1. Ethanol, Fuels and Co-Product Pricing

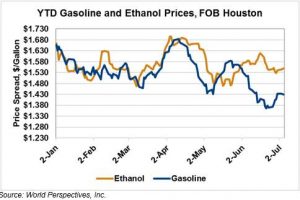

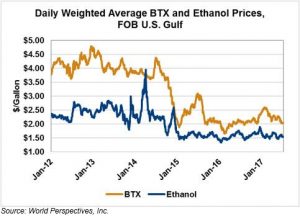

Market outlook: Ethanol futures continued to trade higher this week, the second week of price gains since the market hit 6-months lows in late June. The ethanol market has received secondary price support from corn futures, which are trading higher on drought-related concerns. U.S. spot sales have been sluggish given the holiday-interrupted week but have generally followed corn prices higher.

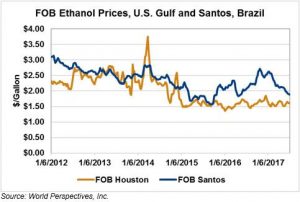

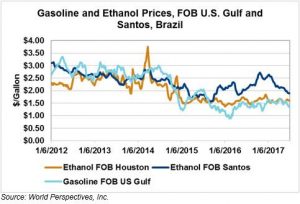

Brazilian ethanol prices are lower this week as supply increases pressure the market. Brazil’s first-half June ethanol production was up 51 percent year-over-year, as the country processed 39.41 MMT of sugarcane. During the first-half of June 2016, Brazil processed 25.99 MMT of sugarcane. FOB Brazil ethanol prices were down $0.031 to $1.854/gallon today. The move increased the spread between FOB Houston and FOB Brazilian ethanol prices to -$0.309/gallon.

Brazil’s ethanol production will likely continue its strong pace into July. On Monday, Brazil’s Petrobras announced price increases for gasoline and diesel, which will be supportive for ethanol production. However, Brazilian ethanol prices may not have hit their seasonal lows yet and Brazil’s political and currency situations leave additional downside price risk.

In the export market, USDA said on Friday, July 1 that India’s ethanol imports would reach 132 million gallons this year, up from 106 million in 2016. USDA expected the growth to continue into 2018, when India could import 159 million gallons. U.S. ethanol exports to India are up 59 percent YTD while U.S. total ethanol exports are up 14 percent.

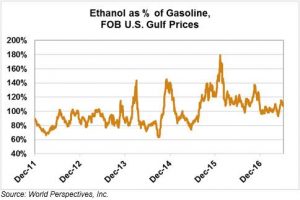

Looking forward, ethanol prices should continue to find support in the U.S. and pressure in Brazil. U.S. ethanol production margins have come under pressure from rising corn prices, which should limit supply growth. Additionally, U.S. gasoline prices have been moving higher which will be supportive as well. Brazil’s political instability remains a risk and the country’s production growth should pressure prices. U.S. ethanol looks to remain competitive against Brazil for the near future.

Price Database: If you are interested in historical price data, please click here.