Supply/Demand Basics

-World’s 2nd largest corn producer and consumer.

-World’s largest swine, aqua, egg, beer, distilled spirits producer, 2nd largestpoultry meat and ethanol producer, and growing dairy and beef producer.

-World’s largest sorghum and second-largest corn importer in recent years; DDGS imports restricted by AD/CVD rules. Corn and sorghum imports gain from Phase One trade deal.

Country Overview

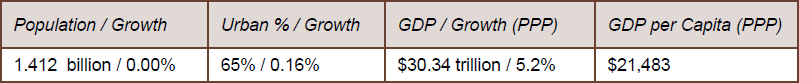

-China’s economy grew by 5.2% in 2023, hitting the government’s official target. Still, concerns about growth remain.

-China’s economy grew by 5.2% in 2023, hitting the government’s official target. Still, concerns about growth remain.

-China increased its pork output in 2023 to a near-record level. But prices plummeted, indicating the market didn’t want that much pork. The volume of pork produced was 57.94 MMT, a 4.6% increase from 2022. China’s corn imports in 2023 came to 27.1 MMT, a 31.6% jump from the level in 2022, following a record import program in December.

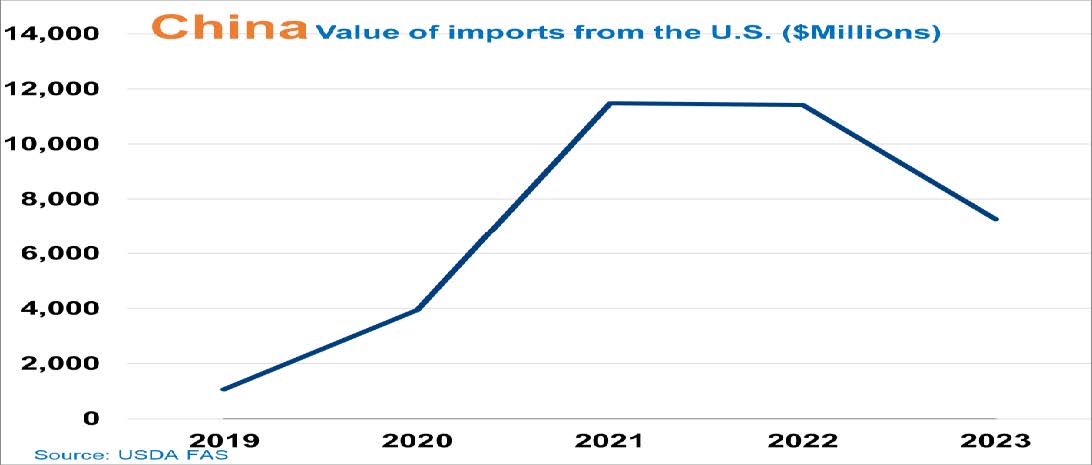

Trade and Market Share Overview

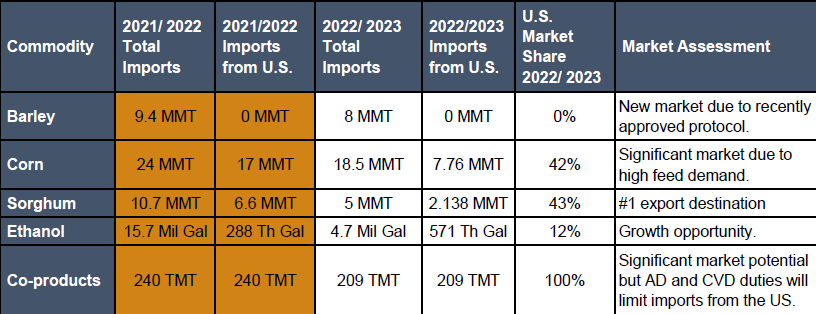

-China was once again a top market for U.S. coarse grains & DDGS in MY 2022/2023 (7.760 MMT for Corn, 2.138 MMT for Sorghum, and 209 TMT for DDGS) and will see more Coarse Grains and Co-Products from diverse origins in 2024, as China diversifies its origination.

-Imports of U.S. ethanol are subject to a 15% (232 tariffs) that was not exempted in the Phase One deal, as well as a 30% tariff (WTO bound rate) re-imposed in late 2016

-DDGS exports are still affected by AD/CV duties, but other constraints are addressed in the Phase One deal.

-A protocol for U.S. barley imports was signed in 2020; No imports in 2023.

Policy Overview

-While trade tension/uncertainties remain, the Phase One trade deal reduced tariffs and resolved many of the non-tariff barriers to exports, including the required GMO processing certificates and TRQ management for corn, the DDGS plant import licenses, and export facility registrations, and resulted in a U.S. barley export protocol.

-China scaled back its commitment to using E10 nationwide starting in 2020 due to reduced corn inventories. However, there is still a need to advocate for the low-carbon and renewable fuel benefits of E10 and SAF, as ethanol competes with the MTBE/methanol sector.

-Self-sufficiency remains a focus in China’s grain and trade policies, and China recently approved corn imports from Brazil and approved 37 local GE corn varieties for cultivation.