Chicago Board of Trade Market News

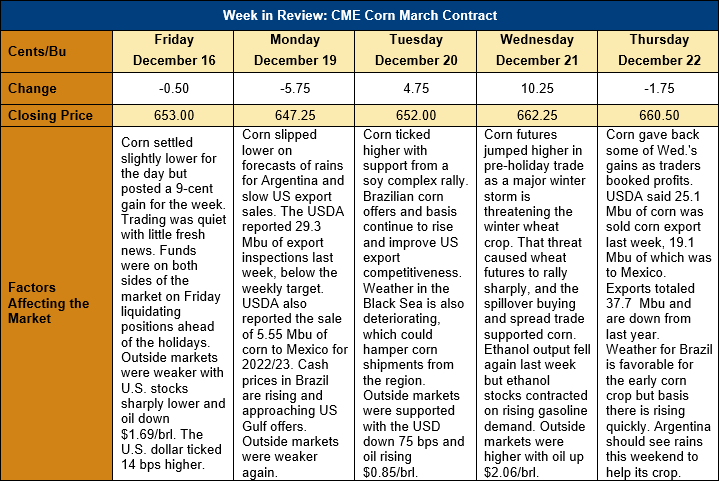

Outlook: March corn futures are up 7 ½ cents (1.1 percent) from last Friday’s close as quiet, pre-holiday trade was briefly interrupted by rallies related to weather scares for the wheat crop. A major winter storm is covering the U.S. late this week with sub-zero Fahrenheit temperatures for eastern Colorado, Kansas, and Nebraska, among other regions. This caused concerns about winterkill in the winter wheat crop that currently has little snow cover. Wheat futures rallied on Wednesday in response to this threat, and spillover buying and spread trade helped lift corn 10 cents that same day. Additionally, the cold weather will boost demand for livestock feed, which helped support corn futures as well.

The weekly Export Sales report featured 0.636 MMT of net export sales, a figure down from the prior week despite a weaker U.S. dollar. The weekly export figure, however, jumped 62 percent higher and hit 0.958 MMT. That put YTD exports at 8.222 MMT (down 35 percent) while YTD bookings (exports plus unshipped sales) now total 20.69 MMT (down 48 percent).

Ethanol production fell last week but remained above 1 million barrels per day for the tenth straight week. The report also featured a surprise decrease in ethanol stocks due to stronger gasoline consumption. The surprise uptick in gasoline and ethanol consumption has helped boost corn demand expectations for 2023.

From a technical standpoint, March corn made two significant bullish developments this week. On Tuesday, the market settled above short-term trendline resistance at $6.51 ¼, which was followed by Wednesday’s bullish move above key resistance at $6.60-6.62. Despite Thursday’s turn lower with resistance at the 40-day moving average, the corn market is now in a short-term trend higher with resistance at $6.68-6.70 and long-term trendline resistance at $6.86 ¾. With Brazilian corn prices rising and U.S. exports expected to follow their seasonal spring increase, the corn market is likely to continue strengthening once traders and funds return from the holidays.