Ethanol, Fuels and Co-Product Pricing

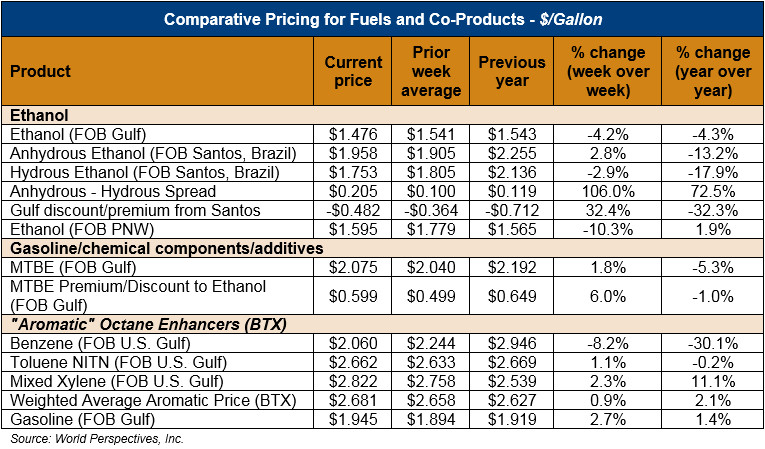

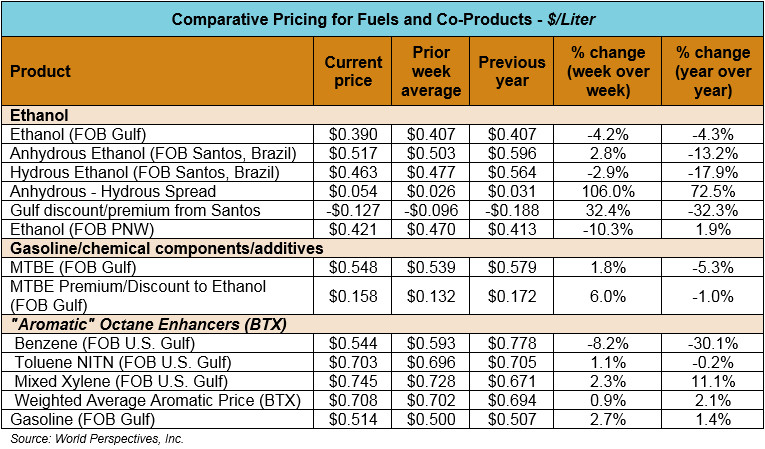

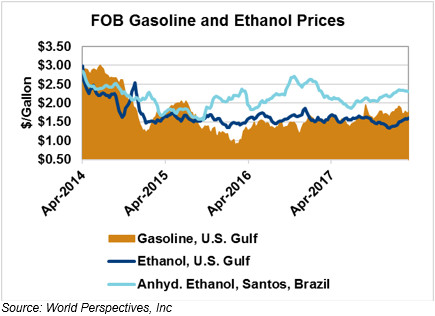

Market Outlook: U.S. ethanol prices ended last week down 4.5 percent and continue down (-1.3 percent) in early week trading. Midwest wholesale rack ethanol prices were unchanged to end last week; they are down to start this week at 39.52 cents/liter (149.59 cents/gallon) through Tuesday’s trading.

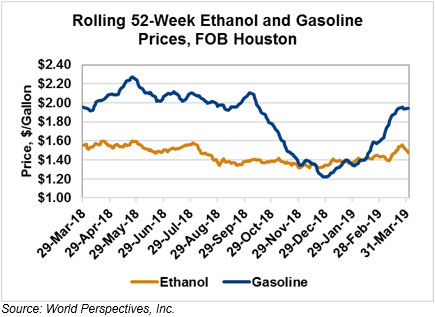

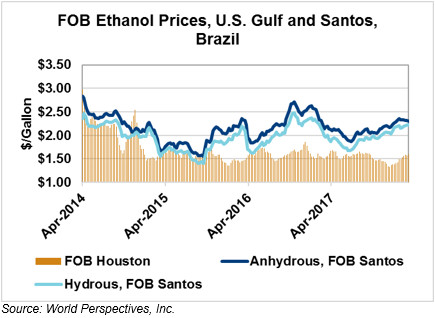

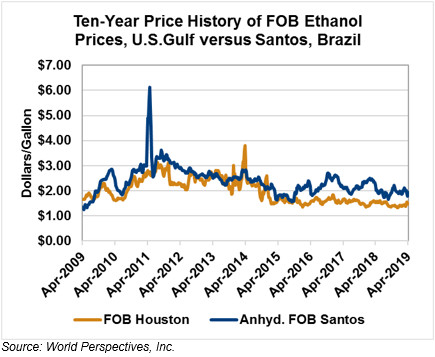

FOB Houston ethanol prices finished last week up 2.5 percent; prices have since fallen and are down 4.2 percent through Tuesday’s trading from Friday’s close. FOB Houston ethanol prices are quoted at 38.98 cents/liter (147.58 cents/gallon). FOB Santos, Brazil ethanol prices ended last week down 4 percent; they are up from Friday’s close and stand at 51.72 cents/liter (195.80 cents/gallon) through Tuesday’s trading.

The FOB Gulf-Santos, Brazil spread widened from last week’s close through Tuesday’s trading and is currently at -12.73 cents/liter (-48.21 cents/gallon).

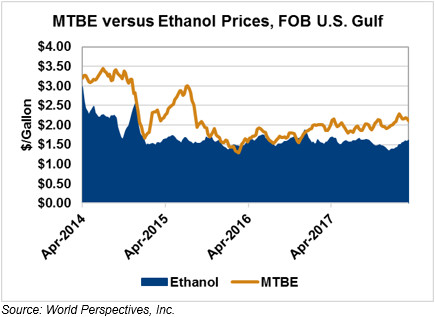

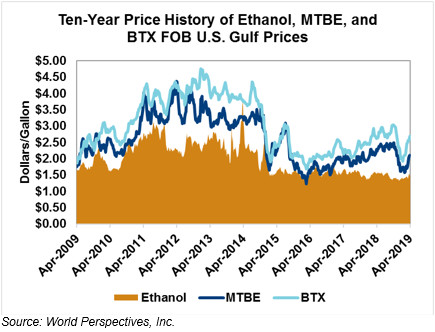

MTBE prices were up 4.4 percent to end last week; they continue up (+1.6 percent) to start this week. MTBE’s premium to FOB Houston ethanol widened again from last week and now stands at 15.74 cents/liter (59.59 cents/gallon).

BTX component prices were up across the board to end last week but are mixed through Tuesday’s trading: Benzene is down 7.4 percent, Toluene is up 0.9 percent and Xylene is up 2.6 percent. The estimated weighted average aromatic price is currently 70.95 cents/liter (268.58 cents/gallon), up 1.1 percent from last Friday’s close. The BTX-Houston ethanol spread widened from last week; the weighted average BTX price is 31.96 cents/liter (120.99 cents/gallon) higher than the FOB Houston ethanol price.

Gasoline and petroleum products were mixed to end last week but are up across the board through early-week trading. This week, RBOB futures are up: 84 (Houston) and 87 (U.S. Gulf) octane gasoline prices are up 3 percent and 3.3 percent, respectively. WTI futures are up 3.9 percent to $62.52/barrel and Brent futures are up 2.7 percent to $69.43/barrel, from Friday’s close through Tuesday’s trading.

Price Database: If you are interested in historical price data, please click here.