To update major grain buying groups and end-users in Latin America on the outlook for the upcoming U.S. corn crop and the current market situation, the U.S. Grains Council (USGC) participated in the virtual Agroeducación Conference on May 6, sponsored in part by R.J. O’Brien, an independent futures brokerage firm based in the United States.

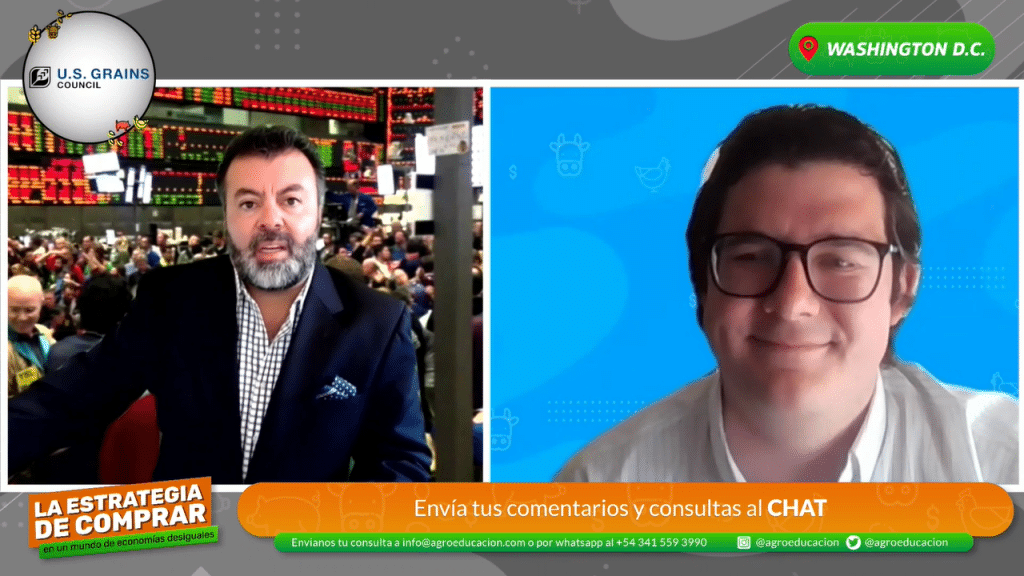

Titled “La estrategia de comprar en un mundo de economías desiguales” – “Buying strategies in a world of inequal economics” – Reece Cannady, USGC manager of global trade, offered the update, highlighting reasons for escalating feed costs.

“The interest of the participants was very much aligned with the interests of all end-users and importers around the world,” Cannady said. “Rising feed costs have put certain markets in a bind—at some point the consumer can no longer support these costs—and I think there is a bit of concern among feed millers around the world, particularly those in emerging markets where meat consumption is a little more elastic.”

Price risks and how feed millers can manage them on both short- and long-term timetables were topics common to all presentations. In addition to Cannady, forward-focused speakers from Agroeducación, the CME Group and R.J. O’Brien, among others in the States, Argentina and Peru addressed supply chain concerns and the tactics that can be employed to overcome them while maintaining profitability.

“I think the message was pretty clear to the participants,” Cannady said. “The road ahead is bumpy and perhaps unclear, but it doesn’t mean there aren’t risk management strategies that can serve end-users and allow them to be profitable.”

Along with many other commodities like lumber and copper, agricultural raw materials have been steadily trending upward with volatility increasing in recent months. July corn futures have increased by 51 percent since the start of 2021, and July soybean futures have increased by over 26 percent during the same timeframe, thrusting already rising feed costs into the global news spotlight.

“At this point, export demand seems to remain strong, which is surprising given the prices,” Cannady said. “Currently, there really aren’t a whole lot of great prospects for lower prices to the end-user until the U.S. crop comes off in the fall, so this year’s crop is perhaps as anticipated and needed as the 2013/2014 crop was.”

More than 700 participants logged in to the conference recorded in Buenos Aires, Argentina, and broadcast around the world via a YouTube livestream.

About The U.S. Grains Council

The U.S. Grains Council develops export markets for U.S. barley, corn, sorghum and related products including distiller’s dried grains with solubles (DDGS) and ethanol. With full-time presence in 28 locations, the Council operates programs in more than 50 countries and the European Union. The Council believes exports are vital to global economic development and to U.S. agriculture’s profitability. Detailed information about the Council and its programs is online at www.grains.org.