Ethanol, Fuels and Co-Product Pricing

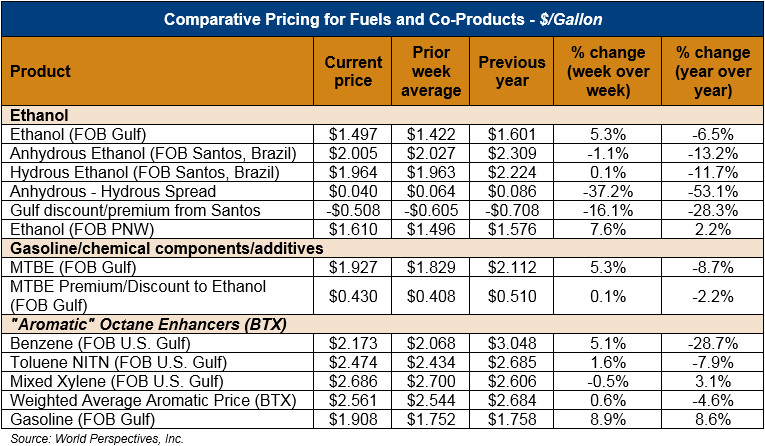

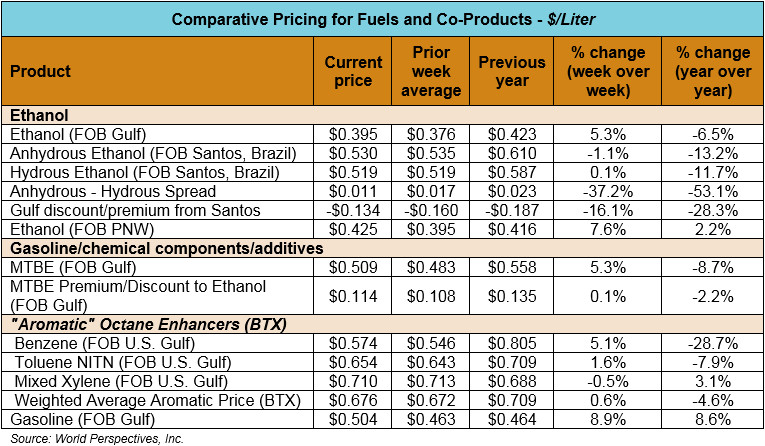

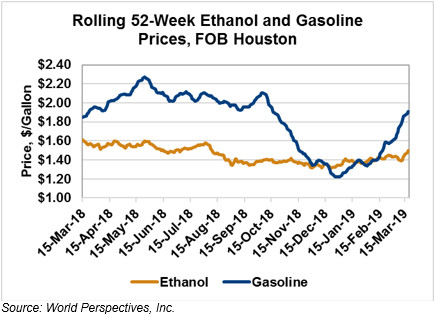

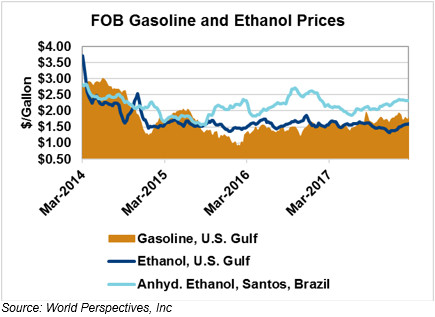

Market Outlook: U.S. ethanol prices ended last week up substantially and continue up (+2 percent) in early week trading. Midwest wholesale rack ethanol prices were up to end last week; they continue up to start this week at 39.40 cents/liter (149.15 cents/gallon) through Tuesday’s trading.

