Chicago Board of Trade Market News

Outlook

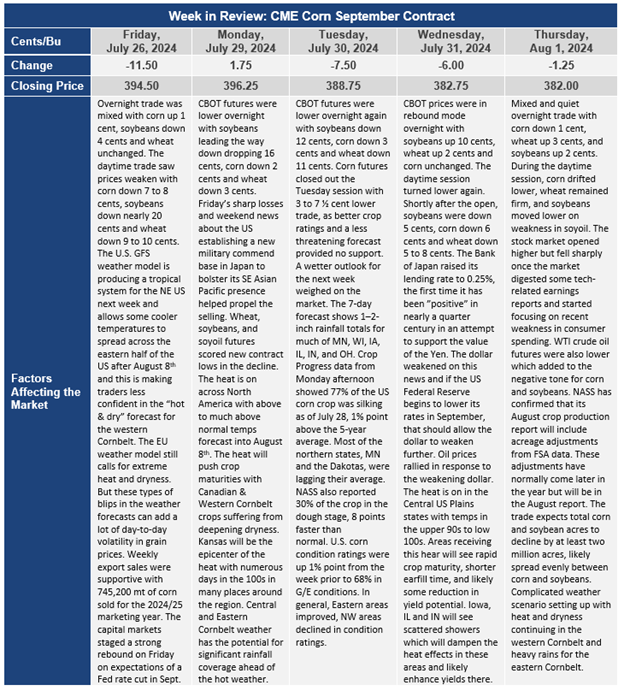

The heat is on in the U.S. Plains states and the market doesn’t care. Corn, soybean and wheat prices dropped sharply Friday and continued the weakness through the first several trading days of the week. Crop condition rating dropped slightly in the western areas of the Cornbelt but improved in the Eastern Cornbelt with good rainfall coverage before warmer temperatures arrived. Crop consultant, Dr. Michael Cordonnier left his corn yield forecast at 181.5 bushels per acre and U.S. corn production at 14.97 billion bushels. He noted that July weather was generally favorable for crop development with rain where needed and soil moisture often replenished before above normal temperatures developed.

Most of the U.S. corn crop pollinated under favorable conditions and this sets the stage for relatively large crops, even record yields, if August weather is not too detrimental. Corn acres in Kansas and Nebraska are most likely to experience excessively hot temperatures in the next week to 10 days. Central Cornbelt and Eastern Cornbelt acres are likely to see some moisture ahead of above normal temperatures. The heat in early August is likely to speed up maturity of the corn crop and shorten the time for earfill which usually results in a few less bushels as the weight of each ear may be less than optimal.

A crop tour in Bulgaria tends to confirm that corn production in southeastern Europe, Romania, and Ukraine could be significantly less than last year if the pictures of damaged ears are representative of widespread crop damage in the area. Excessive heat and dryness have been seen across much of that area throughout the spring and summer growing season.

The Bank of Japan raised its lending rate to 0.25% for the first time in 20+ years. In response to the rate hike, the dollar weakened, and the yen strengthened. Japan’s central bank hinted at additional rate hikes to help lower the cost of imported goods like food and fuel. The U.S. Federal Reserve is expected to lower its key lending rates beginning in September and this could signal the start of a rate-easing cycle by the Federal Reserve which should help rebalance international currencies in a way that favors more grain sales from the U.S.

The ”looming outlook question” is “why is China being so slow in picking up U.S. corn and soybeans supplies when U.S. prices are very competitive with prices in South America?” Cash-connected trade sources are confident that China will secure sizeable quantities of U.S. corn and soybeans, but the timing is quite uncertain. To date, China has booked about 1 MMTs to Brazilian corn (via vessel counts) which is 5 MMT below last year’s record sales pace. With U.S. corn cheaper than Brazilian offers, one would think that China may be considering switching to U.S.-origin corn for future corn import demand. Brazilian corn prices have not fallen as fast as U.S. corn prices as Brazilian farmers are not wanting to sell corn below the government’s minimum price offer. U.S. corn prices are low enough that they should attract more attention from foreign buyers. One wonders if the attention U.S. lawmakers are putting on allegations of fake Used Cooking Oil (UCO) being imported from China are affecting other aspects of U.S.-China ag trade.

CBOT corn prices have already priced in a record U.S. corn yield, with some suggesting that current prices reflect a national yield expectation of 184 to 185 bushels per acre. Central and eastern Cornbelt acres will have to carry that record yield as western Cornbelt acres are being hurried along and stressed.