Ethanol, Fuels and Co-Product Pricing

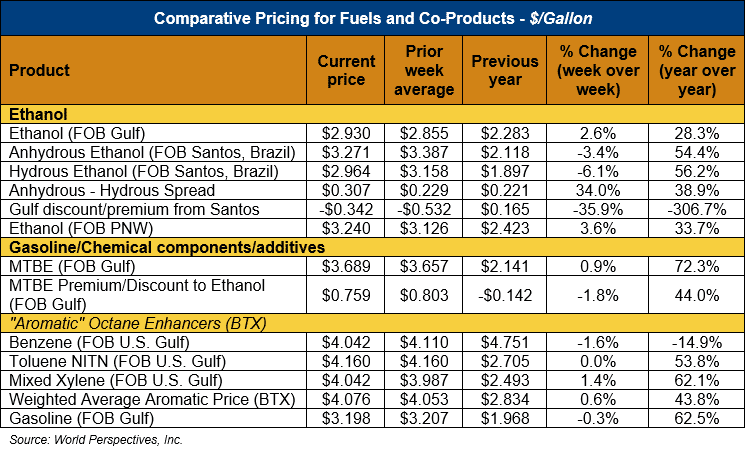

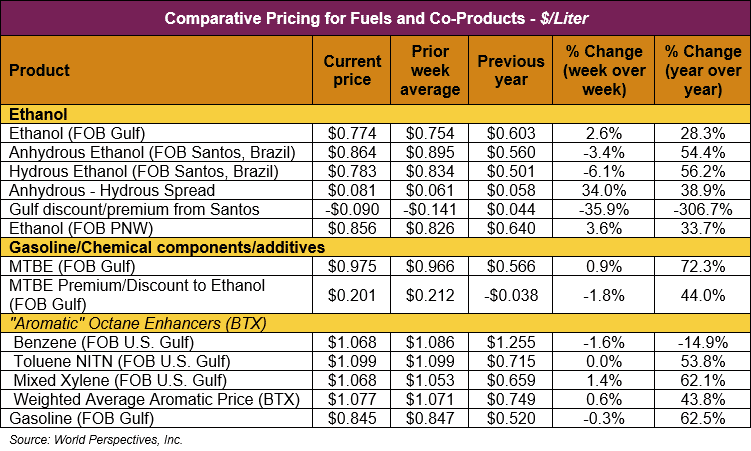

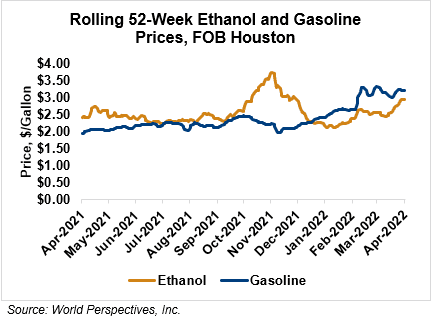

Market Outlook: U.S. ethanol prices ended last week 4.4 percent higher but gave back some of those gains in early week trading and traded down 1.1 percent through Tuesday’s close. Midwest wholesale rack ethanol prices were higher to end last week and were up 1 percent through Tuesday’s market close to their last quote of 77.06 cents/liter (291.71 cents/gallon).

