Ethanol, Fuels and Co-Product Pricing

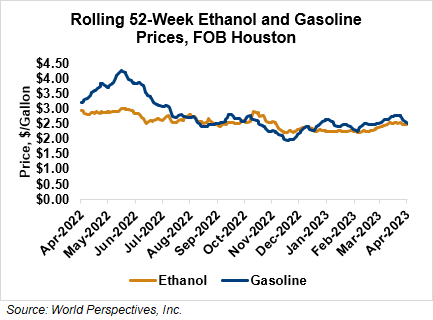

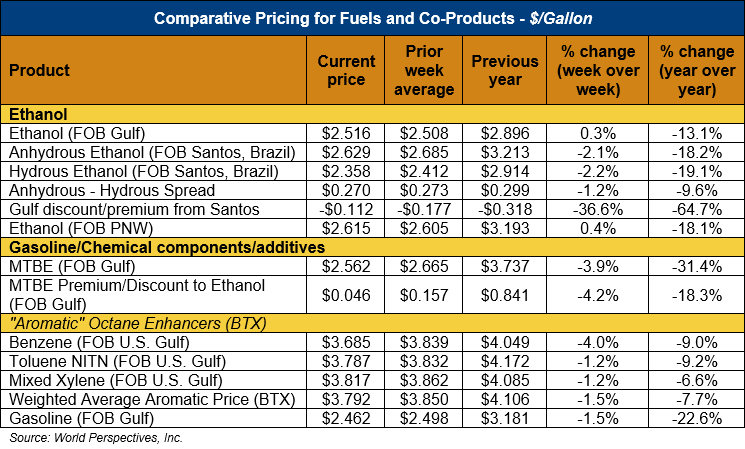

Market Outlook: U.S. ethanol prices ended last week 0.4 percent higher and continued that trend in early week trading and rose 0.4 percent through Tuesday’s close. Midwest wholesale rack ethanol prices were higher to end last week and were up 0.3 percent through Tuesday’s market close to their last quote of 66.99 cents/liter (253.59 cents/gallon).

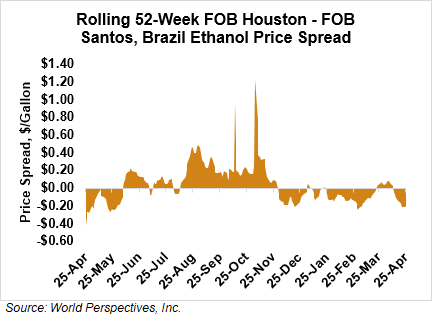

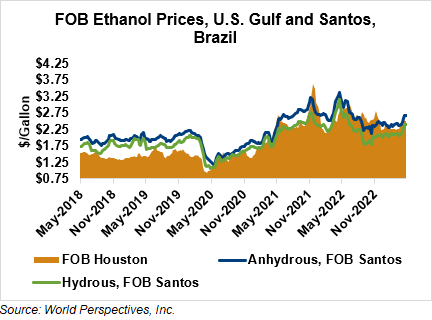

FOB Houston ethanol prices finished last week 1.6 percent higher and are up 0 percent through Tuesday’s trading from Friday’s close. FOB Houston ethanol prices are quoted at 66.48 cents/liter (251.65 cents/gallon). FOB Santos, Brazil anhydrous ethanol prices were higher last week; they are down in early week trading, falling 2.1 percent to 69.44 cents/liter (262.855 cents/gallon) through Tuesday’s trading.

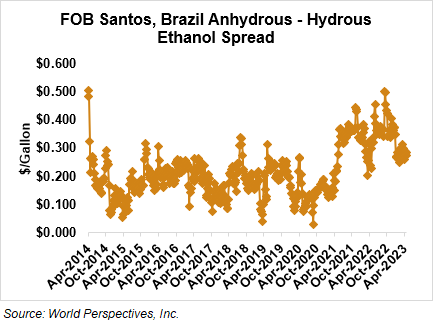

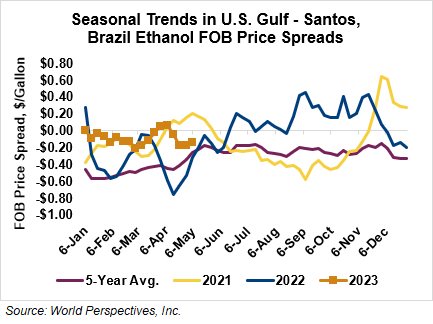

The FOB Gulf-Santos, Brazil ethanol spread has narrowed from last week’s close through Tuesday’s trading and is currently at -2.96 cents/liter (-11.21 cents/gallon).

