Ethanol, Fuels and Co-Product Pricing

Market Outlook: U.S. ethanol prices ended last week 2 percent lower and continued that trend in early week trading to fall 4.2 percent through Tuesday’s close. Midwest wholesale rack ethanol prices were lower to end last week and were down 0.9 percent through Tuesday’s market close to their last quote of 43.37 cents/liter (164.18 cents/gallon).

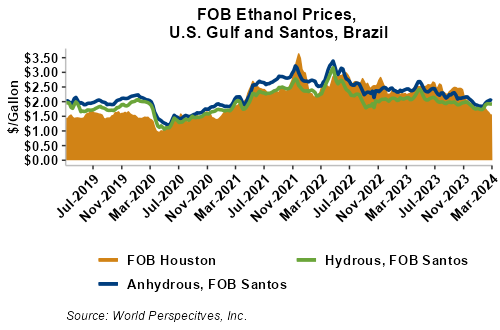

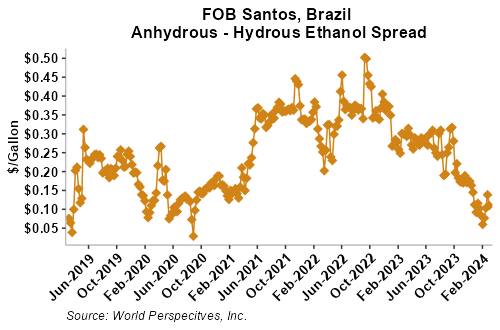

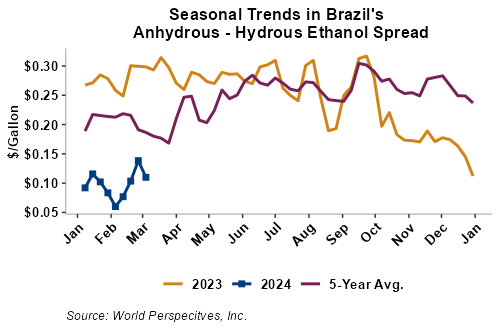

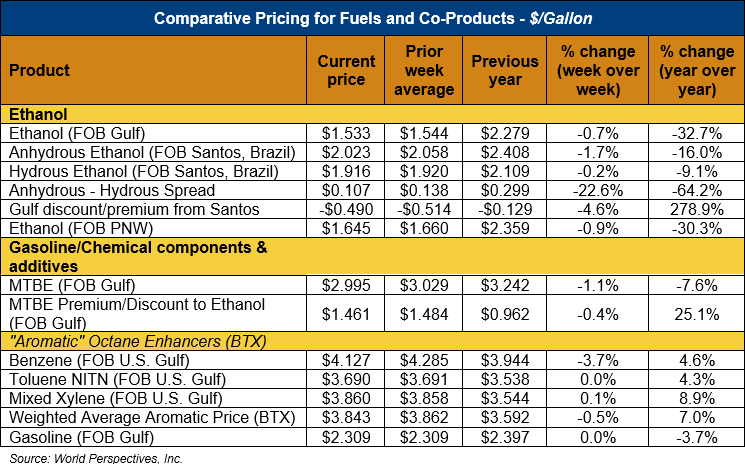

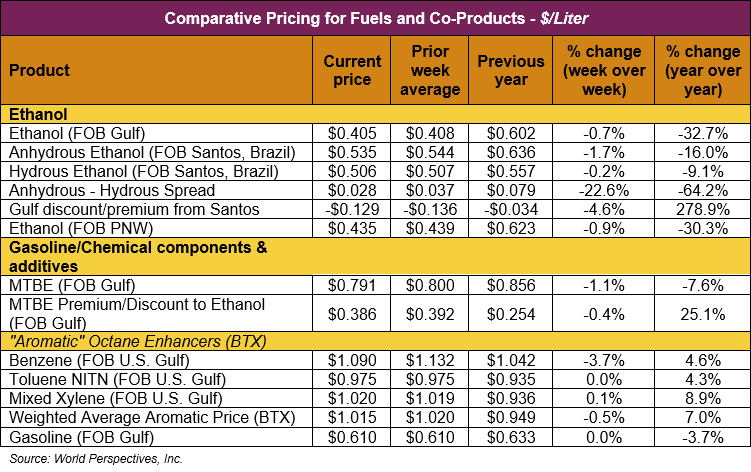

FOB Houston ethanol prices finished last week 1.2 percent lower and are down 1.2 percent through Tuesday’s trading from Friday’s close. FOB Houston ethanol prices are quoted at 40.51 cents/liter (153.34 cents/gallon). FOB Santos, Brazil anhydrous ethanol prices were higher last week; they are down in early week trading, falling 1.7 percent to 53.45 cents/liter (202.34 cents/gallon) through Tuesday’s trading.

