1. Ethanol, Fuels and Co-Product Pricing

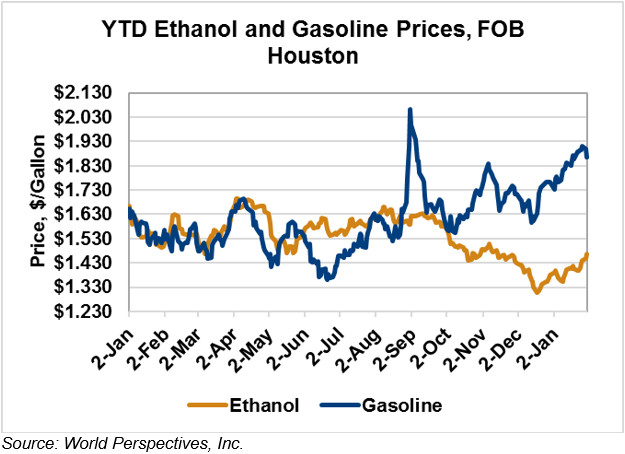

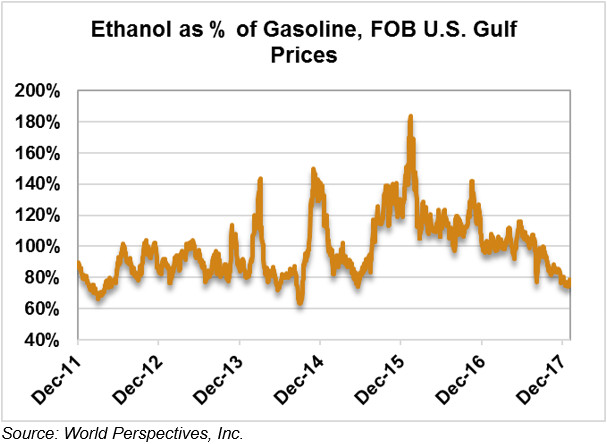

Market Outlook: U.S. ethanol and energy market are mixed to start this week with higher ethanol values and lower crude oil and gasoline prices. March CBOT ethanol futures are up 5.1 percent from last week while Midwest wholesale rack ethanol prices are up 2.9 percent at 38.46 cents/liter (145.60 cents/gallon).

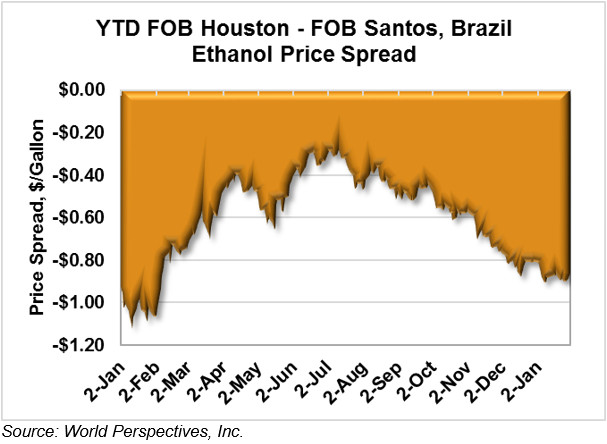

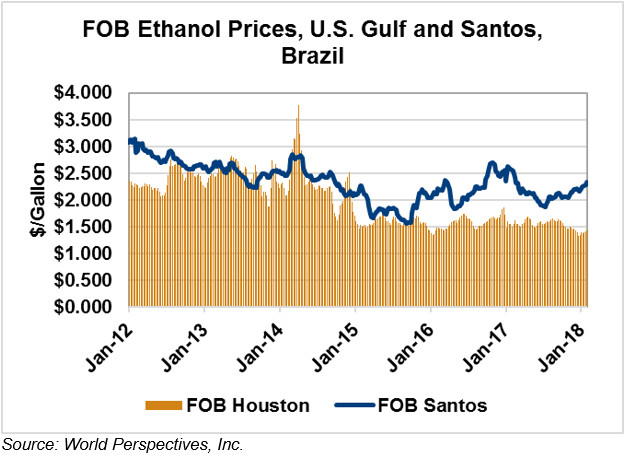

FOB Houston ethanol prices are up 1.126 cents/liter (4.26 cents/gallon) from last week, a 3 percent increase. Prices are likely to continue increasing this week as the recent production drop-off tightens the market. FOB Santos ethanol prices increased 2.1 percent last week (up 1.297 cents/liter to 61.741 cents/gallon or 4.91 cents/gallon to 233.715 cents/gallon).

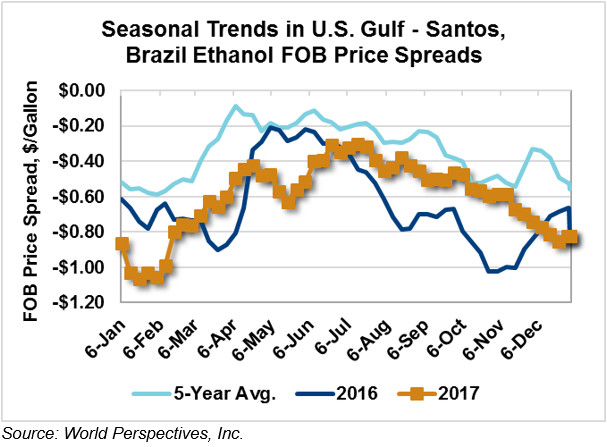

The FOB Houston-Santos spread again moved in favor of U.S.-origin product this week, falling 0.171 cents/liter (0.65 cents/gallon) to its last quote of -23.489 cents/liter (-88.915 cents/gallon). Friday’s close again marked the lowest weekly close in the past six months and the spread is only seven cents away from its all-time lows.

