1. Ethanol, Fuels and Co-Product Pricing

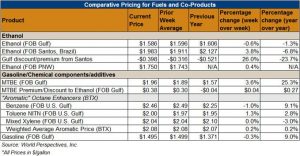

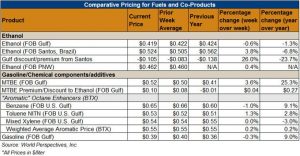

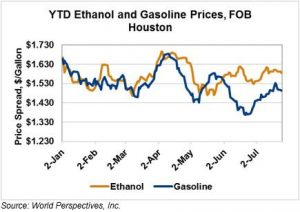

Market outlook: U.S. ethanol prices are softer this week with CBOT ethanol futures down 2.5 cents from last week and FOB Gulf prices off 1.1 cents. Last week, the U.S. EIA reported that ethanol stocks did not change substantially from the prior week, breaking a four-week trend of dwindling stocks. Notably, most of the stocks increase came from the Gulf Coast region where stocks rose 14% to 4.175 million barrels. The larger stocks figure pressured the ethanol market late last week and early this week.

Lower corn futures prices also pressured ethanol futures, though larger losses in corn prices should bolster ethanol producer margins this week. Furfures markets indicated a margin of $0.43/gallon ($0.1136/liter) as of Tuesday’s closing, up from the prior week but down from margins of $0.50-0.60/gallon ($0.132-0.158/liter) seen earlier this summer.

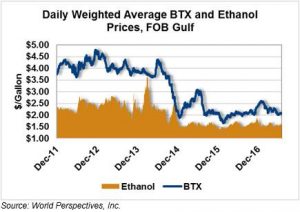

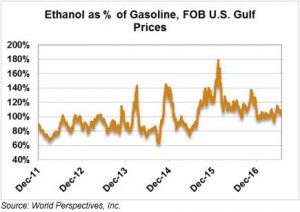

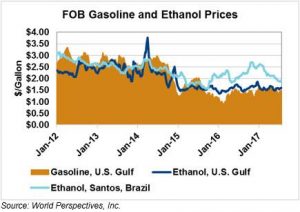

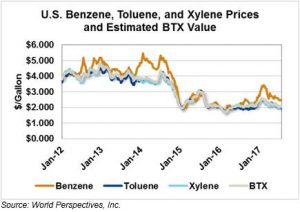

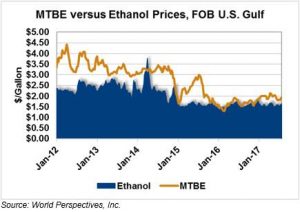

Lower gasoline prices are also partly responsible for lower ethanol prices this week. Offers for 83.7 octane RBOB FOB Houston fell 2.5 cents to $1.522/gallon ($0.402/liter) and prices for 87 octane RBOB waterborne U.S. Gulf fell 2.2 cents to $1.457/gallon ($0.3848/liter). RBOB futures were lower late last week but rebounded early this week. MTBE prices are higher than one week ago, quoted at $1.9848/gallon ($0.5415/liter).

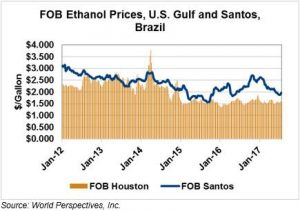

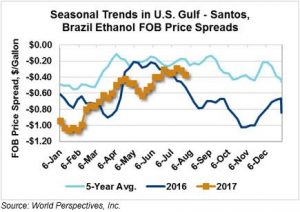

Ethanol prices in Brazil are higher after reaching one-year lows earlier this month. Reported prices for Ethanol FOB Brazil cargo were quoted at $1.99/gallon ($0.523/liter). Rising Brazilian ethanol and falling U.S. prices increased the price spread for ethanol FOB ports this week. The spread between ethanol FOB Houston and FOB Santos, Brazil widened to -$0.40/gallon (-$0.103/liter) this week.

Brazil: Brazilian automakers and ethanol producers reached an agreement at the 10th Ethanol Summit supporting ethanol use, since the lack of sufficient petroleum refining capacity required largest imports of refined products. The agreement set the stage for an integrated agenda that will pursue greater energy efficient and emissions reductions for Brazil. Moreover, the agreement supports two government initiatives: Renaovabio (a biofuels stimulus program) and Rota 2030 (a plan for competitive local auto production).

Brazil’s ethanol production shortfall was pared again in first-half July as mills processed 47.83 MMT of sugarcane, a 1.6% increase from the same period last year. Ethanol sales by South Central producing units reached 1.01 billion liters in first-half July, with only 71.3 million liters being exported. The remainder went to supply Brazil’s domestic market.

Europe: Romania will increase the blend rate for ethanol from 4.5% to 8% in 2018 and to 10% in 2020. The country only has one ethanol plant that produces 80 KMT/year of corn-based ethanol. Romania imported 107 million liters of ethanol in 2016, including 32,000 liters from the U.S.

Romania’s plans to expand ethanol production come at an odd time given broader EU policy dynamics. The EU commission may decide to lower anti-dumping duties on Argentine and Indonesian biodiesel imports as soon as Thursday. Should the Commission lower the duties, biodiesel would become more competitive against ethanol in Europe and ethanol consumption could fall. However, ethanol consumption decreases are only probably in countries with non-specific biofuels mandates. Romania has specific blending mandates for ethanol and biodiesel, 8% and 6.5%, respectively, for 2018-2020.

India: Officials in Utter Pradesh are being urged to allow state-run businesses (ranging from power companies to agribusinesses and others) to run on ethanol. The Indian state the second largest producer of ethanol and its sugar and ethanol producers would benefit from the policy change. More importantly, however, consumers in the region would benefit from the improvement to air quality and human health that stem from ethanol use.

Price Database: If you are interested in historical price data, please click here.