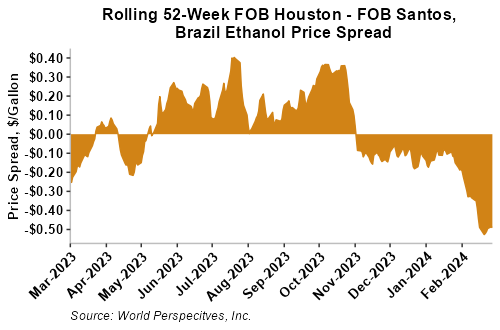

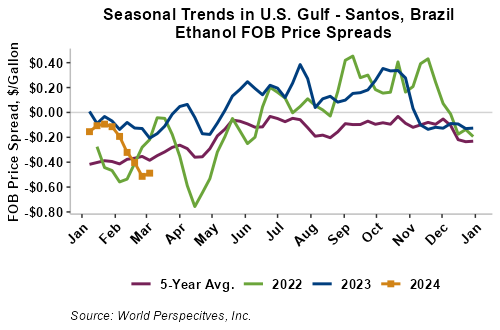

The FOB Gulf-Santos, Brazil ethanol spread has narrowed from last week’s close through Tuesday’s trading and is currently at -12.95 cents/liter (-49 cents/gallon).

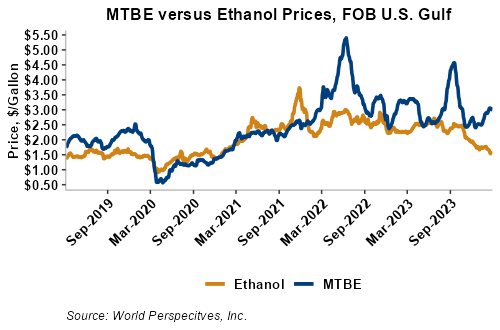

MTBE prices fell 0.2 percent last week and pushed lower still in early week trading to fall 1.1 percent from Friday’s close through Tuesday’s trading. MTBE’s premium to FOB Houston ethanol has decreased from last week’s report and stands at 38.65 cents/liter (146.3 cents/gallon).

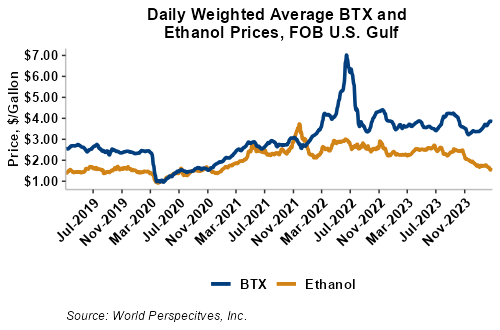

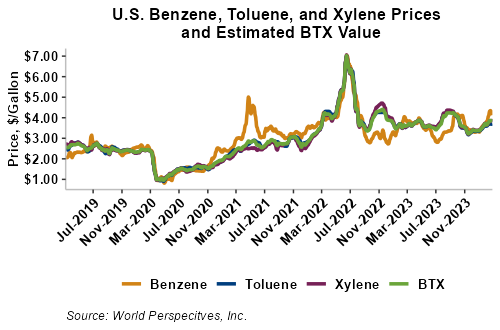

BTX component prices were mixed last week but were steady/lower through Tuesday’s market close: Benzene was down 3.1 percent while Toluene was down 0.1 percent, and Xylene was up 0.1 percent. The estimated weighted average aromatic price is currently 101.6 cents/liter (384.59 cents/gallon), down from last Friday’s close. The BTX-Houston ethanol spread widened last week, and the weighted average BTX price is 61.09 cents/liter (231.25 cents/gallon) higher than the FOB Houston ethanol price.

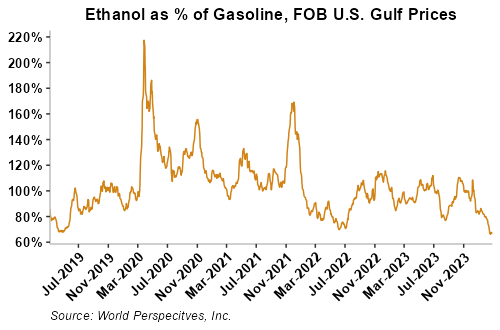

Gasoline and petroleum products were lower last week but rallied in early week trade. RBOB futures are up 3 percent to start the week while 84 octane RBOB (Houston) and 87 octane CBOB (U.S. Gulf) gasoline prices are up 1.8 and up 1.2 percent, respectively. WTI futures are 2.6 percent higher at $78.46/barrel while Brent futures are up 2.3 percent to $82.66/barrel, from Friday through Tuesday’s close.

