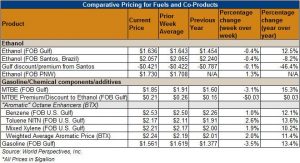

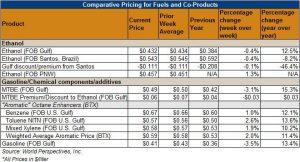

1. Ethanol, Fuels and Co-Product Pricing

Market Outlook: Last week’s plummet in corn prices had a limited effect on those for ethanol. While corn prices fell 20 cents last week, ethanol futures decreased only 3.6 cents/gallon (0.95 cents/liter) and Midwest wholesale rack prices fell 0.5 cents/gallon (0.13 cents/liter) to 172.32 cents/gallon (45.52 cents/liter).

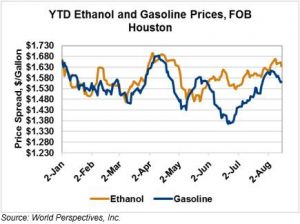

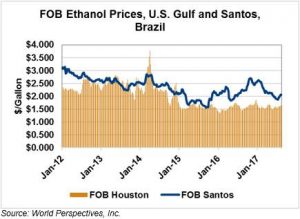

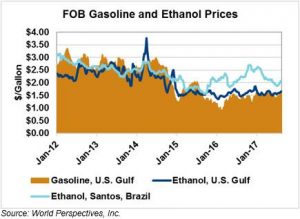

Prices for FOB Houston ethanol followed a similar, albeit smaller, trend, falling 1.6 cents/gallon (0.42 cents/liter) this week to end at 165.15 cents/gallon (43.628 cents/liter). Weakness in the Brazilian market pressured U.S. prices, and Brazilian ethanol FOB Santos dropped 3.4 cents/gallon (0.88 cents/liter) this week. Brazilian FOB Santos ethanol prices were last quoted at 204.85 cents/gallon (54.116 cents/liter).

Because of this week’s price action, the FOB Houston-FOB Santos, Brazil ethanol price spread narrowed to -39.7 cents/gallon (-10.488 cents/liter). The spread reached its narrowest point in early July, hitting 28.7 cents/gallon (7.6 cents/liter). Since then, Brazilian ethanol prices have jumped over 30 cents/gallon while U.S. ethanol prices have sustained a more measured increase.

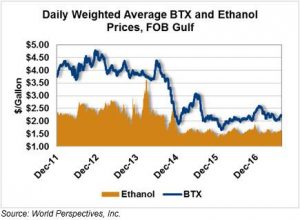

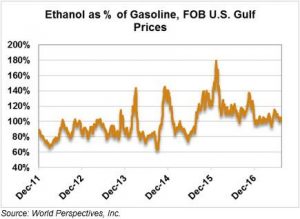

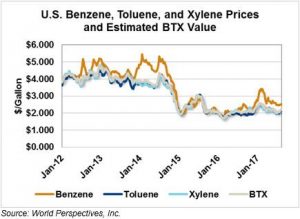

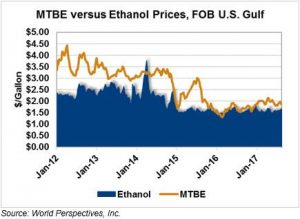

Falling corn prices pushed U.S. ethanol margins to their highest levels this year. Iowa State reported the average margin for a dry-mill plant reached 40.67 cents/gallon (10.7 cents/liter), a weekly increase of 7.2 cents/gallon (1.9 cents/liter). Between lower corn prices and higher DDGs values, ethanol producers will seek to increase output in the coming weeks. Ethanol prices will likely be commensurately pressured, making the biofuel even more competitive as a gasoline additive versus MTBE and the “aromatic” compounds.

Petroleum markets remain weak with Brent crude oil slipping $1.55/gallon ($0.41/liter) to $47.62/gallon ($12.579/liter) and RBOB futures falling 3.9 cents/gallon (1.02 cents/liter) to $1.581/gallon ($0.418/liter) this week.

International Developments:

According to U.S. Census Bureau data, U.S. ethanol exports have reached a new all-time high at approximately 1.15 billion gallons (marketing year-to-date, September-June). This figure bests the 2011/2012 marketing year (September-August) total of 1.09 billion gallons. Exports to Brazil have increased approximately four-fold, and both India and Canada showed notable increases in U.S. ethanol imports.

Brazil: Brazil inaugurated the country’s first corn-only ethanol plant this week. Brazil, which has historically relied on sugar cane for feedstock, is facing a corn supply glut and will turn to ethanol to boost consumption. The new plant, which was inaugurated by President Temer and is owned privately by FS Bioenergia, will produce 240 million liters (63 million U.S. gallons) of ethanol annually. Given that Brazilian corn prices are well below their break-even cost for use in an ethanol plant, it is likely the country will seek to build additional corn-feedstock ethanol plants soon. (Reuters)

Brazil’s South-Central ethanol mills increased production during the second-half of July, producing 2.6% more ethanol than in the same period last year. Production reached 2.08 billion liters, including 935 million liters of anhydrous ethanol (up 2.15% year over year) and 1.14 billion liters of hydrous ethanol (down 1.5% year over year). Meanwhile, demand through the nation at large is mixed through May 2017, with hydrous ethanol demand down 20% and anhydrous demand up 6%. (OPIS)

EU: The USDA’s Foreign Agricultural Service (FAS) recently reported it expects ethanol production in Europe to increase in 2017 and 2018. The report predicted 5.34 billion liters would be produced by the end of 2017 and 5.38 billion in 2018. Bioethanol consumption is set to increase 1.6% in 2017 to 5.355 billion liters and increase another 1.7% in 2018 to 5.445 billion liters. (USDA FAS, World Perspectives, Inc.)

Spain: Ethanol sales increased slightly in June, rising 1% from May and 7% from June 2016. Gasoline consumption in Spain increased 7.5% from May and 4.1% from last year, implying the ethanol incorporation rate (4.97%) fell month-on-month but increased from last June’s 4.9%. In the long-run, Spanish consumption of biofuels is expected to grow due to the January 1 increase in the biofuels mandate from 4.3% to 5%. (Platts, USDA, World Perspectives, Inc.)

India: The most recent government data shows the country’s ethanol blending rate averaged 2.4% as of June 30, 2017. The blending rate is significantly below the government’s goal of a 20% blend rate. The majority of India’s ethanol is produced from molasses, a byproduct of sugarcane processing. India’s gasoline demand is expected to reach 37.7 billion liters in 2018 and rapidly grow to 49 billion liters in 2020. Accordingly, India would need 3.77 billion liters of ethanol in 2018 and 4.9 billion in 2020 to achieve a 10% blending rate. India’s ethanol needs would double to meet the 20% blending rate, implying 7.54 billion liters would be needed for 2018 and 9.8 billion in 2020. (World Perspectives, Inc.)

In 2016, India produced an estimated 965 million liters of ethanol and imported 320 million liters – including 243.5 million from the U.S. destined for the industrial use market. Despite significant shortfalls in production relative to the government mandate, India’s fuel ethanol market remains closed to imports.

Price Database: If you are interested in historical price data, please click here.