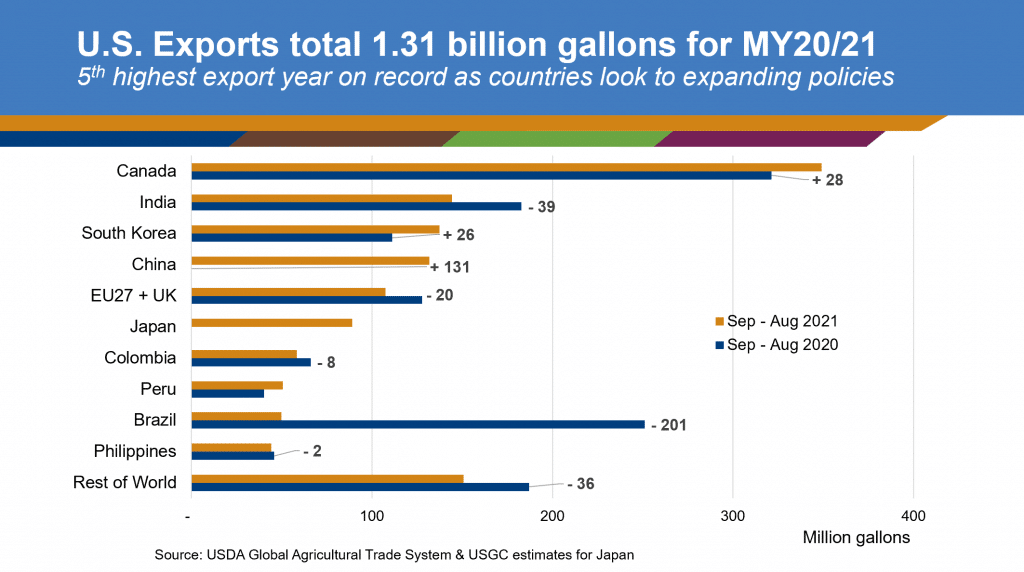

| The marketing year ended Aug. 31, for which numbers became available this week, recording the fifth highest overall export total for U.S. ethanol exports, 1.31 billion gallons, despite market challenges due to COVID-19. Exports were down eight percent from the previous marketing year, reflecting the challenges pandemic restrictions have had on fuel demand and trade. The first half of the year’s exports occurred before the issuance of widespread stay-at-home orders that drastically impacted demand for fuel around the globe. While industrial exports remained strong, they sagged slightly relative to the surge of sanitizing application demand from the outset of the pandemic. “The lingering effects of COVID-19 stay-at-home orders were reflected in global ethanol trade in the most recent marketing year,” said Brian Healy, director of global ethanol market development for the U.S. Grains Council (USGC). “Looking forward, more aggressive blend rates that have already been set, or will need to be set to meet emissions reduction goals, will support increased global ethanol demand and trade.” In descending order, the top 10 export markets for U.S. ethanol were as follows: Canada – Fuel ethanol demand recovered in Canada in the just-finished marketing year after being down by roughly 14 percent the prior year. Looking forward, the federal clean fuel standard, set to be implemented at the end of 2022 and geared toward reducing greenhouse gas (GHG) emissions, and provincial policy expansions like 15 percent renewable content in Ontario in 2025 are expected to drive future demand for ethanol.

India – The country is in the process of implementing an ambitious 20 percent policy by 2023, which, if realized and enforced, would more than double the fuel ethanol demand in the growing market. U.S. exports to India totaled 144 million gallons and were destined for industrial applications due to the restriction on fuel ethanol imports.

South Korea – Another strong industrial-use market, South Korea is currently exploring ways for the transport sector to reduce emissions, illustrated during the recent workshop held in early September. Exports totaled 137 million gallons, a 23 percent increase, reflecting the strategic position of the South Korean market as a transshipment point for Southeast Asian destinations.

China – While China’s 10 percent nationwide mandate was delayed, imports remained strong to meet the provincial policies in place. Ethanol has the potential to contribute to meeting additional China Phase One commitments as well as to support the country’s long-term emissions reduction goals set for 2060. China was the primary mover in the most recent marketing year, rising to the fourth-largest export market after having minimal exports in the two prior marketing years. Exports to China totaled nearly 132 million gallons.

European Union (EU) and the United Kingdom (UK) – Overall, exports to the EU and the UK were down from the prior year by 16 percent, as prices weighed on market access. In September, the UK began its E10 implementation with the expectation domestic capacity would be brought back online following full implementation of the policy.

Japan – Imports of ethanol to Japan are in the form of ethyl tert-butyl ether (ETBE), and the U.S. has market share following a change in Japan’s policy in 2018. The Council estimates U.S. ethanol totaled about 90 million gallons included in ETBE exports to the Japanese market.

Colombia – The drop in the blend rate for the Colombian market has impacted overall demand, as the use of E10 is not expected to fully resume until January 2022. Overall, exports are down by 12 percent compared to last year, totaling 58 million gallons.

Peru – Exports finished up in Peru at 50 million gallons, up by 26 percent.

Brazil – Brazil experienced a loss of more than 200 million exports this marketing year, dropping from the second-largest export market last year to now the ninth largest. Exports dropped 80 percent as the full 20 percent tariff on U.S. exports took effect in December 2020.

The Philippines – The Philippines remains a model for how policy with a role for trade supports domestic ethanol producers when the policy is enforced. Exports rounded out the year just shy of 45 million gallons.

“Looking forward to the new marketing year, three factors will impact global ethanol demand: policy enforcement, inclusion of ethanol in GHG emission reduction policies, and creating tariff equity of ethanol with other transport energy products,” Healy said.

India, the UK and Colombia are key examples of the importance of policy enforcement impacting global demand for ethanol. The U.S. industry is poised to support these countries in full implementation. Japan, Korea and Taiwan have announced net zero targets by 2050, and ethanol can have a role in meeting those goals, making collaboration with local industry and government a priority when demonstrating that feasibility. Finally, tariff parity with other energy products must be realized to ensure ethanol is able to competitively access these markets. |

| |||||||||

About The U.S. Grains Council

The U.S. Grains Council develops export markets for U.S. barley, corn, sorghum and related products including distiller’s dried grains with solubles (DDGS) and ethanol. With full-time presence in 28 locations, the Council operates programs in more than 50 countries and the European Union. The Council believes exports are vital to global economic development and to U.S. agriculture’s profitability. Detailed information about the Council and its programs is online at www.grains.org.