Ethanol Market Overview

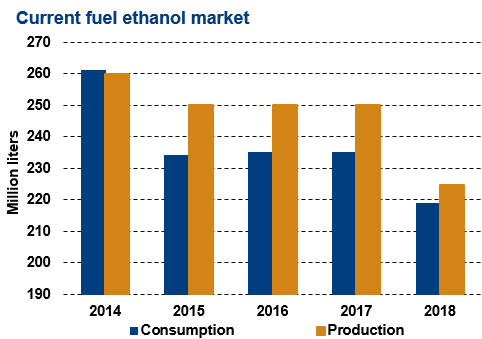

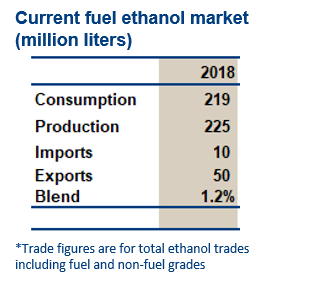

- Fuel ethanol use in Australia has fallen short of the volume implied by the state level mandates, reaching 219 million liters in 2018 equivalent to an average blend of 1.2% nationwide. Ethanol is only mandated in two states in 2018 but mandates have not been met due to exemptions and a lack of enforcement.

- Fuel ethanol consumed in Australia is domestically produced, due to favorable tax incentives for domestic production. Production capacity is near feedstock producing regions in New South Wales and Queensland. The three plants have a combined capacity of 440 million liters using waste wheat, sorghum, and molasses. One plant produces only fuel grade ethanol, the other plants split their output between fuel and non-fuel grade ethanol.

Key Facts

- Mandate:

2018 3% Queensland, 6% New South Wales, 2.5% national average - Ethanol consumption:

2018 219 mn liters (1.2% blend) - Capacity: 440 million liters

- Ethanol plants: 3 (feedstock: waste wheat, sorghum, and sugar)

- Gasoline consumption forecast:

2022 17.7 billion liters

Policy

- Since 2015, excise taxes on domestically produced biofuels have begun to be phased in, with rates reaching 33% of the duty for petrol for fuel ethanol by 2030. This tax structure provides an advantage for domestically produced ethanol, since imported ethanol is taxed at the full rate of gasoline.

- Two states currently have blending mandates, New South Wales (NSW) implemented an E6 blend in 2011 and after years of delays Queensland introduced a 3% target on 1st January 2017 (with plans to raise it to 4% in July 2018). Neither target has been met, the average blend in the first half of 2017 in NSW was just 2.4% while in Queensland it was 1.5%. In NSW consumption has fallen below the targets mainly due to exemptions being exploited by fuel industry participants, steps have been taken to remove these loopholes but so far demand remains low. Demand in Queensland has risen since the mandate was introduced but remains below the mandate. If these mandates were met, the average blend of ethanol in gasoline nationwide would be 2.5%.

- Ethanol is sold in the form of E-10 and E-85 alongside regular gasoline so consumers have a choice at the pump. Poor consumer understanding of biofuels and fleet compatibility has limited demand.

- To fulfil its commitment to the Paris Agreement Australia has set out targets to reduce GHG emissions by 26-28% compared to 2005 levels by 2030. The steps taken so far toward this target have not included increased use of biofuels.

Trade

- Prior to 2014 Australia imported 10-50 million liters of fuel ethanol per year, mainly from Brazil, the U.S. and Indonesia. However, since crude oil prices fell, imported ethanol has been uncompetitive, due to a tax structure, favorable to domestically produced ethanol.

- Australia imposes a basic tariff of 5% on ethanol coming into the country, however they have a number of free trade agreements which include the U.S., New Zealand and much of Asia.

- Aside from the tariff, imports are disadvantaged relative to domestic supplies as they are not eligible for tax exemptions, this adds U.S.$0.30/liter to imports compared to domestic ethanol.

- Australia is a net exporter of ethanol, supplying non-fuel grades to Asian countries. Exports have increased in recent years with a record level of exports recorded in 2017.

Challenges

- Policy has been implemented poorly in the past with mandates announced and then cancelled leading to high levels of uncertainty, discouraging investment in the sector.

- There has also been a lack of information and incentives for consumers.

- Under the Paris Agreement Australia has ambitious plans to reduce GHG emissions, however none of the schemes currently include targets for increased use of biofuels.

Market Outlook

- Australia has potential to increase ethanol use in the future but will need a stronger policy to encourage consumption and incentivize investment in production capacity.

- Due to the tax structure, increase in Australian demand for ethanol are expected to be supplied domestically.

- There are no new plants currently under construction.