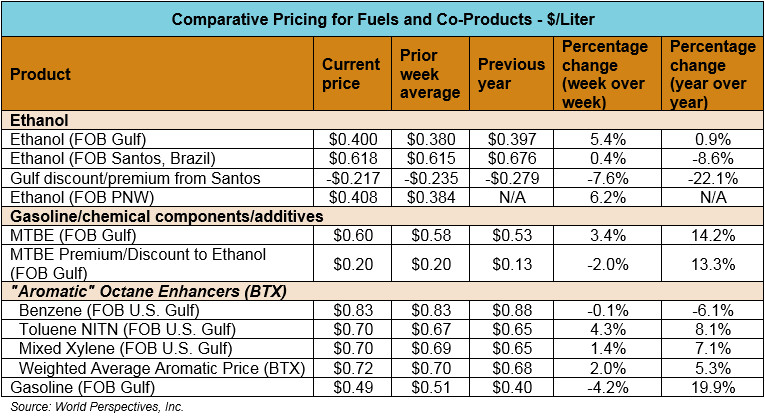

1. Ethanol, Fuels and Co-Product Pricing

Market Outlook: U.S. ethanol prices are higher this week even as broader energy markets struggle to regain their footing after yesterday’s broad-based selloff. Yearly exports reached 5.1 billion liters (1.37 billion gallons) last year, up 17 percent from the prior year and beating 2011 export volumes (the previous record high year) by 658 million liters (174 million gallons). March CBOT ethanol futures are up 2.1 percent from last week while Midwest wholesale rack ethanol prices are up 3.1 percent at 39.67 cents/liter (150.16 cents/gallon).

