Chicago Board of Trade Market News

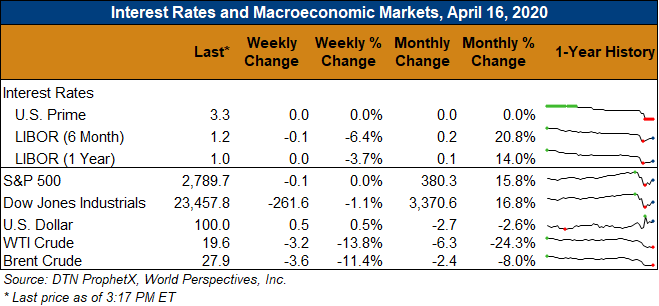

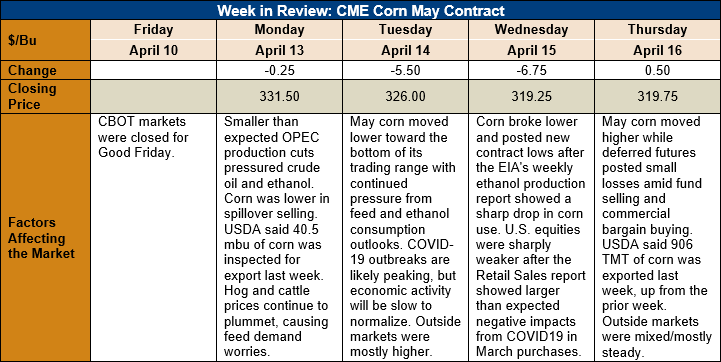

Outlook: May corn futures are 12 cents (3.6 percent) lower this week following significant fund selling that took the market below last week’s trading range. Wednesday brought bearish news for the corn market in the form of updated weekly ethanol production statistics and the U.S. Bureau of Labor Statistics’ monthly Retail Expenditure report. Those two reports pressured the market on Wednesday, though futures stabilized Thursday with another round week of large exports identified in the Export Sales report.

The weekly Export Sales report was bullish the corn market with 980,000 MT of gross corn sales and 906,000 MT of net sales reported for the week ending April 9. The net sales figure was down from the prior week as the U.S. dollar was rallying during that time period. The weekly export figure reached 1.22 MMT, down just 5 percent from the prior week’s marketing-year-high export figure. YTD exports now stand at 20.8 MMT, down 35 percent from a year ago while YTD bookings (exports plus unshipped sales) stand at 34.6 MMT, down 22 percent.

The U.S. equity markets received bearish news on Wednesday as the monthly Retail Expenditure data showed a 6 percent decrease in total retail sales. The larger-than-expected decrease pressured equity and macroeconomic markets with spillover selling developing in the commodity markets as well. Notably, the COVID-19 restrictions have exerted pronounced impacts on the U.S. (and global) food systems, with foodservice sales declining 23 percent year-over-year while March grocery store sales were 30 percent higher than the same period last year. The dramatic change in consumer food consumption and purchasing patterns continues to be reflected in the commodity markets.

Cash corn values are lower across the U.S. this week with the basis remaining steady at 27 cents under May (-27K) futures this week. Interior bids for corn are down 4 percent this week, on average. The break in prices has brought additional international buying interest. Barge CIF NOLA values are down only 3 percent this week while FOB NOLA offers have declined a mere 2 percent. FOB NOLA corn for April shipment is offered at 79K ($158.15/MT) this week.

Sorghum prices have stabilized after several weeks of sharp gains. International demand has been robust, with Japan and China booking large purchases. FOB NOLA export offers are steady at 180 cents over May corn futures (180K) this week, up from 140K just three weeks ago. FOB Texas Gulf offers are 170K as of today’s market close, up over 30 cents/bushel from March offers.

From a technical standpoint, May corn futures have broken below their recent trading range and reached new contract lows on Wednesday. Funds have been net sellers while commercial pricing activity has been aggressive as well. The market is technically oversold, which may bring profit-taking and short-covering trade soon that could create a bounce higher. Additionally, the market is heading into springtime when weather typically creates volatile, and often higher markets. There are many in the market questioning how eager short sellers will be to extend short positions ahead of potentially bullish weather developments.