1. Ethanol, Fuels and Co-Product Pricing

Market Outlook: Weaker corn prices and sagging near-term demand sent ethanol prices lower at the end of last week. Markets have rallied early this week, however, led by strength in the U.S. corn market. Petroleum prices have been largely stable, adding further support to the ethanol markets.

CBOT ethanol futures were pushed sharply lower by weak corn futures late last week, losing 1.32 cents/liter (5 cents/gallon) as corn prices weakened across the Midwest. An early-week rally is underway now as corn futures firmed and supported ethanol prices. November CBOT ethanol futures gained 0.9 cents/liter (3.4 cents/gallon) on Monday and, with current prices at 37.51 cents/liter ($1.42/gallon), are 0.13 cents/liter (0.5 cents/gallon) higher than last week.

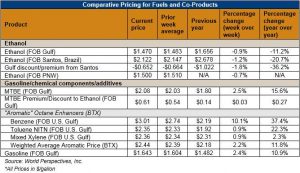

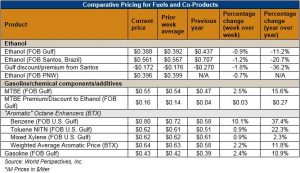

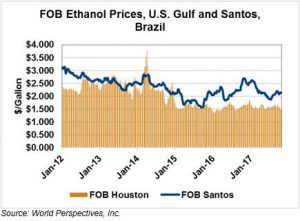

Midwest wholesale rack ethanol prices are 1.6 percent lower to start this week, the second consecutive week of declines. The average rack price is 40.91 cents/liter (154.85 cents/gallon), down 0.67 cents/liter (2.55 cents/gallon) versus this same time last week. Similarly, FOB Houston ethanol prices fell 0.7 percent versus last week, priced at 38.83 cents/liter ($1.47/gallon), a 0.264 cent/liter (1 cent/gallon) decrease from the prior week.

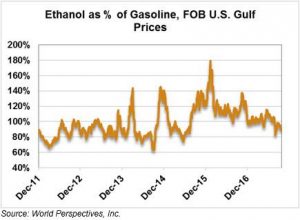

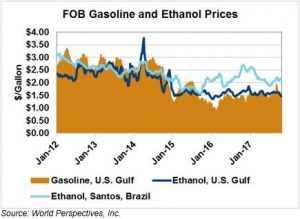

Weakness in global ethanol markets has pressured Brazilian prices, which fell 1.1 percent from last week. FOB Santos anhydrous ethanol is quoted at 56.18 cents/liter ($2.12/gallon), down (0.68 cents/gallon or 2.3 cents/liter) from the prior week. Hydrous ethanol is becoming more competitive against gasoline in Southeast and Center West of Brazil but is losing competitiveness in the South and North East of the country. Ethanol is generally competitive against gasoline at the retail pump when priced at 70 percent or less of retail gasoline values. Currently, ethanol is valued at 69.2 percent of gasoline in the Center West, 80.55 percent in the North East, 66.48 percent in the South East, and 73.3 percent in South Brazil.

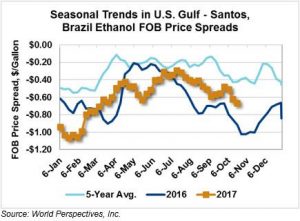

The larger decrease in FOB Santos prices caused the Houston-Santos FOB price spread to narrow this week. The spread, last quoted at -17.356 cents/liter (-65.7 cents/gallon) narrowed 0.343 cents/liter (1.3 cents/gallon) this week. This week’s action brought the spread back from its widest point in six months.

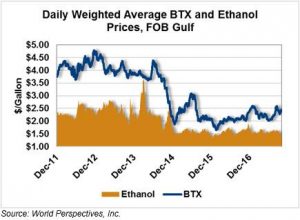

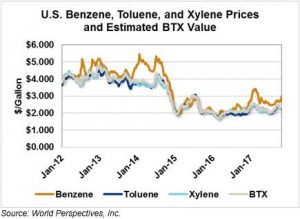

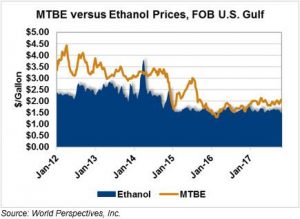

MTBE prices are sharply higher this week and breached 6-month highs. MTBE prices rose 3.7 percent (on top of last week’s 6 percent increase), or 1.94 cents/liter (7.36 cents/liter) to end at 54.65 cents/liter ($2.06/gallon). BTX prices were modestly higher (1.6 percent) to end at $0.633/liter ($2.37/gallon). MTBE is currently 23.51 cents/liter (85 cents/gallon) more expensive than FOB Houston ethanol.

Gasoline prices are steady/higher this week, driven by crude oil prices rising on macroeconomic news. RBOB futures are up 2.32 cents/liter (8.8 cents/gallon) this week while 83.7 octane RBOB gasoline and 87 octane RBOB FOB Houston increased 1.17 cents/liter (4.4 cents/gallon) and 0.7 cents/liter (2.9 cents/gallon) this week. WTI and Brent crude oil futures are 1 percent and 0.8 percent higher this week, respectively.

Price Database: If you are interested in historical price data, please click here.