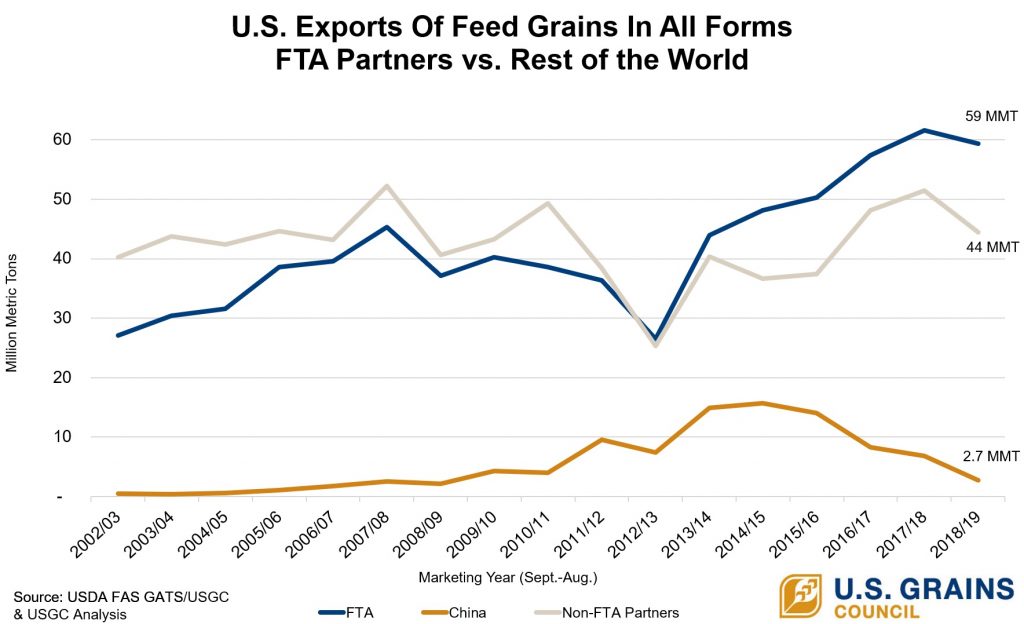

| New export data analysis shows U.S. free trade agreement (FTA) partners continue to be consistently large buyers of U.S. grains in all forms (GIAF). The United States has 14 FTAs in place with 20 countries. These trading partners continue to represent some of the largest and most loyal customers for U.S. corn, sorghum, barley, ethanol, distiller’s dried grains with solubles (DDGS), corn gluten feed/meal and other co-products. FTA partners purchased 59.4 million metric tons (2.34 billion bushels in corn equivalent) of U.S. GIAF in the 2018/2019 marketing year, representing 55 percent of total GIAF exports, according to the U.S. Department of Agriculture (USDA) trade data and analysis by the U.S. Grains Council (USGC). That slice of the overall demand pie has stayed consistent in the first six months of the 2019/2020 marketing year with FTA partners purchasing 56 percent of U.S. GIAF exports, equal to 24.7 million tons (972 million bushels in corn equivalent). “The enduring strength of demand from FTA partners once again demonstrates the importance of the market access provided by these agreements,” said Floyd Gaibler, USGC director of trade policy and biotechnology. “Working to defend and expand markets allows the Council to do what it does best – capture short-term market opportunities and build long-term demand for U.S. coarse grains and co-products.” North American Trading Partners Continue To Top FTA List Mexico and Canada continue to represent the largest FTA trading partners, thanks to geographic proximity and duty-free access provided by the North American Free Trade Agreement (NAFTA) and maintained in the United States-Mexico-Canada Agreement (USMCA). Since the FTA’s inception in 1994, U.S. agricultural exports to Canada and Mexico tripled and quintupled, respectively, bolstered by these comparative advantages, well-developed North American supply chains and robust market development work by the Council and its members. In the current marketing year, Mexico continues to rank as the top market for U.S. corn, barley and DDGS, the second largest U.S. sorghum market and the ninth largest U.S. ethanol market. Canada is the second largest U.S. ethanol buyer, second largest U.S. barley buyer, fourth largest corn buyer and seventh largest U.S. DDGS buyer. Central American Buyers Represent Growing Demand For U.S. GIAF Proximity of Central American markets also facilitates the movement of U.S. agricultural goods, supported by market access advantages built into the Dominican Republic-Central America Free Trade Agreement (CAFTA-DR). CAFTA-DR is a regional free trade agreement between the United States and Central American trading partners – Costa Rica, El Salvador, Guatemala, Honduras, Nicaragua and the Dominican Republic. The agreement allows favorable tariff treatment for more than 95 percent of U.S. agricultural products, including corn. The agreement entered into force in 2006, and the Council has since worked to emphasize the U.S. origin advantages to regional buyers and end-users. As a result, U.S. corn exports to CAFTA-DR countries have increased more than three-fold since the agreement went into effect. Three of these markets – Guatemala, Honduras and Costa Rica – all rank in the top 10 U.S. corn buyers for the 2019/2020 marketing year, thus far, continuing growth from 2018/2019. Guatemala ranked as the eighth largest buyer at 1.22 million tons (48 million bushels) in 2018/2019, the first time the country purchased more than one million tons. Costa Rica continued an upward streak for the last four marketing years, purchasing 885,000 metric tons (34.8 million bushels) in 2018/2019. New Japan Agreement Strengthens Trade With U.S. Farmers, Agribusinesses Notably, the attached chart does not include Japan as an FTA partner. The U.S.-Japan Trade Agreement, which went into effect on Jan. 1, 2020, is not a comprehensive free trade agreement, but does provide important market access provisions for U.S. coarse grains, co-products and ethanol. The agreement solidifies trade with Japan by maintaining a zero duty on imports of corn for feed and eliminating a 3 percent tariff for corn other than feed. Japan will also eliminate U.S. sorghum tariffs, which are as high as 3 percent, and reduce a mark-up on barley for feed. The agreement also includes a staged reduction for U.S. ethanol and U.S. corn, barley and sorghum flour. The agreement also preserves duty-free market access for U.S. feed and food corn, corn gluten feed and DDGS. Thus far in the 2019/2020 marketing year, Japan ranks as the second largest market for U.S. corn, third largest market for U.S. barley/barley products, fourth largest market for U.S. sorghum and sixth largest market for U.S. DDGS. If these purchases were added to the FTA trading partner total, it would further strengthen the market share offered by the closest of U.S. grains’ buyers. Follow along as the 2019/2020 marketing year progresses with the Feed Grains In All Forms portal, where the Council tracks U.S. exports of U.S. coarse grains, co-products, ethanol and meat equivalents on a monthly basis. The interactive resource also converts these exported volumes into corn equivalents, which offers a holistic view of the amount of U.S. feed grains consumed by overseas customers. |

About The U.S. Grains Council

The U.S. Grains Council develops export markets for U.S. barley, corn, sorghum and related products including distiller’s dried grains with solubles (DDGS) and ethanol. With full-time presence in 28 locations, the Council operates programs in more than 50 countries and the European Union. The Council believes exports are vital to global economic development and to U.S. agriculture’s profitability. Detailed information about the Council and its programs is online at www.grains.org.