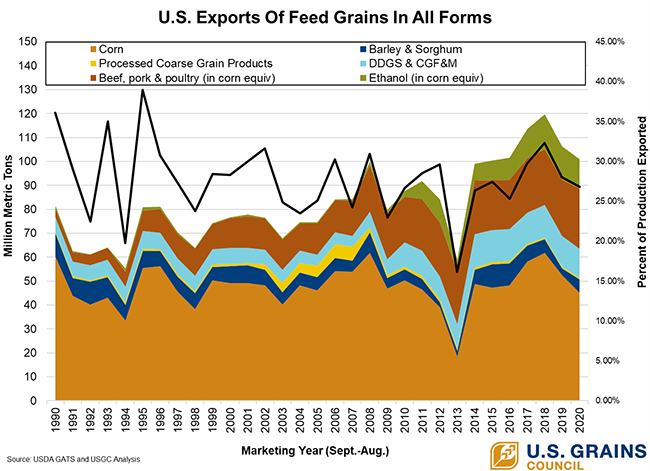

U.S. exports of grain in all forms (GIAF) reached nearly 101 million metric tons, equivalent to 3.97 billion bushels, by the end of the 2019/2020 marketing year, according to data from the U.S. Department of Agriculture (USDA) and analysis by the U.S. Grains Council (USGC). While the export total declined five percent year-over-year, GIAF exports still represented the fifth highest year on record.

Tracking GIAF exports provides a more holistic view of the feed grains produced by U.S. farmers and consumed by overseas customers than sales of one grain product alone. To do so, the Council reviews exports across 10 product sectors, including raw grain exports of U.S. corn, barley and sorghum and value-added products including ethanol, distiller’s dried grains with solubles (DDGS) and other co-products as well as the corn equivalent of exported meat products.

“There is no other way to frame it: the last marketing year was extremely difficult,” said Ryan LeGrand, USGC president and chief executive officer. “Our corn crop faced serious problems during planting, the growing season and harvest but the resiliency and forward-looking approach of the U.S. farmer remained ever-present.

“Feed grain exports started slowly but the last half of the year saw a rapid surge in sales and shipments, providing a strong finish to the 2019/2020 marketing year. As move into 2020/2021, the Council is encouraged by the near-record sales happening already in the current marketing year.”

U.S. corn exports represented the largest percentage decline in 2019/2020, down 14 percent year-over-year due to competitive South American supplies. Exports for the year totaled 45.1 million tons (1.78 billion bushels). Mexico retained its position as the top market for U.S. corn at 14.5 million tons (571 million bushels), down 10 percent year-over-year. Notably, Colombia increased imports slightly to 4.91 million tons (193 million bushels). China skyrocketed into the top five U.S. corn buyers at 2.09 million tons (82.2 million bushels), a dramatic increase from 259,000 tons (11.6 million bushels) the year prior.

The outbreak of COVID-19 knocked back U.S. ethanol production and global demand for fuel ethanol. However, thanks to a surge in demand for industrial uses like sanitizer, ethanol exports ended the year at 1.36 billion gallons (482 million bushels in corn equivalent), down 12 percent year-over-year. Exports to Brazil also saw a substantial decline of nearly 30 percent year-over-year to 263 million gallons (93.3 million bushels in corn equivalent). As a result, Canada claimed the top market slot at 321 million gallons (114 million bushels in corn equivalent).

Reduced production from U.S. ethanol plants in spring and summer 2020 had a ripple effect on the availability and prices of U.S. DDGS. As a result, U.S. DDGS exports ended the year down 6.6 percent at 10.5 million tons. Mexico remained the top buyer, although total imports of 1.8 million tons represented nearly an 11 percent decline year-over-year. By contrast, several top buyers of U.S. DDGS saw increases from the previous year, including South Korea, Thailand, Turkey, Japan, the Philippines and New Zealand.

U.S. exports of barley and barley products also declined 7.5 percent year-over-year to 493,000 tons (22.6 million bushels). Mexico was the top buyer at 350,000 tons (16.1 million bushels), down year-over-year due to COVID-19 restrictions that limited beer production during summer 2020.

One sector seeing a bounce upward for the 2019/2020 marketing year was U.S. sorghum exports, coming in at 5.15 million tons (203 million bushels). China was the driver, importing 3.67 million tons (144 million bushels). While this is a substantial increase from the previous year, exports remain well below previous highs. Exports to Mexico also increased 21.5 percent to 594,000 tons (23.4 million bushels), and smaller buyers like Mexico and Japan also saw significant increases.

The 2020/2021 marketing year officially began on Sept.. 1, 2020, with the first month of USDA export data to be released in November. Follow along with the Council as the organization tracks GIAF exports throughout the year with the Feed Grains In All Forms portal.

About The U.S. Grains Council

The U.S. Grains Council develops export markets for U.S. barley, corn, sorghum and related products including distiller’s dried grains with solubles (DDGS) and ethanol. With full-time presence in 28 locations, the Council operates programs in more than 50 countries and the European Union. The Council believes exports are vital to global economic development and to U.S. agriculture’s profitability. Detailed information about the Council and its programs is online at www.grains.org.