Chicago Board of Trade Market News

Outlook

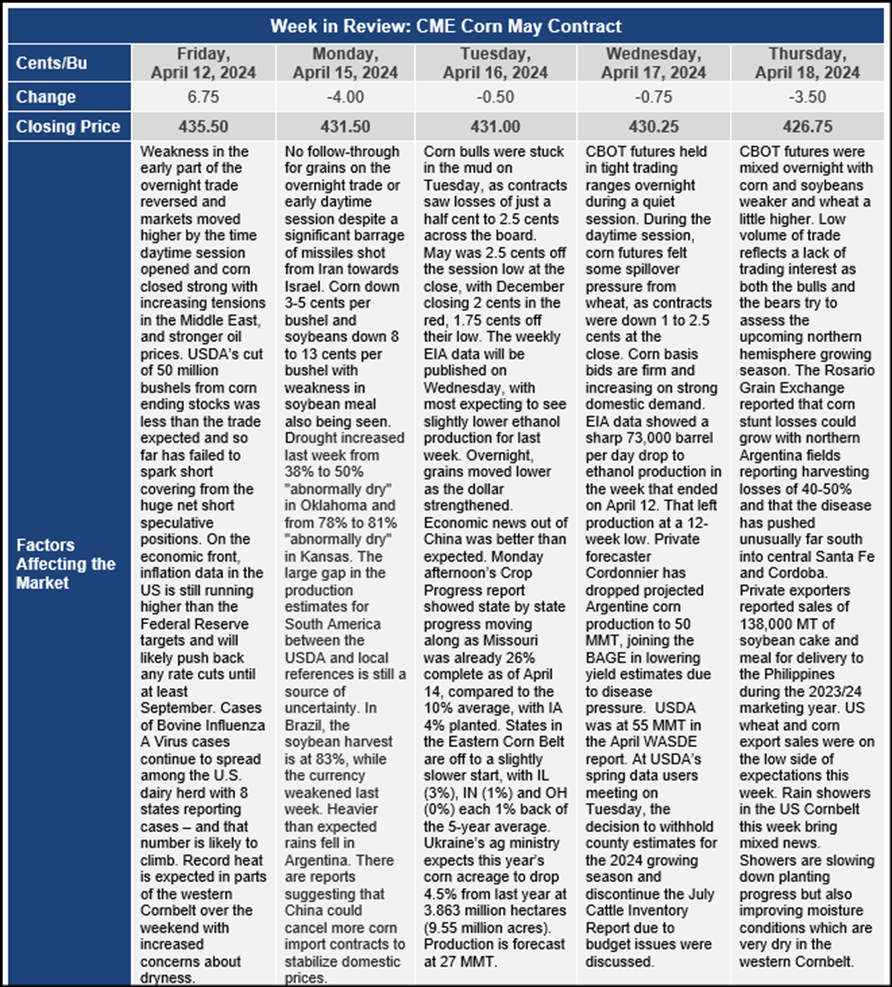

In corn, the World Board increased both feed and ethanol demand by 25 million bushels this month. Given the strength of the U.S. economy, ethanol demand could show further strength. Both feed and fuel demands may have been short-changed by another 25 million bushels and if that demand emerges it could send corn’s old-crop stocks below 2.1 billion bushels. However, the focus is now on the upcoming U.S. planted area and yield trend. The Eastern Cornbelt (ECB) has had some recent rains slowing its plantings while the Western Cornbelt (WCB) has been dryer. The pace of U.S. 2024 planting will be market factors with the ECB being slowed by numerous showers last week. Another hefty rain event arrived on Tuesday for Iowa, Illinois and progressed east this week. Rain in the western Cornbelt will slow the pace of planting for a few days but the rains are alleviating some of the concerns about top soil moisture conditions in the western Cornbelt which were getting very dry.

Reducing the U.S. 2024/25 corn output & U.S. carryover supplies back towards the 1.5 billion bushel level will be needed for a dramatic improvement in corn’s longer-term price outlook. Corn’s cash basis rise into plus territory suggests that U.S. ethanol and feedlot demand are looking for supplies ahead of the U.S. planting season.

South America’s crop conditions, particularly in Argentina and Brazil’s second crop corn and the U.S. plantings will be big price factors going forward. Brazil’s safrina corn output needs rain into May to achieve the USDA’s 124 mmt outlook. A recent rain across Mato Grasso, Gioia, MGDS & Parana after a sparse couple weeks is a positive, but this year’s late double-crop corn seeding means moisture is needed through mid-May for a strong output. The recent reports about Argentina’s corn issues aren’t as positive about their 2024 output as initially forecast. This suggests their available world supplies could be curtailed.

Mideast tensions could be an ongoing source of volatility if the conflict expands beyond the events of last weekend. Ukraine’s recent export activity has rebounded back to 2023 grain corridor levels. This is a positive for them moving exports down the west side of the Black Sea. Overall, political tensions will continue to be a market factor across the world going forward.

U.S. trade representative Katherine Tai said her office is pushing for Brazil to remove its 18 percent tariff on imports of U.S. ethanol; there is no duty on Brazilian ethanol entering the United States.

Mexico’s surging demand for imported corn remains a contributor to U.S. corn supply and demand fundamentals. Mexico is just beginning a cycle of large corn imports which is likely to continue for several more years, and possibly longer, if Mexican weather conditions fail to improve. USDA in its April report raised 2023/24 Mexican corn imports by 500,000 MTs to a record 21.2 MMTs. This follows guidance from the USDA attache’ in Mexico that suggested 2023 production in Mexico had been overstated. U.S. export commitments to Mexico as of April 4, 2024, totaled 735 million bushels, up 190 million bushels (35%) from last year. USDA is expected to raise Mexican corn imports in crop year 2024/25 by another 1-2 MMTs. Total U.S. corn exports could be raised by 50 million bushels in upcoming reports based on the strength of exports to Mexico.