Ethanol Market Overview

- There is no production or consumption of fuel ethanol in the UAE. Although the government targets a rising share of renewables in transport, policies are focused on improving vehicle efficiency. There has been some interest in the use of biodiesel and aviation biofuels from waste oil feedstocks.

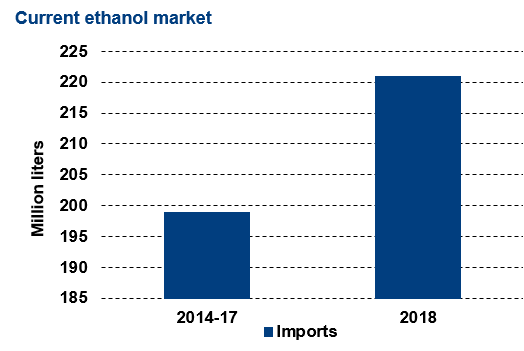

- The UAE imported just over 220 million liters of ethanol in 2018. Imported ethanol is destined for industrial use and blended into gasoline for reexport.

- Beverage alcohol consumption in UAE is controlled through a permitting process.

- Petrochemical industry is the main user of ethanol present in the UAE market. The product is being used in a variety of applications including manufacturing processes detergents, paints and perfumes and steel cable products.

Key Facts

- Mandate:

2018: None - Gasoline consumption forecast:

2022 13.5 billion liters

Policy

- The UAE ratified the 2015 Paris Agreement on Climate Change through Vision 2021 and UAE Energy Plans 2050. The country has set a target of increasing its clean energy contribution to the total energy mix from 0.2% in 2014, to 24% by 2021. This will be achieved through renewable and nuclear energy and is underpinned by detailed emirate level targets and policies.

- The UAE continues to improve the emission standards for new motor vehicles, in accordance with European emission standards, as well as through the introduction of standard labels. These initiatives target both improvements in fuel economy and a reduction in local air pollution.

- The UAE also intends to introduce comprehensive regulations for electric vehicles to facilitate their uptake domestically.

- Ethanol could play a role in achieving the UAE’s renewable energy targets as well as meeting emission standards and air quality requirements. However, food security is a key concern and therefore any fuel ethanol would have to be produced from non-food feedstocks. Thus far, biofuels in transport have been confined to the use of FAME from waste oils such as used cooking oil. There has also been some interest in projects using novel feedstocks for aviation biofuels.

- The constituent emirates of UAE are Abu Dhabi (which serves as the capital), Ajman, Dubai, Fujairah, Ras al-Khaimah, Sharjah and Umm al-Quwain.

Challenges

- The UAE has a large market for gasoline and an E10 blend would require over 500 million liters of ethanol per year.

- In the absence of any supportive ethanol policy, ethanol would have to compete with components of gasoline on price. Gasoline is currently sold in the UAE at below world market prices, although the government intends to stop subsidising fuel prices. Its Status as a clean fuel generally, explicitly nor implicitly mentioned.

- The lack of agricultural production makes developing an ethanol industry unfeasible.

Market Outlook

- There is no sign that the UAE will be a consumer of fuel ethanol in the future. While the government is keen to reduce its consumption of fossil fuels in the transport sector, measures to date have focused on the diesel sector.

- However, demand for ethanol for reexport may continue to rise as UAE remains a key exporter of finished gasoline throughout the region.