Ethanol Market Overview

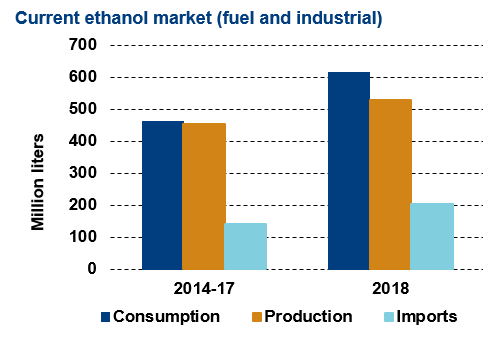

- Fuel ethanol consumption in Colombia is driven by a nationwide 10% mandate, previously government restrictions on imports has seen consumption fail to reach the target.

- Consumption in 2017 reached 493 million liters equal to an average blend of 7.6% ethanol in gasoline nationwide. Output is around 450 million liters from sugarcane.

- Consumption has historically been determined by domestic output as the government has reduced mandates in years where output has been poor in order to limit the use of imported ethanol.

- There have been discussions over increasing the ethanol blending mandate to 15%. However, domestic supply has not been sufficient to make this achievable, with further complications from potential fiscal losses due to decreased income from taxes on reduced gasoline sales.

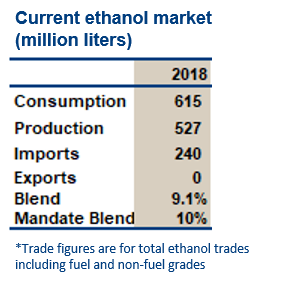

Key Facts

- Mandate:

2018 10% (some states exempt) - Consumption:

2018 615 million liters (9.1% blend) - Capacity: 600 million liters

- Ethanol plants: 8 (main feedstock: sugarcane)

- Gasoline consumption forecast:

2022 5.4 billion liters

Policy

- An E8 mandate was implemented at the start of 2012. The mandate was scheduled to increase to 10% but when this was implemented in 2013, the result was large scale imports rather than higher domestic output causing the government to drop the mandate back to E8 in 2014. Domestic ethanol capacity has increased, accompanied by a mandate for E10 in 2018.

- From 2014 to April 2017, the Colombian government restricted imports of fuel ethanol if domestic production was deemed sufficient to meet the mandate. To further restrict the need for imports, the government has temporarily reduced the mandate to zero several times when adverse conditions have hit Colombian output. However, since 1st May 2017, the restrictions on ethanol entering the country have been lifted resulting in a sharp increase in imports from the U.S. There have been many petitions from domestic producers to reinstate limits on imports.

- Colombia signed up to the Paris Agreement in 2016 and have committed to reduce their GHG emissions by 20% compared to a business-as-usual scenario by 2030 with a provision to increase the target to 30% if international support is provided.

- On December 2017, the Colombian Government enacted GHG reduction requirements for fuel ethanol used toward the blending mandate in the country, which becomes more stringent over five years. These regulations restrict the number of U.S. fuel ethanol producers capable of exporting to Colombia, and make U.S. ethanol less price-competitive, as they act as a non-tariff barrier to trade.

Trade

- The majority of ethanol imported into Colombia historically has been non-fuel grades due to restrictions on the use of imported ethanol for fuel. Around 5-15 million liters of fuel ethanol imports were reported from the U.S. during the years that restrictions were in place.

- The restrictions on imports were lifted in 2017, leading to much higher volumes of ethanol entering the country and fuel ethanol exports from the U.S. reached 68 million liters and 173 million liters in 2018.

- Without imports Colombia will struggle to meet even an E8 mandate as demand for gasoline is forecast to grow over the forecast period raising the volume of ethanol needed.

- A tariff of 10% is applied to fuel ethanol imports, except for the U.S. which is exempt due to the free trade agreement.

Challenges

- Regulations on GHG emissions required for fuel ethanol are expected to restrict U.S. ethanol exports to Colombia by 2020. However, producers are undertaking considerable efforts to comply with these regulations. If unsuccessful, Colombia’s blending mandate is likely to go unmet.

- Growth in ethanol production capacity is limited due to the lack of available land in the Cauca valley for expanding cane area.

- As GHG restrictions are enforced, the government may waive the mandate, as has been done in the past.

Market Outlook

- The mandate was increased to 10% due to increases in domestic ethanol capacity and specific environmental challenges at the city level.

- There has also been talk of raising the mandate further, but this is unlikely to happen given the current resistance to imports, the inability for domestic expansion to meet demand, and the fiscal impact of reduced Government income from taxes on lower amounts of gasoline sold.

- In 2018, a tight global sweetener market led Colombian mills to switch output toward ethanol at the expense of sugar.

- Any increase in ethanol output is likely to fall short of rapid increases in overall gasoline demand in Colombia, requiring more imports to meet market demand and current blending requirements.