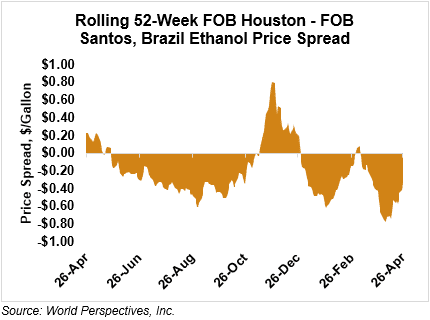

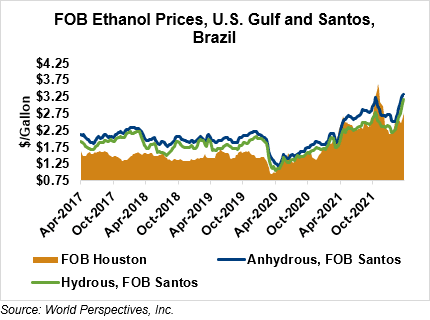

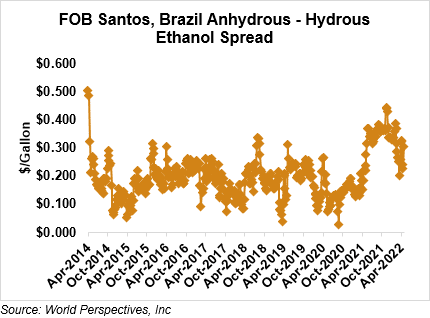

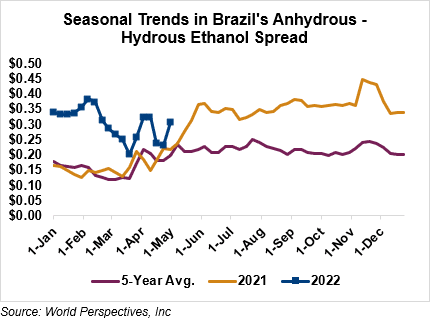

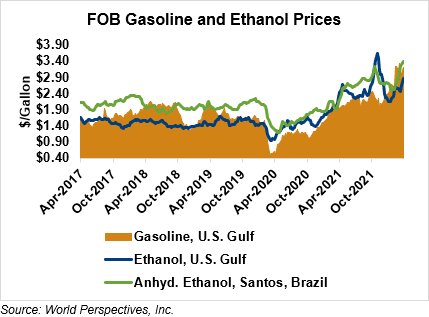

FOB Houston ethanol prices finished last week 7.2 percent higher but are down 0.4 percent through Tuesday’s trading from Friday’s close. FOB Houston ethanol prices are quoted at 77.39 cents/liter (292.97 cents/gallon). FOB Santos, Brazil anhydrous ethanol prices were higher last week; they are down in early week trading, falling 3.4 percent to 86.42 cents/liter (327.12 cents/gallon) through Tuesday’s trading.

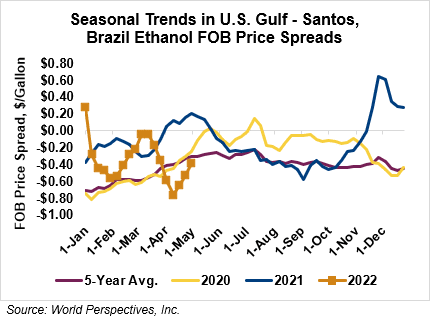

The FOB Gulf-Santos, Brazil ethanol spread has narrowed from last week’s close through Tuesday’s trading and is currently at -9.02 cents/liter (-34.15 cents/gallon).

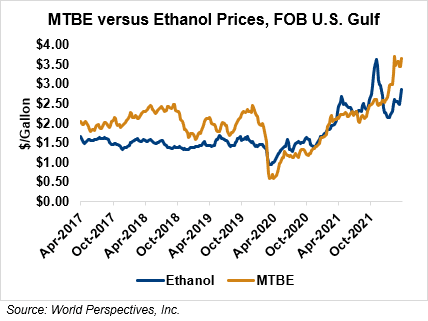

MTBE prices rose 5.7 percent last week and were fractionally higher in early week trading, up 0.4 percent from Friday’s close through Tuesday’s trading. MTBE’s premium to FOB Houston ethanol has increased from last week’s report and stands at 19.59 cents/liter (74.14 cents/gallon).

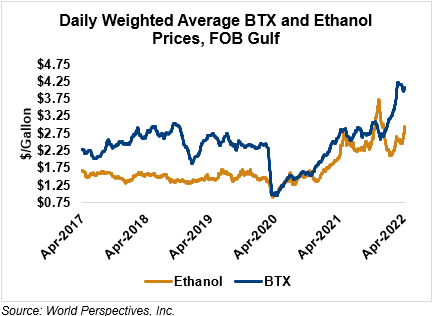

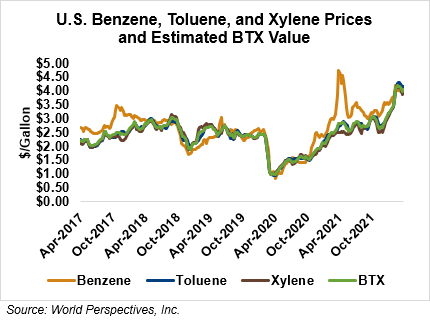

BTX component prices were mixed last week and continued that trend through Tuesday’s market close: Benzene was down 1.5 percent while Toluene was up 0 percent, and Xylene was up 1.1 percent. The estimated weighted average aromatic price is currently 107.55 cents/liter (407.1 cents/gallon), up from last Friday’s close. The BTX-Houston ethanol spread widened last week, and the weighted average BTX price is 30.15 cents/liter (114.14 cents/gallon) higher than the FOB Houston ethanol price.

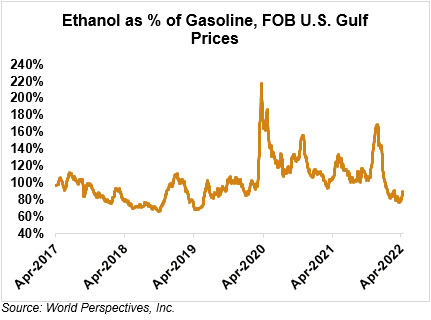

Gasoline and petroleum products were lower last week but are mostly higher in early week trade. RBOB futures are up 1 percent to start the week while 84 octane RBOB (Houston) and 87 octane CBOB (U.S. Gulf) gasoline prices are up 1 and down 2.1 percent, respectively. WTI futures are 0.1 percent lower at $101.96/barrel while Brent futures are down 1.2 percent to $104.87/barrel, from Friday through Tuesday’s close.

Price Database: If you are interested in historical price data, please click here.