MTBE prices fell 12.2 percent last week and added to those losses in early week trading to fall 3.3 percent from Friday’s close through Tuesday’s trading. MTBE’s premium to FOB Houston ethanol has decreased from last week’s report and stands at 1.62 cents/liter (6.13 cents/gallon).

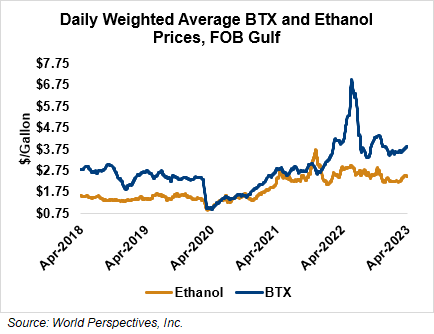

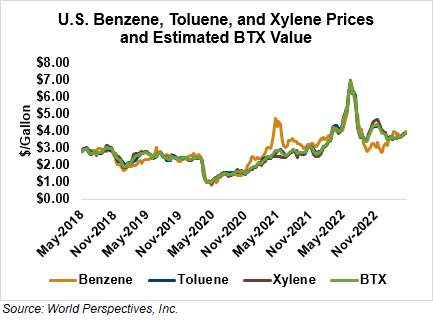

BTX component prices were sharply lower last week and were weaker still through Tuesday’s market close: Benzene was down 3.6 percent while Toluene was down 1 percent, and Xylene was down 1 percent. The estimated weighted average aromatic price is currently 100.38 cents/liter (379.96 cents/gallon), down from last Friday’s close. The BTX-Houston ethanol spread narrowed last week, and the weighted average BTX price is 33.9 cents/liter (128.32 cents/gallon) higher than the FOB Houston ethanol price.

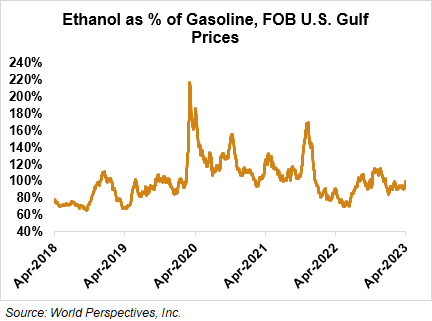

Gasoline and petroleum products were lower last week but are sharply lower in early week trade. RBOB futures are down 3.9 percent to start the week while 84 octane RBOB (Houston) and 87 octane CBOB (U.S. Gulf) gasoline prices are down 3.5 and 3.2 percent, respectively. WTI futures are 6.8 percent lower at $71.58/barrel while Brent futures are down 6.2 percent to $75.32/barrel, from Friday through Tuesday’s close.

