Chicago Board of Trade Market News

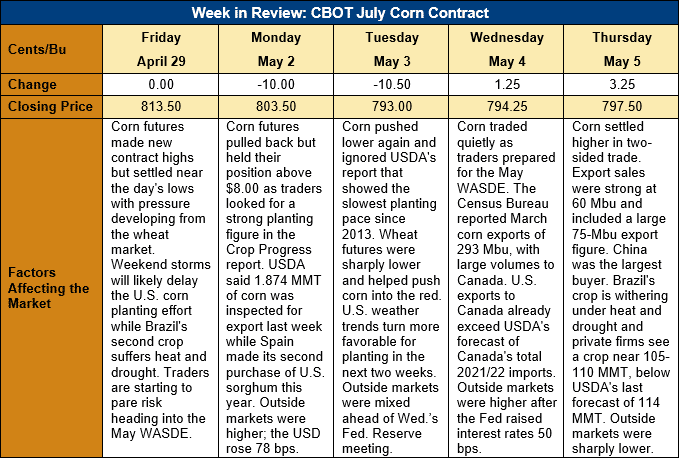

Outlook: July corn futures are 16 cents (2.0 percent) lower this week with commodity markets turning sideways ahead of next week’s May WASDE, which will feature USDA’s first full look at the 2022/23 crop year. Traders are adjusting positions and are reluctant to add new risk heading into the report, which resulted in sideways/lower trade. World grain fundamentals remain bullish, however, with the ongoing conflict in Ukraine restricting exports and concerning weather trends in the U.S. and Brazil.

The U.S. corn planting is off to the slowest start since 2013 with farmers having seeded just 14 percent of the crop through Sunday. Last year, the crop was 42 percent planted by the same date and the five-year average progress rate is 33 percent. The barley crop, however, is getting seeded in-line with its typical pace as farmers have planted 36 percent of the crop, compared to a five-year average rate of 37 percent. The delayed corn planting in Iowa, Indiana, and Illinois is increasingly concerning, though the weather outlook for the coming two weeks should allow for faster fieldwork. Conversely, a cool, wet weather pattern persists for the northern Plains, which will likely continue to delay planting in the Dakotas and parts of Minnesota.

U.S. corn net export sales totaled 0.782 MMT for the week ending April 28, down 10 percent from the prior week. Exports, conversely, were up 22 percent at 1.904 MMT and put YTD exports at 40.03 MMT, down 6 percent. U.S. exporters also booked 88,000 MT of sorghum net sales and shipped 0.212 MMT, the latter figure up 26 percent from last week.

The U.S. exported 7.443 MMT (293 million bushels) of corn in March, according to the U.S. Census Bureau, up slightly from February’s 7.39 MMT (291 million bushels). Of note is the fact that Canada continues to be a major importer of U.S. corn following last year’s drought that curtailed its domestic feed supplies. U.S. corn exports to Canada so far in the 2021/22 marketing year total 4.37 MMT (172 million bushels), up from the 0.94 MMT (37 million bushels) exported through March last year. USDA’s April WASDE called for Canada to import 3.8 MMT (150 million bushels) this marketing year, a measure that has already been exceeded. Consequently, it is likely that USDA will increase its assessment of the U.S. old crop export program in next week’s May WASDE.

From a technical standpoint, July corn futures have turned sideways in a wide range from $7.81 to $8.24 ½ (the contract high) heading into the May WASDE report. Fundamentals remain bullish between the drought damage to Brazil’s safrinha crop and the delayed U.S. planting, but traders are cautious amid the possibility of higher-than-expected corn acres in next week’s report. July corn futures have trendline support at $7.61 and $7.09 below that. Notably, corn futures often dip lower in late spring after the completion of planting but add back “weather risk” premiums in the summer.