Ethanol Market Overview

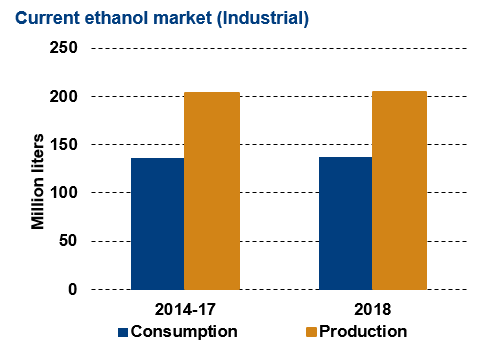

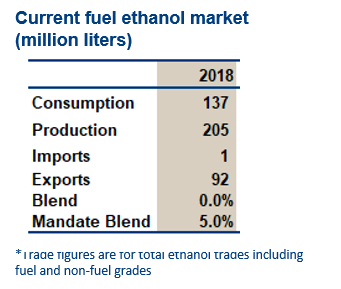

- Indonesia has a 5% ethanol mandate with a 20% target by 2025. In 2018, industrial ethanol consumption is estimated at 137 million liters.

- Domestically produced ethanol is uncompetitive with the price of gasoline, other oxygenates, and is double that of U.S. FOB Gulf.

- There are six plants capable of producing fuel ethanol with a capacity of 290 million liters. There are also 14 ethanol plants producing non-fuel ethanol for the medical industry, cosmetics, and export. Production is based on molasses from the local sugar industry.

- Most government support for biofuels is targeted for the biodiesel sector.

Key Facts

- Mandate:

2018: 5% - Consumption:

2018 137 million liters (industrial) - Capacity: 290 million liters

- Ethanol plants: 6 (feedstock: molasses)

- Gasoline consumption forecast:

2022 45.9 billion liters

Policy

- In December 2015, the government published new national biofuel targets. The bioethanol mandate in transport for the non-Public Sector service Obligation (PSO) rises from 5% in 2016 to 10% in 2020 and 20% in 2025. The Non-PSO sector accounts for the bulk of road transport and is the main source of ethanol demand.

- There is also a bioethanol mandate in the PSO sector which rises from 2% in 2016, to 5% in 2020 and then 20% in 2025. The PSO for ethanol refers to subsidised fuel used by small scale industry, fishing and agriculture. The biofuel blending mandate is administered by the Ministry of Energy and Mineral Resources (MEMR) Regulation.

- Indonesia has announced plans to move to E2 in 2018.

- Although there is no ethanol production, the government has improved its price support measures. The ethanol market price index has been changed from an Argus price-based formula (world price) to a molasses based formula. While the formula raises the ethanol price, the government is currently unable to fund the formula and fuel ethanol production remains at close to zero.

- In 2016, the government also proposed funds to subsidise the domestic price gap between ethanol and gasoline but this measure was not approved by the House of Representatives.

- In October 2016, Indonesia ratified the Paris Agreement on Climate Change. The country pledges to cut greenhouse gas emissions by 29% by 2030 and up to 41% with foreign support including technology and finance.

Trade

- The country exports 50-100 million liters per annum of industrial and potable grade ethanol. In 2018, exports reached 92 million liters. The main destination was the Philippines with smaller quantities going to Japan and Thailand.

- Indonesia currently imports nearly no ethanol. This is because the country has relatively high import tariffs, a limited policy, and it is unclear what oxygenates are used in the local fuel supply.

- The import tariff on denatured and undenatured ethanol is 30%.

Challenges

- The government does not compel Pertamina (the state owned oil company) to blend ethanol.

- As domestic ethanol is more expensive than gasoline, oil companies face losses on ethanol blending, and supply is limited.

- There is a lack of awareness about ethanol as an oxygenate and availability through trade in in Indonesia that needs to be overcome.

- Pertamina currently has limited infrastructure for the blending and supply of ethanol.

Market Outlook

- It is unlikely that domestic ethanol production will expand in the near term due to feedstock constraints.

- Indonesia will be the 6th largest fuel market by 2022.

- The country has enough molasses to produce 355 million liters of ethanol if there is a sufficient incentive.