Ethanol, Fuels and Co-Product Pricing

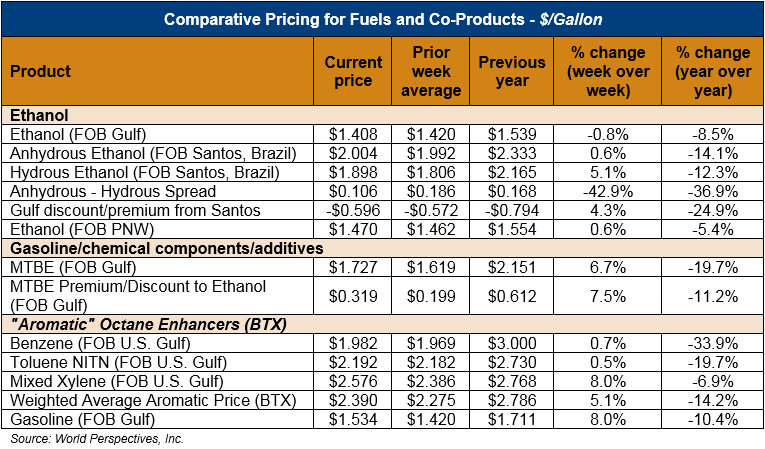

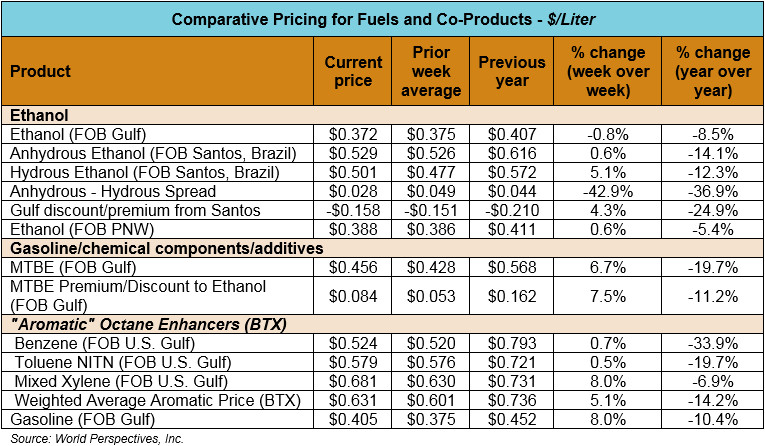

Market Outlook: U.S. ethanol prices ended last week up 0.8 percent but are down nearly 1 percent in early week trading. Midwest wholesale rack ethanol prices were up 2.1 percent to end last week; they are down fractionally to start this week at 38.16 cents/liter (144.47 cents/gallon) through Tuesday’s trading.