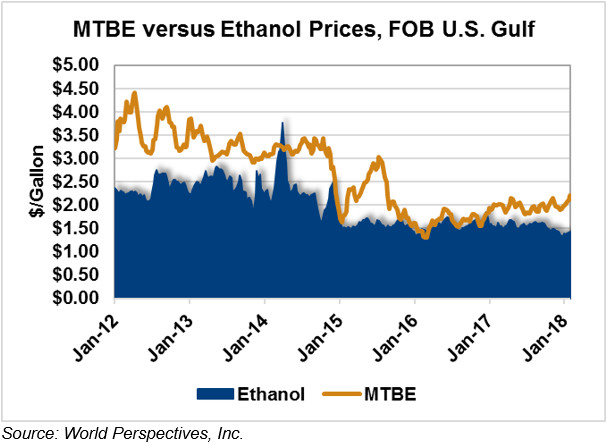

MTBE prices are 6.4 percent higher in early week trading at 59.17 cents/liter (223.99 cents/gallon). FOB U.S. Gulf MTBE is now 20.92 cents/liter (79.19 cents/gallon) higher than FOB Houston ethanol.

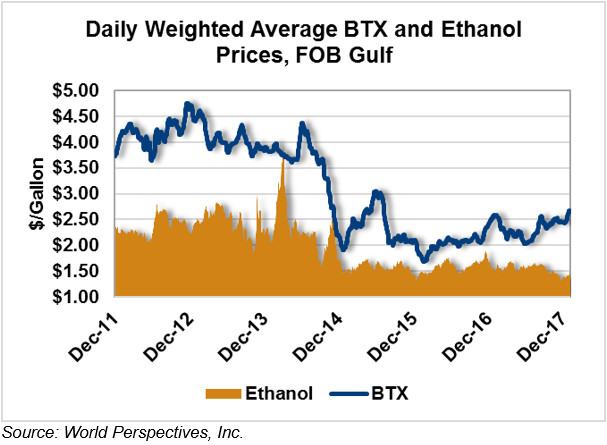

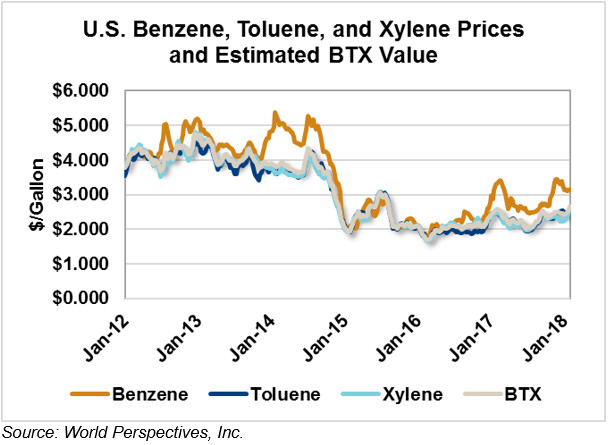

BTX component prices are steady/higher in early week trading, with benzene prices up 0.1 percent, toluene up 2.1 percent, and xylene up 4 percent. The weighted average aromatic price is currently estimated at 70.28 cents/liter ($2.6605/gallon), up 2.9 percent from last week. The weighted average BTX price is 32.03 cents/liter (121.25 cents/gallon) higher than FOB Houston ethanol prices.

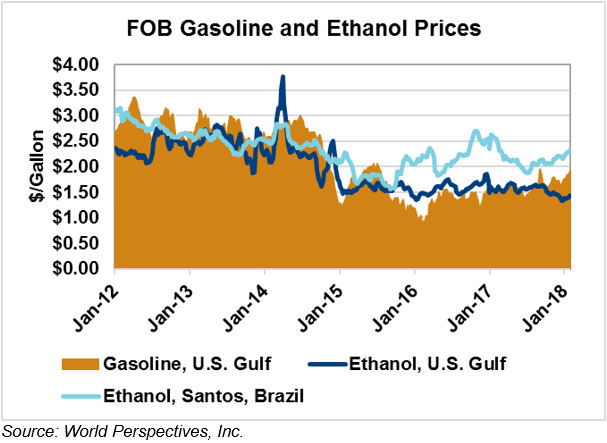

Gasoline and petroleum products are lower to start the current week. RBOB futures are down 2.5 percent (1.21 cents/liter or 4.57 cents/gallon) while 84 octane RBOB and 87 octane CBOB are each 1 percent lower. WTI crude oil futures are down $1.76/barrel from last week while Brent futures have lost $2.14/barrel.

Price Database: If you are interested in historical price data, please click here.