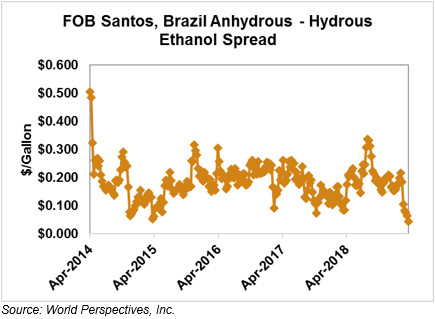

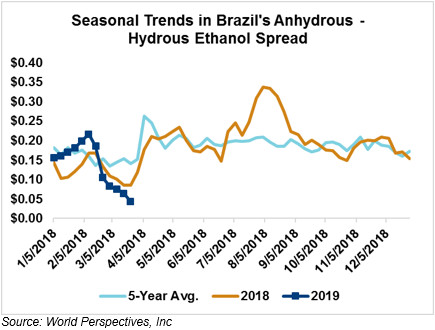

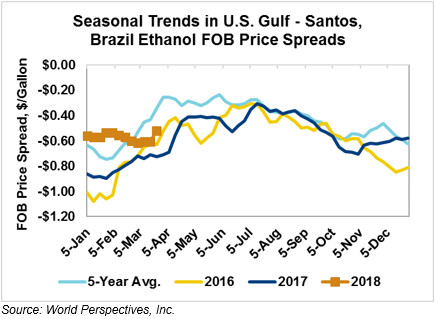

FOB Houston ethanol prices finished last week down fractionally; prices are up over 5 percent through Tuesday’s trading from Friday’s close. FOB Houston ethanol prices are quoted at 39.54 cents/liter (149.67 cents/gallon). FOB Santos, Brazil ethanol prices ended last week down fractionally; they continue down from Friday’s close and stand at 52.95 cents/liter (200.45 cents/gallon) through Tuesday’s trading.

The FOB Gulf-Santos, Brazil spread narrowed from last week’s close through Tuesday’s trading and is currently at -13.41 cents/liter (-50.77 cents/gallon).

MTBE prices were up nearly 5 percent to end last week; they continue up (+5 percent) to start this week. MTBE’s premium to FOB Houston ethanol widened from last week and now stands at 11.26 cents/liter (42.63 cents/gallon).

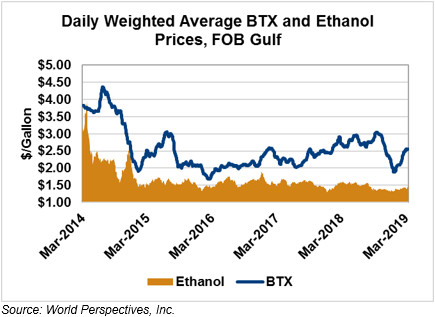

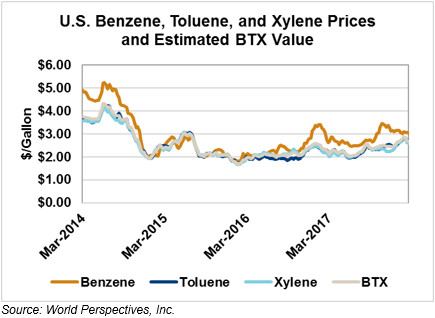

BTX component prices were mixed to end last week and continue mixed through Tuesday’s trading: Benzene is up 4 percent, Toluene is up 1.2 percent and Xylene is down 0.5 percent. The estimated weighted average aromatic price is currently 67.50 cents/liter (255.51 cents/gallon), up slightly last Friday’s close. The BTX-Houston ethanol spread narrowed from last week; the weighted average BTX price is 27.95 cents/liter (105.84 cents/gallon) higher than the FOB Houston ethanol price.

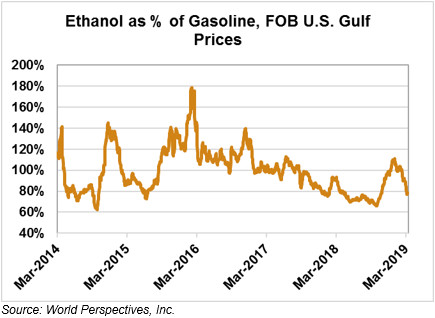

Gasoline and petroleum products were up to end last week and continue up across the board through early-week trading on the strength of macroeconomic and supply/demand signals. This week, RBOB futures are up: 84 (Houston) and 87 (U.S. Gulf) octane gasoline prices are up 4.1 percent and 4.4 percent, respectively. WTI futures are up 0.5 percent to $58.83/barrel and Brent futures are up 0.5 percent to $67.51/barrel, from Friday’s close through Tuesday’s trading.

Price Database: If you are interested in historical price data, please click here.