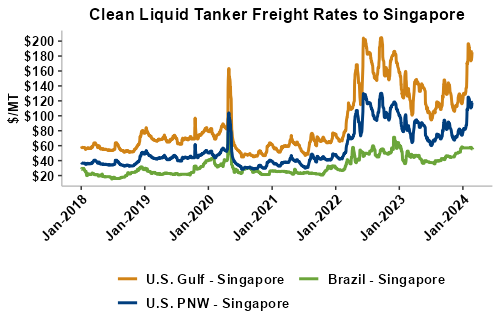

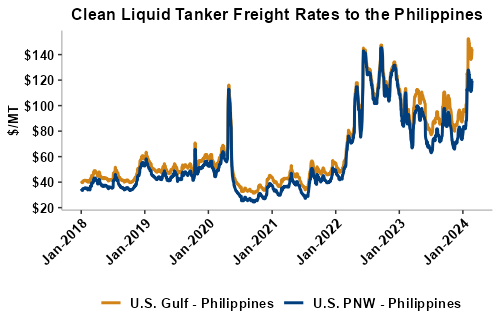

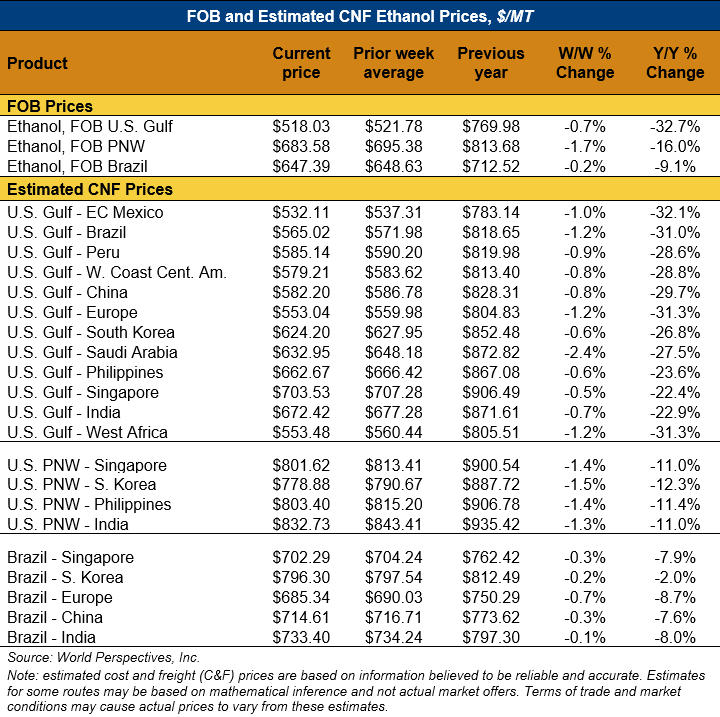

Liquid tanker rates are 3 percent lower on average this week with offers for the U.S. PNW to India seeing the largest gains (up 1 percent). Freight from the U.S. Gulf to the East Coast of Mexico saw the largest declines and is down 9 percent from last week. On average, tanker freight from the U.S. Gulf is down 4 percent this week while freight from the PNW is largely unchanged. Liquid tanker freight rates from Brazil are down 2 percent, on average, this week. Freight rates across all origins are 22 percent higher than this same week in 2023.

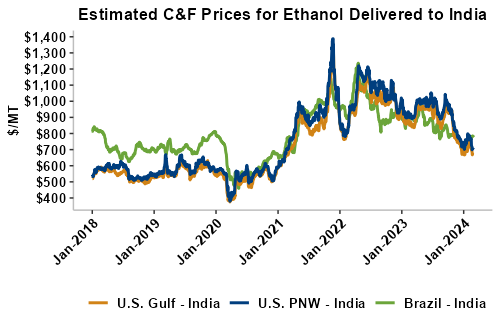

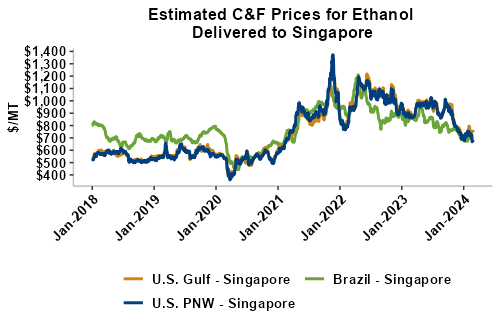

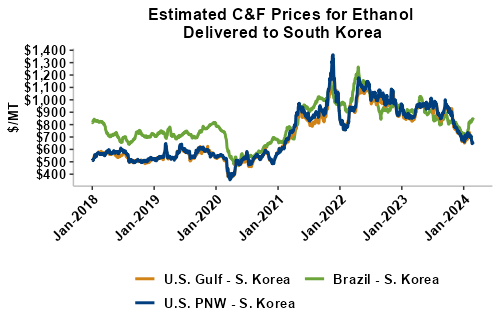

On a cost-and-freight (C&F) basis, offers are mostly lower this week as both freight rates and FOB ethanol offers have moved below last week’s values. Prices for ethanol C&F to Central America from the U.S. Gulf are down 0.9 percent this week and are down 29.8 percent from this same week in 2023. Values for PNW ethanol to Southeast Asia average $794.63/MT this week, down 1.5 percent from the prior week and down 11.5 percent year-over-year. That compares to U.S. Gulf to Southeast Asia C&F prices that average $663.47/MT and are down 0.6 percent from last week and are down 24.2 percent year-over-year. C&F prices for Brazilian ethanol to Southeast Asia are down 0.4 percent from last week.