Ethanol, Fuels and Co-Product Pricing

Market Outlook: U.S. ethanol prices ended last week up fractionally but are down (-1.3 percent) in early week trading. Midwest wholesale rack ethanol prices were up to end last week; they continue up to start this week at 40.18 cents/liter (152.08 cents/gallon) through Tuesday’s trading.

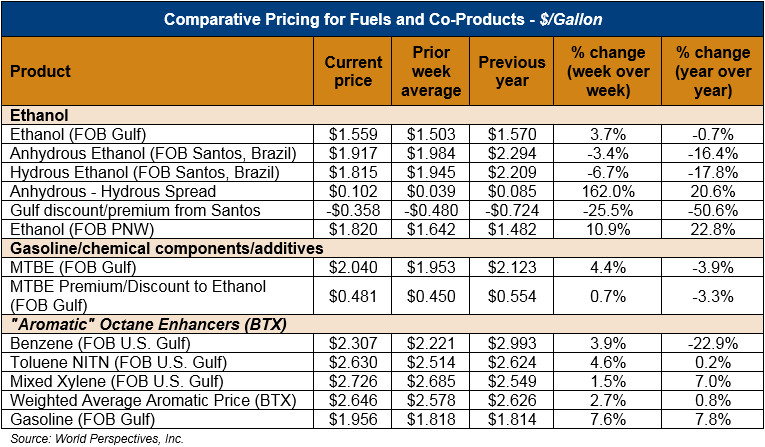

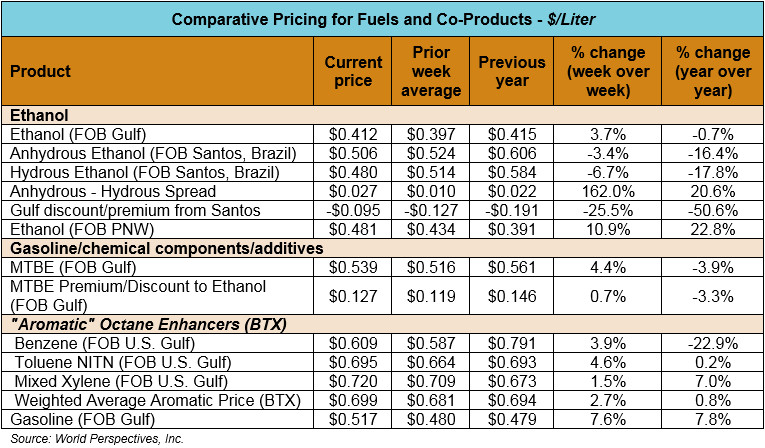

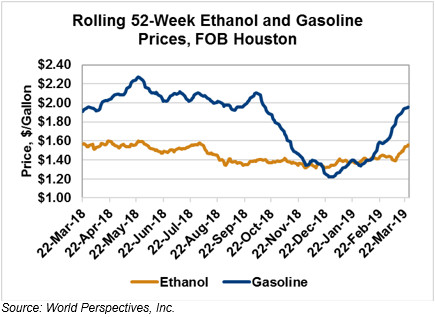

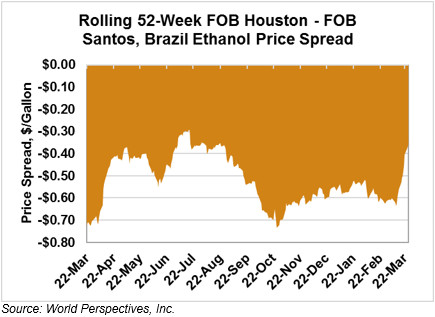

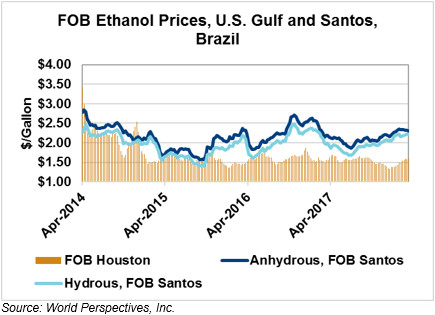

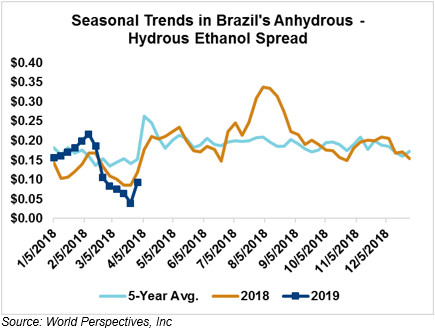

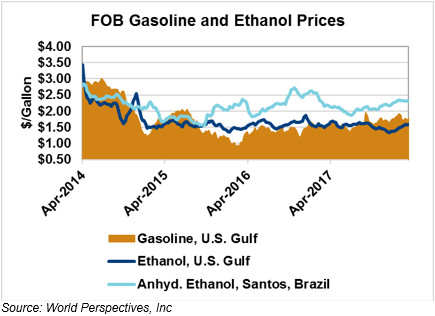

FOB Houston ethanol prices finished last week up nearly 6 percent; prices are up 3.7 percent through Tuesday’s trading from Friday’s close. FOB Houston ethanol prices are quoted at 41.19 cents/liter (155.93 cents/gallon). FOB Santos, Brazil ethanol prices ended last week down 2.1 percent; they continue down from Friday’s close and stand at 50.64 cents/liter (191.71 cents/gallon) through Tuesday’s trading.

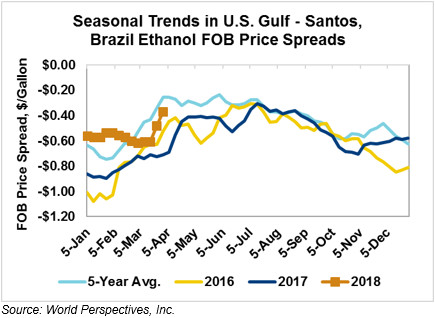

The FOB Gulf-Santos, Brazil spread narrowed from last week’s close through Tuesday’s trading and is currently at -9.4 cents/liter (-35.77 cents/gallon).

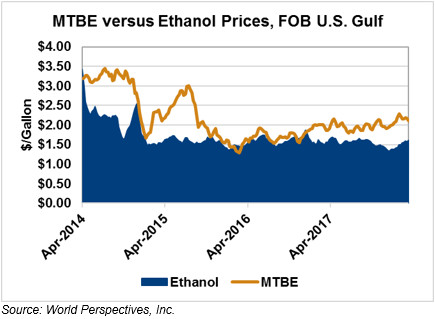

