Chicago Board of Trade Market News

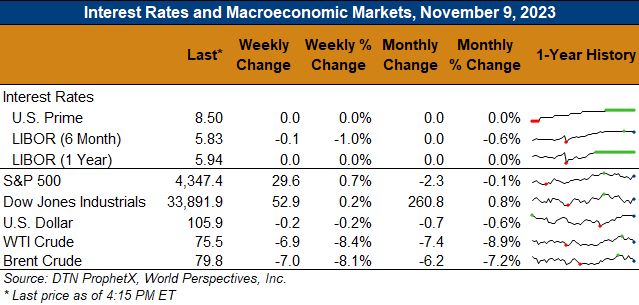

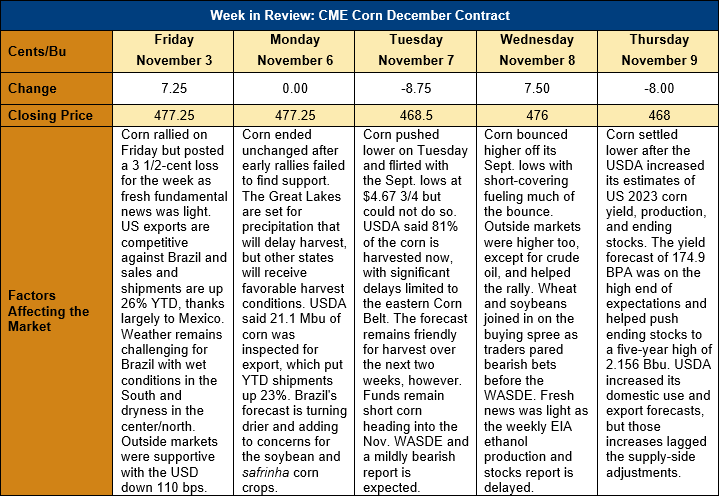

Outlook: Corn futures are 9 ¼ cents (1.9 percent) lower this week as choppy, indecisive trade before the November WASDE gave way to selling pressure after the report’s release. Eight cents of the week’s losses were scored on Thursday afternoon as USDA increased its forecasts for the U.S. corn yield, production, and ending stocks. Expectations of larger global production and ending stocks also pressured the corn market on Thursday afternoon.

The biggest surprise in the November corn balance sheet was the increase in 2023/24 ending stocks, now pegged at a five-year high of 54.77 MMT (2.156 billion bushels). USDA’s forecast was on the high end of pre-report expectations and exceeded the average estimate by 1.3 percent. Higher 2023 yields, estimated at 10.98 MT/ha (174.9 bushels per acre) and up 1.1 percent from the October estimate, drove much of the ending stocks increase. Larger yields pushed the 2023 crop to 386.96 MMT (15.234 billion bushels), up 11.1 percent from 2022/23. Greater corn supplies allowed USDA to increase its domestic use forecasts; feed and residual use rose 1.27 MMT (50 million bushels) and ethanol use rose 0.64 MMT (25 million bushels). Exports also received a boost and the current forecast of 52.71 MMT (2.075 billion bushels) is 1.27 MMT (50 million bushels) greater than last month’s prediction.

Increases in ending stocks exceeded the increase in total use and left the ending stocks-to-use ratio at 14.9 percent, up 0.2 percentage points from the prior month and up 5 percentage points from 2022/23. The ending stocks-to-use ratio is the highest since 2018/19 and prompted USDA to lower its forecast of the average farm price by 2 percent to $190.93/MT ($4.85/bushel).

USDA increased its forecast of world 2023/24 corn production by 6.3 MMT to a record-high 1,221 MMT. Increases in the harvests in Ukraine and Russia, which rose 1.5 and 1.4 MMT respectively, and the U.S. crop were primarily responsible for the gains in global output. USDA also issued a forecast of larger global corn trade, with the U.S., Ukraine, Russia, Turkey, and Paraguay expected to export greater volumes this year. Corn imports are expected to climb significantly for Canada, Egypt, Mexico, and the EU. Global 2023/24 corn ending stocks were forecast 2.6 MMT higher at 314.98 MMT, up 0.83 percent from October and up 5.3 percent from 2022/23.

The 2023 U.S. corn harvest is entering its final stage with 81 percent of fields harvested through Sunday. The progress rate advanced 10 percentage points from the prior week and is above the five-year average of 77 percent. Farmers in the western Corn Belt and northern Plains continue to make quick progress with the harvest, while rains delay fieldwork in the eastern Corn Belt. Ohio and Michigan are 15 and 11 percent, respectively, behind their aveage harvest progress rates for the first week of November. Fortunately, the one-week weather forecast offers mostly warm and dry conditions for the northern U.S., including the eastern Corn Belt, that will aid harvest progress.

The weekly U.S. Export Sales report featured 1.08 MMT of new corn sales and exports of 0.825 MMT, which was up 63 percent from the prior week and a marketing-year high. YTD exports now total 5.814 MMT and are up 32 percent while YTD bookings (exports plus unshipped sales) are up 31 percent at 19.29 MMT and account for 45.7 percent of USDA’s forecasted 2023/24 export program.

December corn futures have tested major technical support at the mid-September low of $4.67 ¾ four times in the past five days. The market has been unable to move significantly below this level or settle beneath it, which has kept prices in a range-bound pattern. Funds remain heavily short corn futures and the November WASDE did not offer incentives for them to exit this position, but the steady improvement in corn exports will likely limit additional downside moves. Typically, corn futures embark on a seasonal grind higher during this time of year, which will also mitigate downside risk. With the November WASDE and most of the U.S. harvest now come and gone, corn futures are likely to see steady strength and upside trade develop heading into the new year.