Chicago Board of Trade Market News

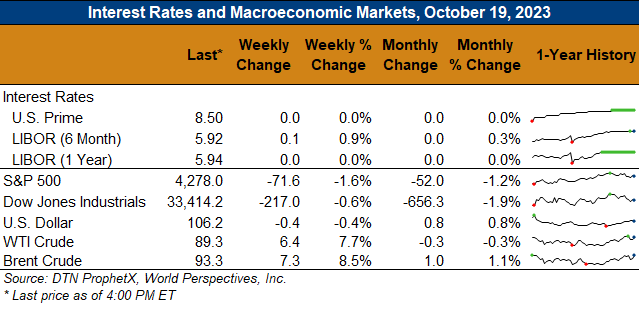

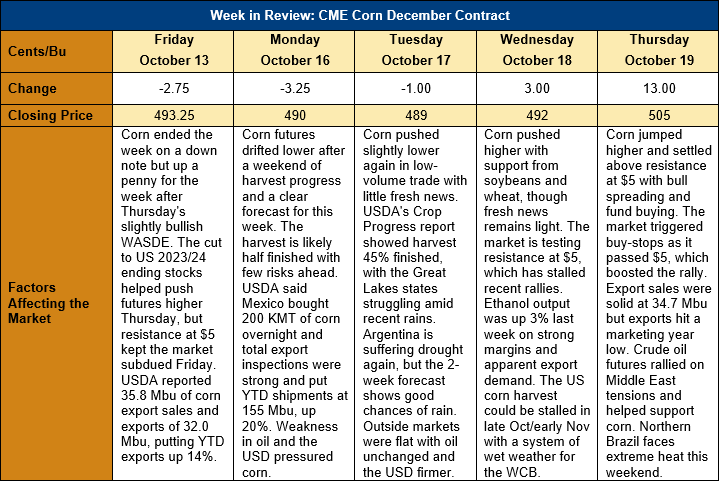

Outlook: Corn futures are 11 ¾ cents (2.4 percent) higher this week after the market defied the typical mid-October harvest weakness and posted a strong technical rally on Thursday. Thursday’s trade saw December corn break above the major technical and psychological resistance level of $5.00 and trigger buy-stops in the process, which extended the rally. There wasn’t one particular factor that sent the market higher on Thursday, rather it seemed the market moved on a confluence of data points. Last week’s cut to U.S. corn ending stocks in the WASDE provided a more supportive backdrop, as did growing heat and drought in north-central Brazil. Additionally, conditions in Argentina remain dry (though rains are forecast for the next few weeks) and U.S. exports are running ahead of expectations. Finally, there is some weather risk for the U.S. harvest late next week and in early November as the weather pattern will shift to feature heavy rains for the central Plains and western Corn Belt.

The U.S. corn harvest is 45 percent finished according to Monday’s Crop Progress report from USDA and that figure is 3 percentage points above the five-year average pace. USDA said 95 percent of the corn is mature, which minimizes possible frost-freeze risk for northern growing states. Harvest should make strong progress this week with clear conditions in the Corn Belt and only light rains in the Northern Plains and Great Lakes states. That forecast starts to change next week, however, with harvest-disrupting rains developing in the central U.S. and Great Lakes that could last into early November.

The weekly U.S. Export Sales report featured 0.905 KMT of new corn sales with Mexico and Japan emerging as the top buyers. Exports were down from the prior week at 516 KMT but were enough to put YTD shipments at 4.0 MMT, up 30 percent. YTD bookings (exports plus unshipped sales) now total 16.176 MMT, up 17 percent.

Demand for U.S. sorghum was also strong last week as buyers booked 62.1 KMT of gross sales and shipped 72.7 KMT, the latter of which was up 22 percent from the prior week. YTD sorghum exports now total 373.5 KMT (up 1,018 percent) while YTD bookings have reached 2.356 MMT (up 658 percent).

Despite the ongoing harvest, corn basis in the U.S. has firmed from last week and now stands at -24Z (24 cents below December futures), up 3 cents/bushel from last week. On the export market, FOB U.S. Gulf offers are up 1 percent from the prior week at $231.29/MT.

Technically, December corn posted a bullish move on the charts Thursday with a strong settlement above $5.00 in heavy-volume trade. The market is following a trendline higher and Thursday’s bullish move will likely attract additional technical and speculative buying. The December contract is now targeting the 100-day moving average at $5.09 ½ and the psychologically important $5.25 level is the next upside target above that. Any weakness will likely see the market find support at the former resistance level of $5.00 and then at the $4.90 trendline.