Chicago Board of Trade Market News

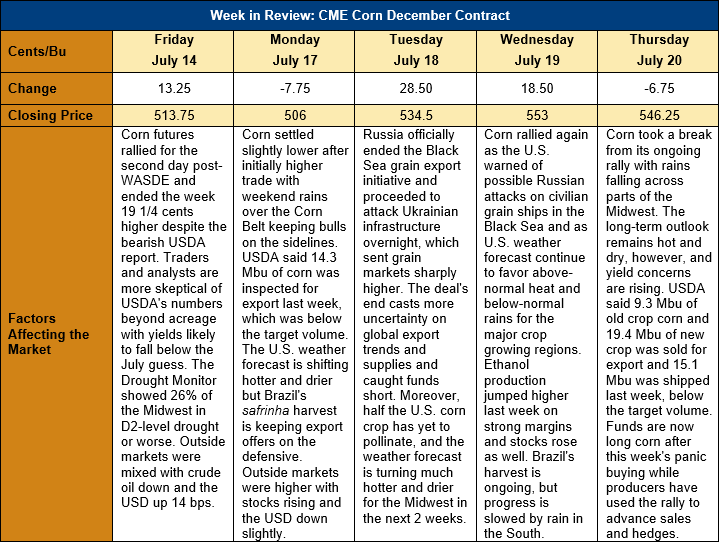

Outlook: Corn futures are 32 1/2 cents (6.3 percent) higher this week after a combination of Russia ending the Black Sea grain export corridor and hot, dry weather forecast for the U.S. Midwest sent markets on a sharp rally. The combination of geopolitics and weather risk prompted a fierce round of short-covering and panic buying earlier this week that seemed to fade on Thursday. The current consensus is that markets have largely adjusted to the end of the Black Sea agreement, but the ongoing drought and weather concerns for the U.S. will likely keep markets moving higher.

The Black Sea grain corridor deal, initially brokered last summer with help from the UN and Turkey, expired on Monday after Russia declined to renew its terms. Following the expiration, which had included protections for three of Ukraine’s grain export ports, Russia launched a series of drone and missile attacks on Ukraine’s two biggest ports. The deal’s lapse and the subsequent attacks have prompted insurance companies to pull coverage from vessels in the Black Sea. The attacks cash significant uncertainty as to Ukraine’s ability to ship grain to world market, with the country now constrained to shipping via the Danube River or via rail to Northern Europe. The constraints Ukraine now faces may give other global producers opportunities to fill near-term export demand.

In addition to the bullish Black Sea events this week, the U.S. weather forecasts have shifted negatively for crop production with unusual heat and below-normal rainfall predicted into early August. The hot, dry weather comes as roughly half the U.S. corn crop will be pollinating in the next few weeks, with USDA notion Monday that 47 percent of the crop was silking as of 16 July. Heat, especially high temperatures overnight, can be severely detrimental to corn yields and the markets are closely watching updated weather forecasts for insights on this year’s U.S. production.

Relevant to the yield discussion is the fact that U.S. corn conditions improved last week, and the good/excellent rating rose 2 percentage points to 57 percent. This is the lowest mid-July rating since the massive drought of 2012, but conditions are now much better than in that year. Also of note for crop production estimates is the fact that the sorghum conditions rose 3 percentage points to 58 percent while the share of barely rated good/excellent was unchanged at 52 percent.

U.S. old crop corn export sales are following their seasonal trend lower and gross sales totaled 412.5 KMT last week. Conversely, new crop sales are trending higher and totaled 492 KMT last week, a 4 percent weekly gain. Old crop exports totaled 383.8 KMT last week, down from the first week of July but YTD bookings still total 39.745 MMT, or 95 percent of USDA’s July WASDE forecast.