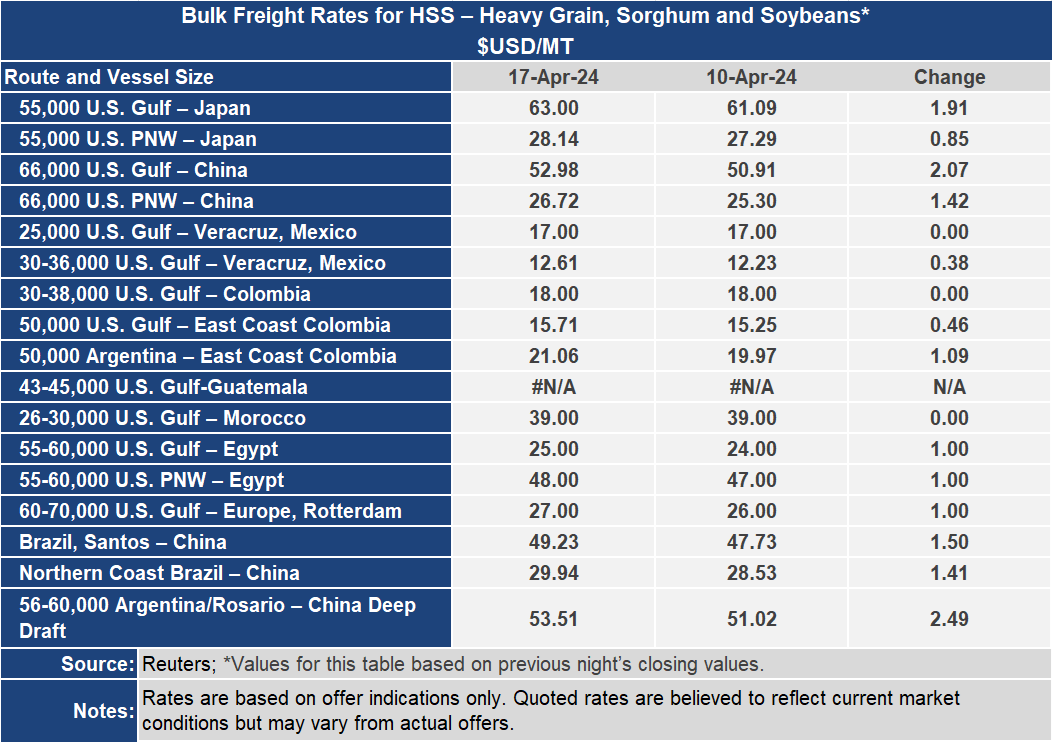

The strength of the dry indices flowed over to voyage rates. For grain shipments out of the U.S. Gulf to Japan, the freight rate ended the week up 3% or $1.91 per metric ton higher for the current week to $63.00 per metric ton. Out of the Pacific Northwest, the rate to Japan was up 3% or $0.85 per metric ton to $28.14 per metric ton. The spread between these routes ended the week at $34.86 per metric ton, an increase of 3% or $1.06 per metric ton.

Container freight rates for cargo destined to the United States from the Far East continue to fall, down 31% from this year’s peak in February to an index of 3,318 through April 15, 2024. The backhaul rates from the U.S. to the Far East are taking different paths. The West Coast index is up 15% from the lows posted in January this year to an index of 789, while out of the East Coast, the index is down 12% from the recent high in February to an index of 430.