Chicago Board of Trade Market News

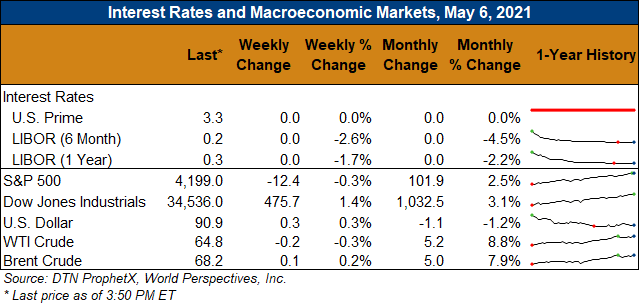

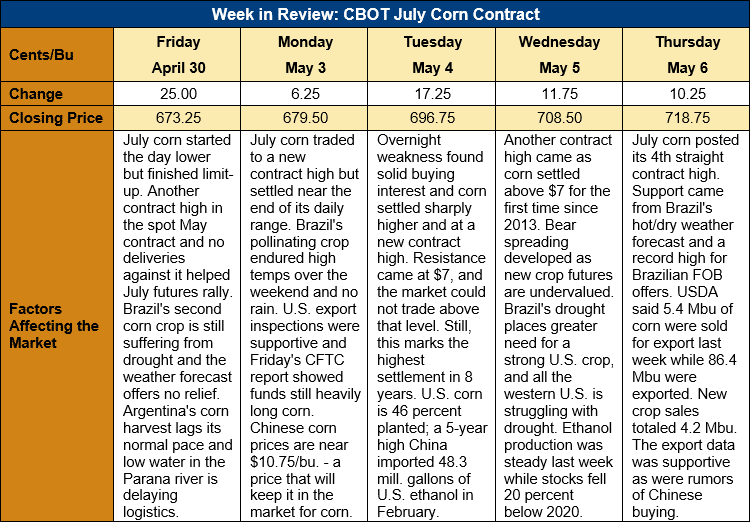

Outlook: July corn futures are 45 ½ cents (6.8 percent) higher this week as the 2021 bull market continues. July corn settled above $7.00/bushel on Wednesday, the first time a July corn contract has done so since 2013. Old-crop/new-crop bear spreads have become increasingly popular this week with traders seeing a need to bid up new crop prices with drought expanding in the U.S. and Brazil. Funds have been solid buyers on this week’s rally, though old-crop trading volumes have fallen.

Brazil’s weather forecast remains hot and dry for the key second corn crop producing states of Mato Grosso, Parana, and Mato Grosso do Sul. Temperatures this week and next are forecast to be above-aveage in most of central Brazil while the south sees some relief from cooler conditions. All of central and southern Brazil is forecast to receive nearly no precipitation over the next week, which will draw soil moisture levels to near-zero for parts of the country. The two-week forecast features heavy rains for southern Brazil, but Mato Grosso will remain exceptionally dry. The current forecast does nothing to stop the deterioration of Brazil’s safrinha corn crop yields.

The ongoing drought in Parana, Brazil caused the state’s corn conditions ratings to fall significantly this week. The share of the crop rated good/excellent fell from 40 percent last week to just 28 percent this week. The trend is not isolated to Parana and the nearby state of Mato Grosso do Sul reported that only 13 percent of its safrinha crop was rated in “good” condition. Mato Grosso’s Institute of Agricultural Economics (IMEA) lowered its corn yield forecast by 2 percent to 6.07 MT/ha (96.3 Bu/ac). IMEA said in its 3 May 2021 report yields were projected to be 6.7 percent lower than the prior year.

Two additional concerns for the global corn markets are the delay in Argentina’s corn harvest and low water levels in the Parana river. The Argentine corn harvest is lagging its normal pace as farmers elect to finish the soybean harvest before returning their focus to corn. Recent rains have also delayed fieldwork for harvesting both crops. Additionally, low draft levels in the Parana river are altering logistics trends and forcing more corn to be loaded in southern ports to complete vessels. These two factors are helping keep markets nervous and support prices.

The USDA’s weekly Export Sales report featured 137,000 MT of net sales and 2.195 MMT of exports. The export figure was up 15 percent from the prior week and puts YTD exports at 43.503 MMT (up 81 percent). The corn export pace is still on track to exceed USDA’s current forecast and analysts are looking for the agency to increase its projection in next week’s May WASDE.

July corn futures are in a strong trend higher and show few signs of slowing down. The market posted four consecutive new contract highs as of Thursday’s close and also made a psychologically and technically important close above $7.00 on Wednesday. Funds continue to be net buyers and end-users are scaling-up pricing ideas, offering support on any break in the market.

Two technical factors suggest some caution is warranted, however. First, the 14-day relative strength index (RSI) closed at 83.2 Thursday afternoon, reflecting a deeply overbought market. An RSI above 80 often indicates the market is ready for a correction lower. The second factor is that this week’s rally has come with declining trading volumes. The declining volume suggests underlying buying interest may be waning for the contract. Overall, however, the charts remain extremely constructive and with no signs (so far) of a market top or reversal, the outlook remains higher.