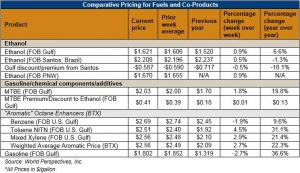

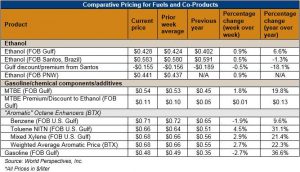

1. Ethanol, Fuels and Co-Product Pricing

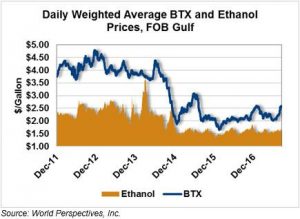

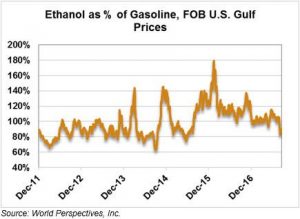

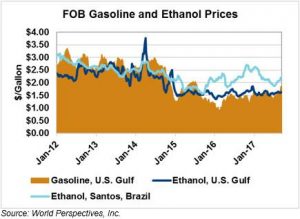

Market Outlook: Ethanol markets are stronger for the second consecutive week. Markets finished last week with a strong tone as traders sought to complete trades during the U.S. holiday-shortened week. That pricing strength has carried over to the present week, despite a softening gasoline market.

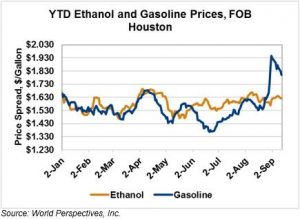

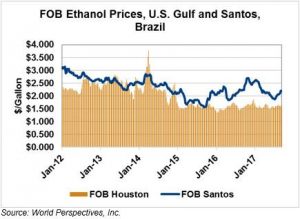

CBOT ethanol futures are up 4.5 cents/gallon (1.19 cents/liter) to start the week as production margins remain positive. Wholesale rack prices in the U.S. are mixed but generally with a stronger tone; the national average price is 0.62 cents/gallon (0.16 cents/liter) higher this week than last. Hurricane Harvey’s short-run impacts on the Gulf economy are largely finished, allowing FOB Houston prices to ebb accordingly. FOB Houston prices are 1.75 cents/gallon (0.462 cents/liter) lower this week than last.

In Brazil, ethanol prices are stronger to start this week with FOB Santos offers touching $2.21/gallon ($0.584/liter). The Brazilian market is recovering from a sharp selloff early last week and today’s prices are 5.3 cents/gallon (1.4 cents/liter) lower than one week ago. FOB Santo’s prices have been trending steadily higher since early July and are expected to continue rising.

The rising prices in Brazil moved the FOB Houston/FOB Santos ethanol price spread to more heavily favor U.S.-origin product this week. The spread, currently quoted at -59.35 cents/gallon (-15.679 cents/liter), widened 4 cents/gallon (1.1 cents/liter) from Friday’s close during Monday and Tuesday’s trading. Houston ethanol has historically traded at a price discount to those of Brazil, except during short-lived market anomalies. In early 2017, the spread hit 5-year lows when it touched -$1.08/gallon (-28.5 cents/liter). While the spread has narrowed since then, U.S. Gulf ethanol still retains an above-average discount to Brazilian prices.

Petroleum markets are cautiously softer this week as Hurricane Harvey’s impacts dissipate but those of Hurricane Irma are yet to be judged. Gasoline prices are 11-14 cents/gallon (2.9-3.8 cents/liter) lower this week but are near their two-year highs. WTI crude oil futures are down 42 cents/gallon (11 cents/liter) to start the week while Brent crude oil futures are up 89 cents/gallon (23.5 cents/liter) from last week.

International Developments

Vietnam: The Ministry of Finance is currently proposing to lower the import tax from 20 percent to 17 percent on biofuel. ON January 1, 2018, Vietnam will implement its nationwide E5 blend mandate and expects to move to E10 by 2019. According to research from the ministry, lowering the biofuel import tax supports the country in meeting its E5 and E10 goals.

Canada: In the first seven months of 2017, Canada imported 710 million liters of ethanol from the U.S. an increase of 15 percent from the same period in 2016. Canada is currently in the process of rewriting its clean fuel standard, which may expand the role that biofuels have in supporting Canada to reach its Paris Agreement commitments.

Philippines: The U.S. exported 132 million liters of ethanol to the Philippines, January-July 2017, an increase of 25 percent from the same period in 2016. This trade continues to strengthen despite the expectation that domestic production in the Philippines would increase through 2017. Trade remains a key component of the Philippines biofuels program to meet its current E10 blend mandates for ethanol. (USDA, GAIN)

Nigeria: From January-July 2017, the U.S. exported 52 million liters of ethanol to Nigeria, an increase of 96 percent from the same period in 2016 and is on pace to nearly reach record level exports in 2011 of 91 million liters. (USDA, GAIN)

Price Database: If you are interested in historical price data, please click here.