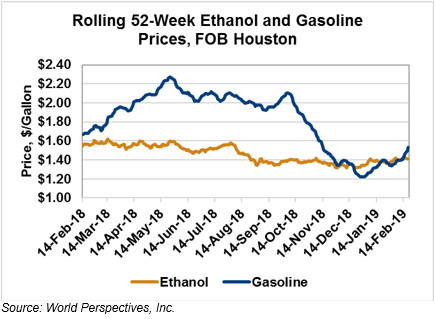

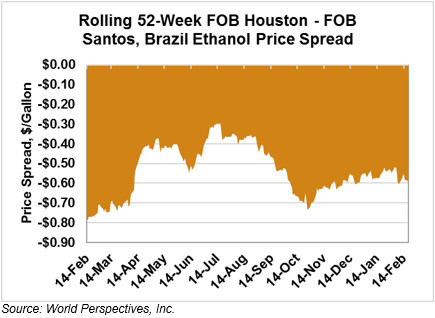

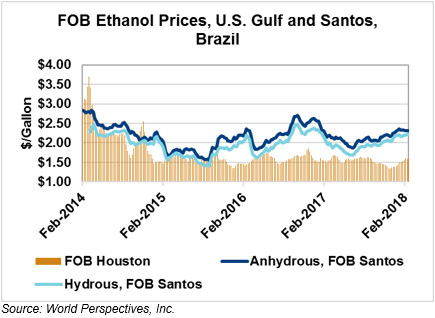

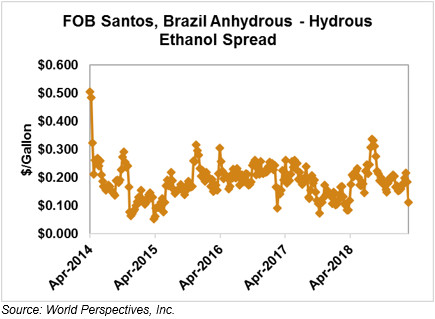

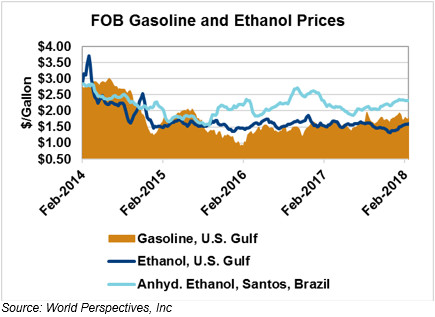

FOB Houston ethanol prices finished last week up nearly 1 percent; prices are down 0.8 percent through Tuesday’s trading from Friday’s close. FOB Houston ethanol prices are quoted at 37.19 cents/liter (140.78 cents/gallon). FOB Santos, Brazil ethanol prices ended last week up 1.4 percent; prices continue up from Friday’s close and stand at 52.94 cents/liter (200.41 cents/gallon) through Tuesday’s trading.

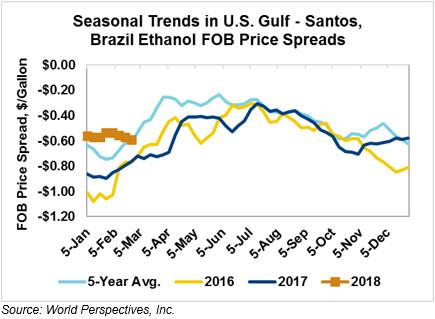

The FOB Gulf-Santos, Brazil spread widened from last week’s close through Tuesday’s trading and is currently at -15.75 cents/liter (-59.62 cents/gallon).

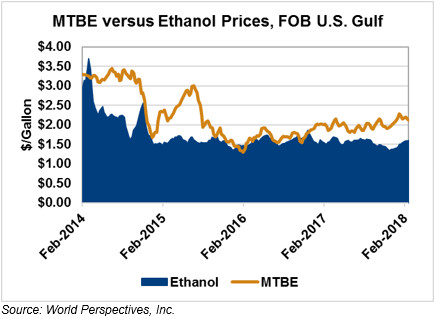

MTBE prices were up 2.2 percent to end last week; they are up nearly 6 percent to start this week. MTBE’s premium to FOB Houston ethanol widened significantly from last week and now stands at 8.04 cents/liter (30.45 cents/gallon).

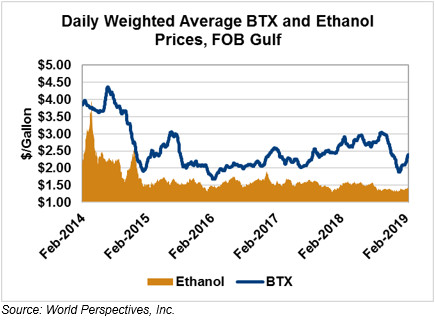

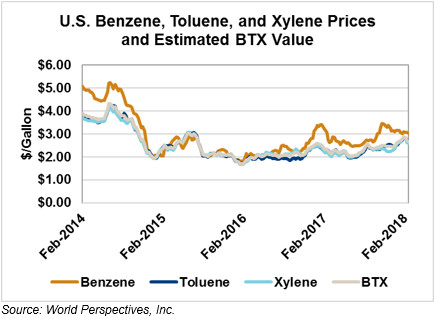

BTX component prices were up across the board to end last week and continue up through Tuesday’s trading: Benzene is up 0.7 percent, Toluene is up 0.4 percent and Xylene is up a substantial 7.5 percent. The estimated weighted average aromatic price is currently 62.96 cents/liter (238.32 cents/gallon), up from last Friday’s close. The BTX-Houston ethanol spread widened from last week; the weighted average BTX price is 25.76 cents/liter (97.53 cents/gallon) higher than the FOB Houston ethanol price.

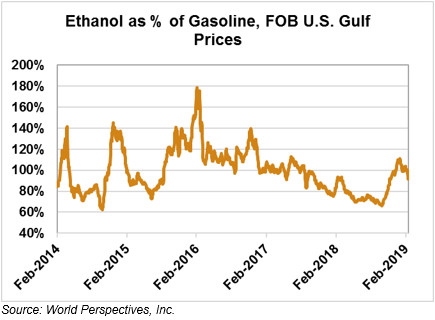

Gasoline and petroleum products were up to end last week on positive macroeconomic/policy signals but are mostly down through early-week trading. This week, RBOB futures are down: 84 (Houston) and 87 (U.S. Gulf) octane gasoline prices are down 0.6 percent and 1.4 percent, respectively. WTI futures are up 1.0 percent to $56.21/barrel and Brent futures are down 0.5 percent to $65.92/barrel, from Friday’s close through Tuesday’s trading.

Price Database: If you are interested in historical price data, please click here.