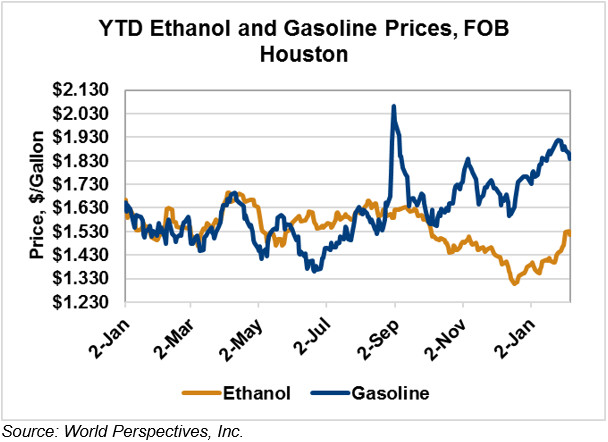

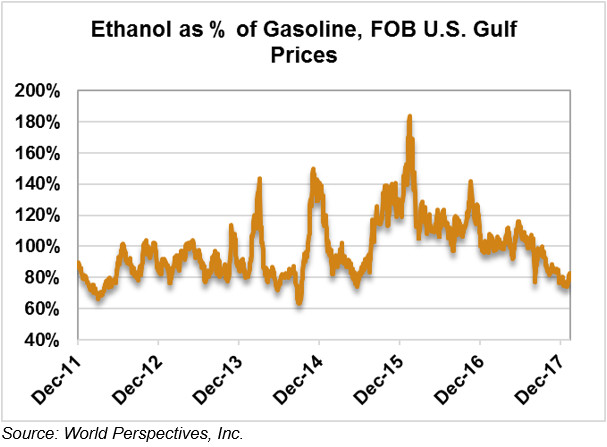

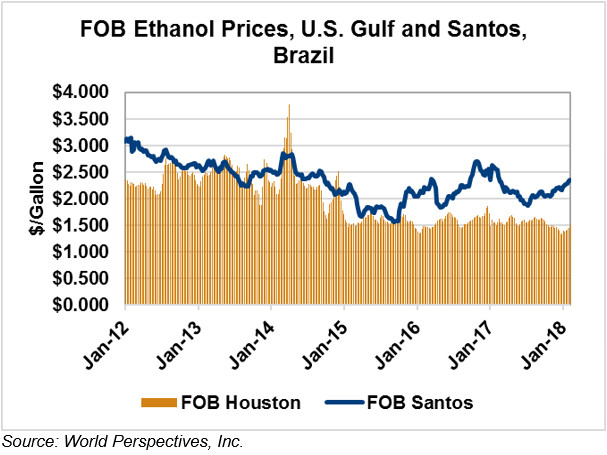

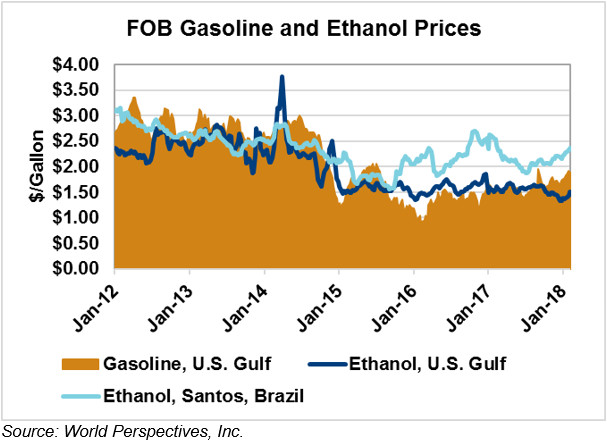

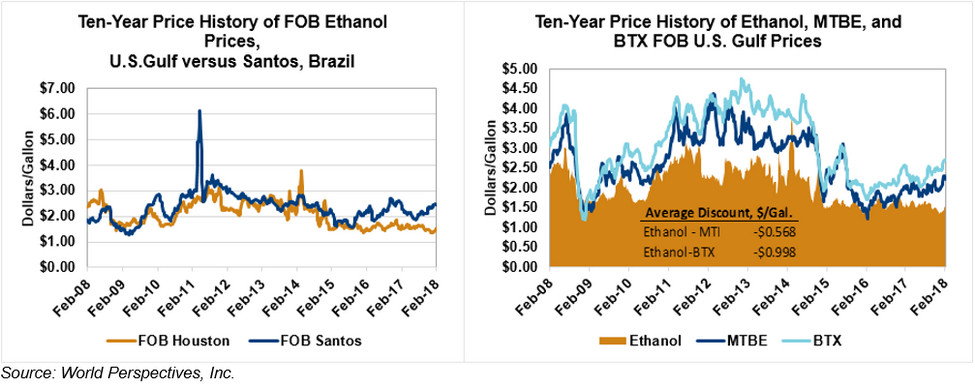

FOB Houston ethanol prices are up 2.476 cents/liter (9.37 cents/gallon) from last week, a 6.5 percent increase. FOB Gulf gasoline prices have been rising in recent weeks, adding strength to ethanol values. FOB Santos ethanol prices increased 0.6 percent last week (up 0.34 cents/liter to 61.853 cents/gallon or 1.29 cents/gallon to 234.14 cents/gallon).

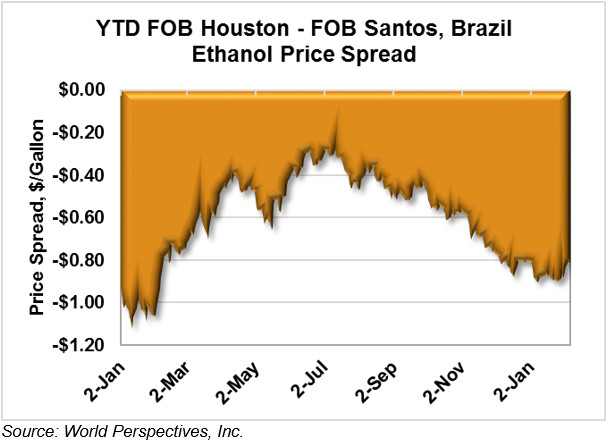

In early week trading, FOB Houston-Santos spread is narrowing, rising 2.136 cents/liter (8.08 cents/gallon) to its last quote of -21.387 cents/liter (-80.959 cents/gallon). Friday’s close of -89.04 cents/liter, however, again marked the lowest value in six months. While the spread was widening through Friday’s prices, the rate of decrease was slowing.