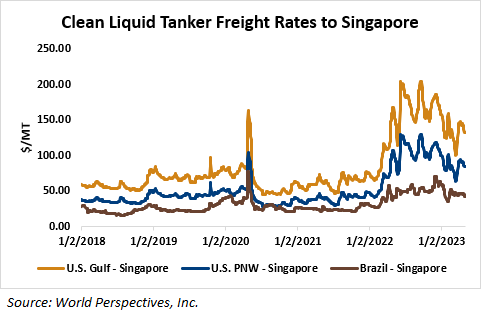

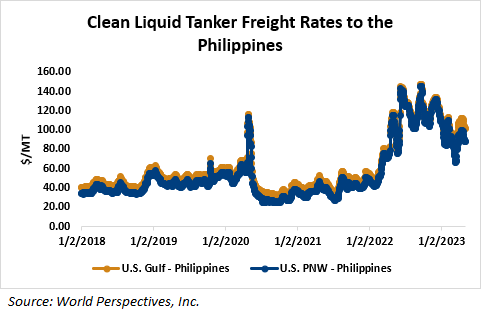

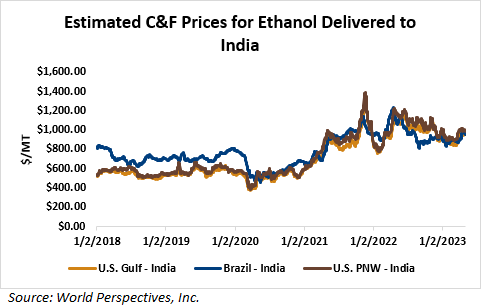

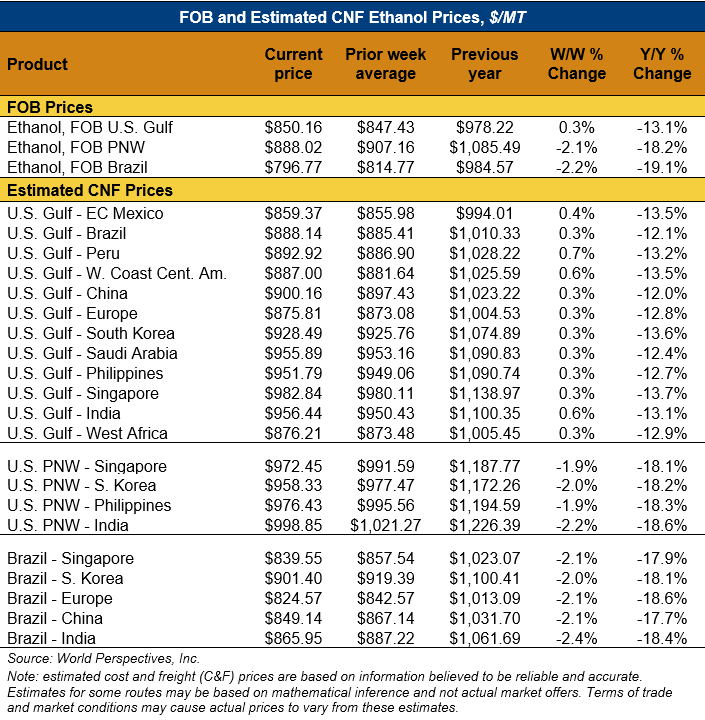

Liquid tanker rates are 1 percent higher on average this week with offers for the U.S. Gulf to Peru seeing the largest gains (up 1 percent). Freight from Brazil to India saw the largest declines and is down 5 percent from last week. On average, tanker freight from the U.S. Gulf is up 2 percent this week while freight from the PNW has posted a 1 percent decline. Liquid tanker freight rates from Brazil are down 1 percent, on average, this week. Freight rates across all origins are 9 percent lower than this same week in 2022.

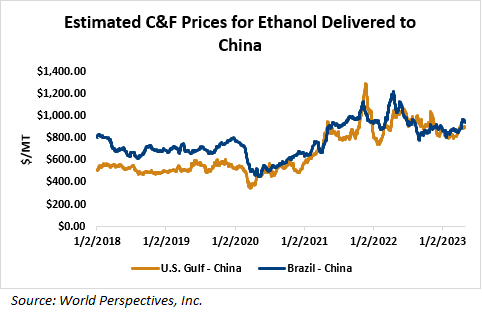

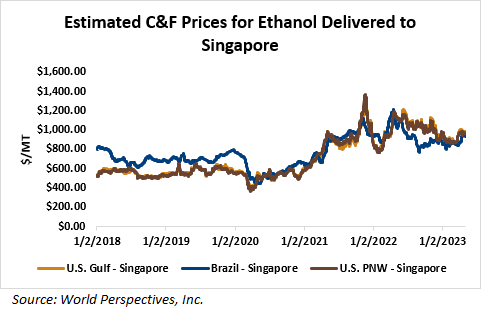

On a cost-and-freight (C&F) basis, offers are mostly higher this week as higher freight rates offset lower FOB offers for ethanol. Prices for ethanol C&F to Central America from the U.S. Gulf are up 0.6 percent this week and are down 13.4 percent from this same week in 2022. Values for PNW ethanol to Southeast Asia average $969.07/MT this week, down 1.9 percent from the prior week but down 18.2 percent year-over-year. That compares to U.S. Gulf to Southeast Asia C&F prices that average $954.37/MT and are up 0.3 percent from last week but are down 13.4 percent year-over-year. C&F prices for Brazilian ethanol to Southeast Asia are down 2.1 percent from last week.