Ethanol, Fuels and Co-Product Pricing

Market Outlook: U.S. ethanol prices ended last week 1.8 percent lower but are steady in early week trading, unchanged through Tuesday’s close. Midwest wholesale rack ethanol prices were lower to end last week and are down 0.9 percent through Tuesday’s market close to their last quote of 62.09 cents/liter (235.05 cents/gallon).

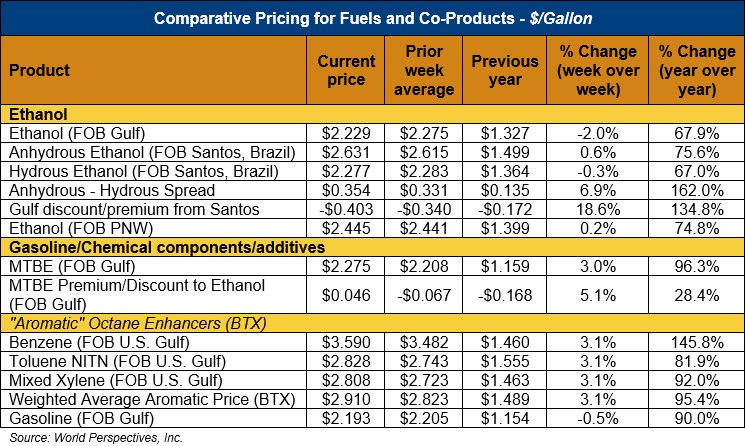

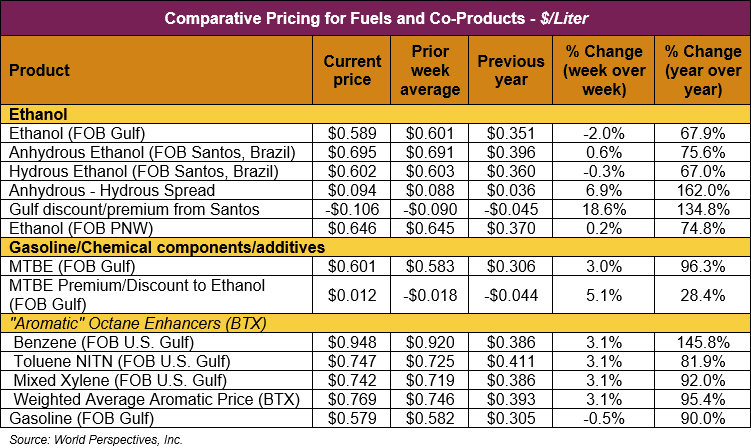

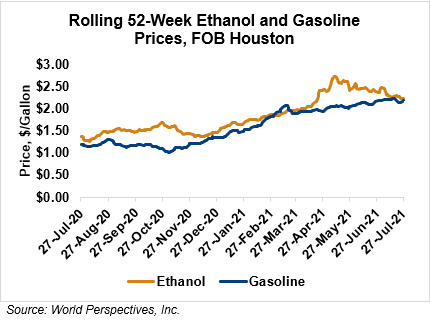

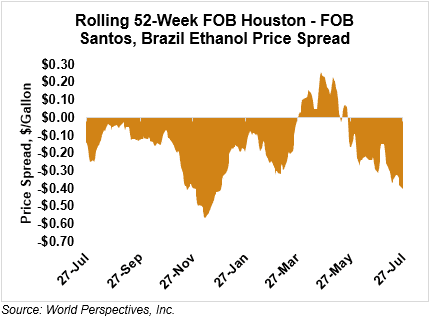

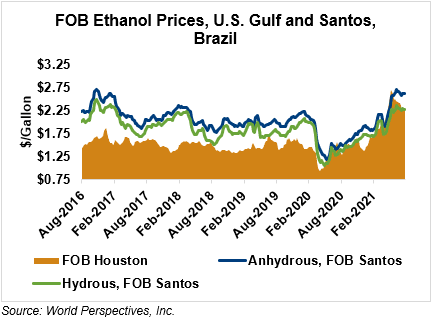

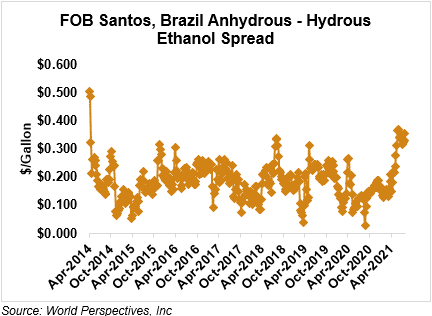

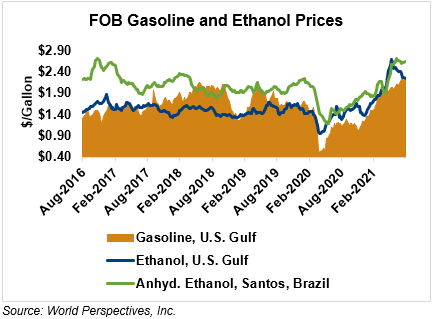

FOB Houston ethanol prices finished last week 0.5 percent higher but are down 2 percent through Tuesday’s trading from Friday’s close. FOB Houston ethanol prices are quoted at 58.88 cents/liter (222.87 cents/gallon). FOB Santos, Brazil anhydrous ethanol prices were higher last week; they are up in early week trading, rising 0.6 percent to 69.51 cents/liter (263.14 cents/gallon) through Tuesday’s trading.

