1. Ethanol, Fuels and Co-Product Pricing

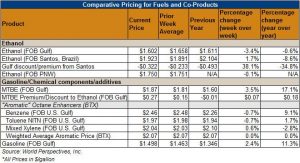

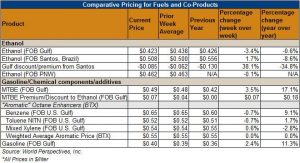

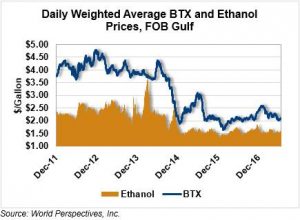

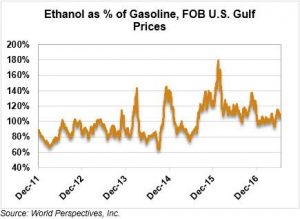

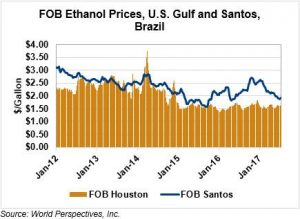

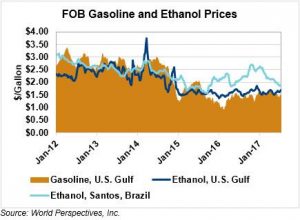

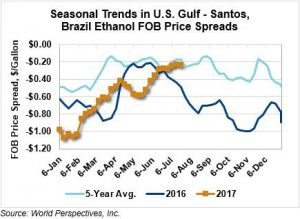

Market outlook: Spot ethanol prices are steady-to-weaker to start the week after volatile trading last week. Ethanol futures managed a marginal gain on Tuesday but are down 1.2 cents from last week. Similarly, FOB Houston prices were steady Monday and Tuesday but fell 2.3 cents from last week. Brazilian ethanol prices are working their way higher, up 1.4 cents/gallon this week. The FOB Houston/FOB Santos, Brazil spread is quoted at -$0.325/gallon, 2.9 cents wider than this time last week.

Ethanol margins were higher at the end of last week and are higher to start this week, thanks to lower corn prices. A bearish WASDE report sent corn futures lower and aggressive selling by farmers also pressured cash prices. Dry-mill ethanol plants saw margins grow by 10.8 cents/gallon this week to 28.46 cents/gallon. DDGS prices have been stable, ensuring good co-product revenue, even as ethanol prices were down for the week.

Minnesota’s E15 sales hit a record high of 1.19 million gallons in May, according to the Minnesota Bio-Fuels Association. May marked third straight month where sales topped 1 million gallons in the state. May 2017 sales were more than double those of May 2016.

Thailand: Thailand’s Alternative Energy Development Plan (ADEP) is boosting expectations for the country’s ethanol and biodiesel production next year. The USDA recently predicted Thailand’s ethanol output will increase 7 percent to 1.5 billion liters in 2018, an increase of 100 million liters. The AEDP has an overall goal that 30 percent of energy consumption will come from renewable energy by 2036. To meet this goal, the Thailand government has set goals for expanding both biofuels production and consumption.

Oddly, the AEDP is entirely reliant on the country’s domestic resources and does not incorporate imports of biofuels or biofuels feedstock. The government is reviewing the AEDP, paying special attention to the fact that domestic biofuels feedstock production will likely be insufficient to meet the country’s 2036 goal. A revised AEDP that includes imports as a supply source would be a wise – and economically efficient – plan for Thailand’s biofuels policy.

Canada: Policy makers in Ontario are closely watching the California senate this week as Sacramento lawmakers negotiate the state’s future cap-and-trade program. Ontario expects to link its cap-and-trade program to those of California and Quebec and the details would be made public once finalized by all three jurisdictions.

Brazil: A Brazilian tanker full of ethanol will arrive in California this week. The tanker, reportedly carrying between 30,000 and 40,000 cubic meters of Brazilian fuel ethanol, will arrive on July 27th and will be the third Brazilian ethanol tanker sent to the U.S. in 2017. So far, all Brazilian ethanol imported into the U.S. this year has gone to California because Brazilian sugarcane ethanol carries a price premium to corn ethanol under California’s Low Carbon Fuel Standard (LCFS). Industry sources recently pegged the LCFS as creating a 21.2 cent/gallon premium for Brazilian sugarcane ethanol versus corn ethanol, the type of premium that makes occasional arbitrage plays possible.

Separately, a study from researchers at Northwestern University and the University of Singapore found ultrafine particle emission rose by a third in Sao Paulo, Brazil when higher ethanol prices encouraged drivers to switch from ethanol to gas. The reverse effect between gasoline/ethanol prices and particulate levels, was also identified. Researchers noted a “lockstep movement” between the economic and environmental factors.

Europe: The United Kingdom’s Royal Academy of Engineering recently released a report detailing suggested steps the government should take for the biofuels industry – including a short-run focus on second generation biofuels development. The report also suggested a cap for crop-based biofuels to reduce the risk of land-use change and incentives for using “marginal land” for biofuels feedstock production.

Price Database: If you are interested in historical price data, please click here.