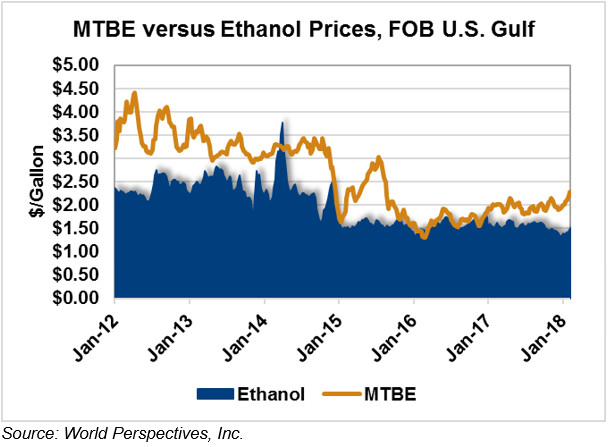

MTBE prices are 4 percent higher in early week trading at 60.77 cents/liter (230.04 cents/gallon). FOB U.S. Gulf MTBE is now 20.303 cents/liter (76.85 cents/gallon) higher than FOB Houston ethanol.

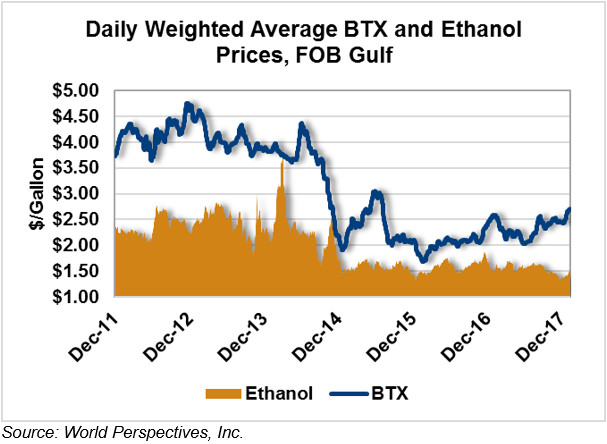

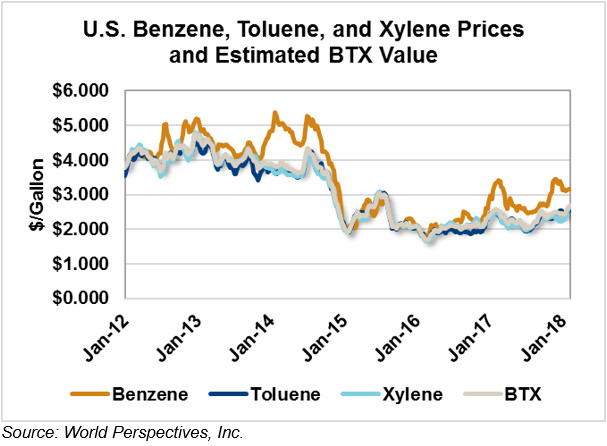

BTX component prices are higher in early week trading, with benzene prices steady, toluene up 4.1 percent, and xylene up 1.3 percent. The weighted average aromatic price is currently estimated at 71.57 cents/liter ($2.709/gallon), up 1.9 percent from last week. The weighted average BTX price is 31.104 cents/liter (117.74 cents/gallon) higher than FOB Houston ethanol prices.

Gasoline and petroleum products are lower to start the current week. RBOB futures are down 3.3 percent (1.59 cents/liter or 5.97 cents/gallon) while 84 octane RBOB and 87 octane CBOB are 3.2 percent and 1.1 percent lower, respectively. WTI crude oil futures are down $1.90/barrel from last week while Brent futures have lost $1.59/barrel.

Price Database: If you are interested in historical price data, please click here.