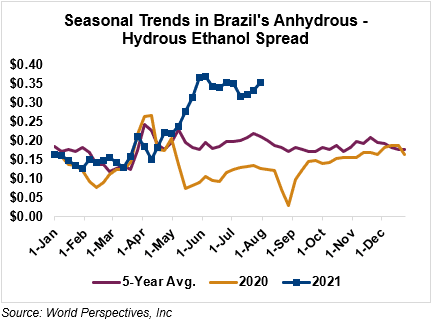

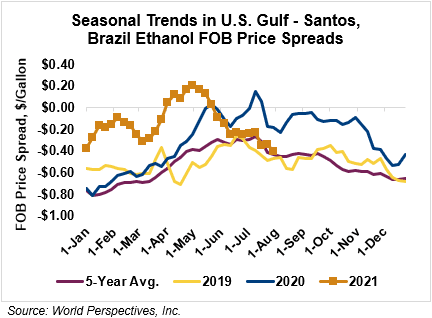

The FOB Gulf-Santos, Brazil ethanol spread has widened from last week’s close through Tuesday’s trading and is currently at -10.64 cents/liter (-40.27 cents/gallon).

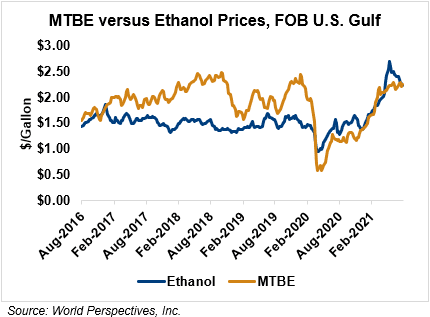

MTBE prices fell 4 percent last week but are paring some of those losses in early week trading, up 2.3 percent from Friday’s close through Tuesday’s trading. MTBE’s premium to FOB Houston ethanol has increased from last week’s report and stands at 0.77 cents/liter (2.93 cents/gallon).

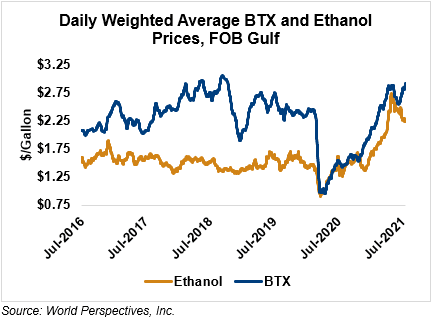

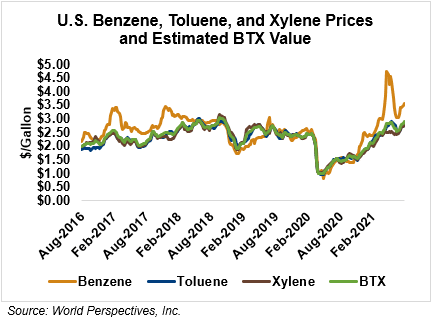

BTX component prices were higher last week and are adding to those gains through Tuesday’s market close: Benzene is up 2.5 percent while Toluene is up 2.6 percent, and Xylene is up 2.6 percent. The estimated weighted average aromatic price is currently 76.5 cents/liter (289.59 cents/gallon), up from last Friday’s close. The BTX-Houston ethanol spread widened last week, and the weighted average BTX price is 17.63 cents/liter (66.72 cents/gallon) higher than the FOB Houston ethanol price.

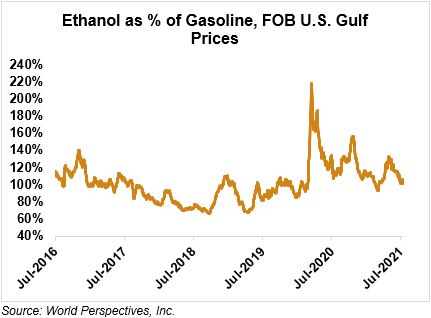

Gasoline and petroleum products were higher last week and are mostly continuing that trend in early week trade. RBOB futures are up 1 percent to start the week while 84 octane RBOB (Houston) and 87 octane CBOB (U.S. Gulf) gasoline prices are up 0.4 and up 0.1 percent, respectively. WTI futures are 0.6 percent lower at $71.65/barrel while Brent futures are up 0.6 percent to $74.58/barrel, from Friday through Tuesday’s close.

Price Database: If you are interested in historical price data, please click here.