MTBE prices were up nearly 7 percent to end last week; they continue up (+3.8 percent) to start this week. MTBE’s premium to FOB Houston ethanol widened again from last week and now stands at 12.37 cents/liter (46.83 cents/gallon).

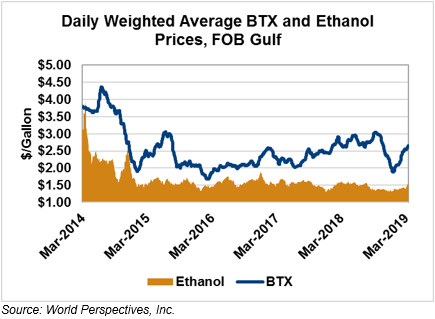

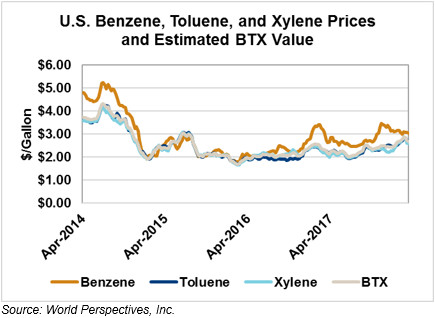

BTX component prices were mixed to end last week but are up across the board through Tuesday’s trading: Benzene is up nearly 4 percent, Toluene is up over 4 percent and Xylene is up 0.9 percent. The estimated weighted average aromatic price is currently 69.57 cents/liter (263.35 cents/gallon), up 2.2 percent from last Friday’s close. The BTX-Houston ethanol spread widened from last week; the weighted average BTX price is 28.37 cents/liter (107.42 cents/gallon) higher than the FOB Houston ethanol price.

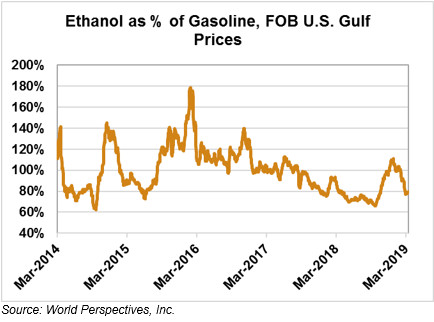

Gasoline and petroleum products were up to end last week and continue up across the board through early-week trading on the strength of macroeconomic and supply/demand signals. This week, RBOB futures are up: 84 (Houston) and 87 (U.S. Gulf) octane gasoline prices are up 2.1 percent and 2.2 percent, respectively. WTI futures are up 1.4 percent to $59.87/barrel and Brent futures are up 1.3 percent to $67.89/barrel, from Friday’s close through Tuesday’s trading.

Price Database: If you are interested in historical price data, please click here.