1. Ethanol, Fuels and Co-Product Pricing

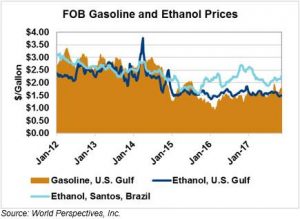

Market Outlook: Weakness in gasoline prices and corn futures pressured ethanol in early-week trading. Nearby CBOT ethanol futures slipped 1.53 cents/liter (5.8 cents/gallon) from last week as December corn futures reached a new contract low today. The corn market seems to be making seasonal lows with the harvest nearly completed, which should keep ethanol prices on the defensive for the next several weeks.

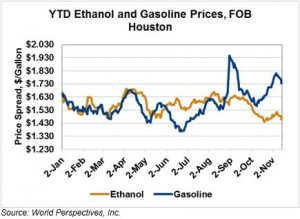

U.S. national rack spot prices are heading lower after an early-November rally and prices fell 0.43 cents/liter (1.63 cents/gallon) this week from last. Gasoline prices, which had trended higher through October, are in retreat which is pressuring wholesale ethanol prices. Many petroleum traders are expecting the recent round of positive gasoline demand numbers to correct lower, and this view is leading to greater selling pressure.

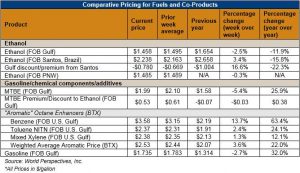

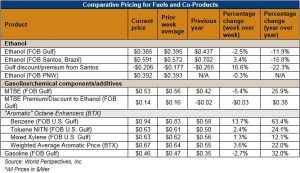

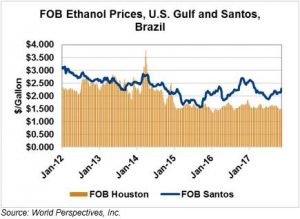

On the export side, FOB Houston ethanol remains the cheapest source of octane globally. FOB Houston prices fell 0.859 cents/liter (3.25 cents/gallon) this week to their last quote of 39.164 cents/liter ($1.4825/gallon). FOB Santos, Brazil prices strengthened this week in response to rising demand, gaining 1.7 percent or 1.004 cents/liter (3.8 cents/gallon) week-over-week. The diverging trends between Houston and Santos, Brazil ethanol prices increased the spread between the two series. The spread widened 10.4 percent (1.862 cents/liter or 7.05 cents/gallon) this week to its last quote of -19.747 cents/liter (-74.75 cents/gallon). The spread is now 10 cents above its widest point in the past five years. The spread’s widest point was Friday’s quote of -22.35 cents/liter (-84.6 cents/gallon).

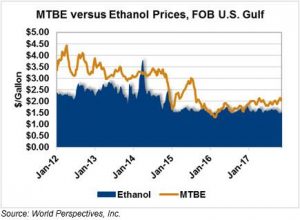

MTBE prices are lower this week after setting a six-month high two weeks ago. MTBE FOB U.S. Gulf prices fell 1.66 cents/liter (6.3 cents/gallon) this week to 54.27 cents/liter (205.45 cents/gallon). FOB Houston MTBE is priced 15.16 cents/liter (57.37 cents/gallon) above FOB Houston ethanol.

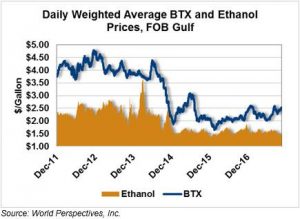

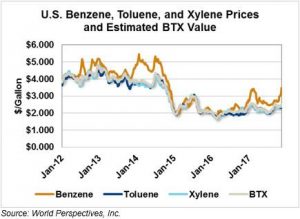

BTX component prices are higher with Benzene prices gaining 6.8 percent week-over-week and Toluene and Xylene prices each gaining 0.9 percent, respectively. The weighted average aromatic price is currently estimated at 66.2 cents/liter ($2.506/gallon), up 1.8 percent from last week. The weighted average BTX price is 25.8 cents/liter (97.65 cents/gallon) higher than FOB Houston ethanol prices.

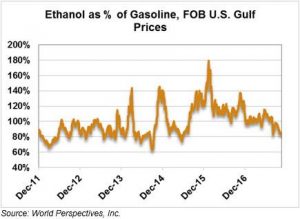

Gasoline prices are lower this week, as global petroleum markets settle down from last week’s shake-up in Saudi Arabia and as traders’ views on demand are turning more bearish. RBOB futures are down 1.48 cents/liter (5.63 cents/gallon) this week while 83.7 octane RBOB FOB Houston pipeline is 1.52 cents/liter (5.74 cents/gallon) lower at 45.71 cents/liter (173.04 cents/gallon). 87 octane RBOB FOB Houston is 1.45 cents/liter (5.49 cents/gallon) lower at 46.11 cents/liter (174.54 cents/gallon). Brent and WTI crude oil are also suffering from the petroleum sell-off, losing 2.7 percent and 2.9 percent, respectively.

Price Database: If you are interested in historical price data, please click here.