Ethanol Market Overview

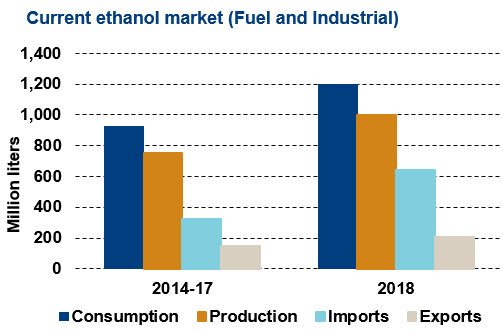

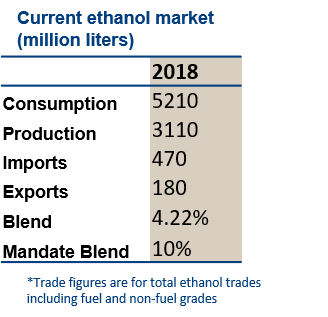

- India has target to blend 10% ethanol into gasoline nationwide, which has never been achieved. Molasses is used for production feedstock domestically. In recent years, molasses supplies have been insufficient to meet the target. The new policy allows for cane juice, B heavy molasses and grain to be used in production, with differential pricing.

- The government sets the ethanol price and tenders are held between ethanol producers and Oil Marketing Companies (OMC’s). In past years, prices were either set too high for OMC’s (too expensive relative to gasoline) or set too low for producers (they could get a better return from industrial/beverage sales). Fuel ethanol consumption is volatile year-year.

- In years of molasses shortages, ethanol imports have increased for chemical and industrial uses.

Key Facts

- Target:

2018: 10% target - Consumption:

2018 1.5 billion liters (fuel) - Capacity: 2.6 billion liters

- Ethanol plants: 161 (feedstock: molasses)

- Estimated gasoline consumption:

2022 48.0 billion liters

Policy

- The 2009 National Policy on Biofuels set an aspirational target of a 20% blend for ethanol in gasoline by 2017. Due to limited molasses availability and restrictions on imports for the fuel market, the target has gone unmet.

- The government fixes ethanol prices. In the past, prices were often set below industrial and beverage ethanol, leading producers to prioritise these grades over fuel. In October 2016, fuel ethanol prices were lowered to INR 39/liter (ex-factory) for the period December 2016 to November 2017. However, the cost to OMC’s has risen as they must now pay the new Goods and Services Tax (GST) of 5%, as well as transport costs from the mill to the refinery.

- The 2018 National Policy of Biofuels permits conversion of cane juice, B heavy molasses and grains for fuel. U.S. ethanol exports to India are destined for the industrial use market.

- The Paris Agreement on Climate Change came into force in November 2016 and India’s pledges include a reduction in the emissions intensity of GDP by a third to 35% by 2030.

Trade

- Imports of ethanol have increased in recent years. Imported ethanol cannot be used in the ethanol blending program, imports that supply the industrial sector allow domestic producers to divert supplies into the fuel market.

- The bulk of imports, upwards of 90 percent, are from the U.S. Brazil is the second largest supplier.

- In March 2016, India reduced its basic import tariff on denatured ethanol from 5% to 2.5% for ethanol intended for the manufacturing of excisable goods.

- Undenatured ethanol incurs a basic import tariff of 150%.

- The new Goods and Services Tax rate of 5% applies to fuel and 18% on industrial grades, while the taxation of potable alcohol is subject to state legislation. Under the new tax structure, the central excise tax and state-by-state VAT are eliminated. In the new tax regime, GST is treated as an input tax, and is used a credit against output tax, thus eliminating the double tax (tax-on-tax) earlier.

Challenges

- There is insufficient molasses to meet the government’s target of 10%.

- Sugar production is cyclical which means that molasses supplies are volatile year-on-year.

- Administrative hurdles and taxes still prevent the free movement of ethanol between some states.

- The lack of a binding mandate means demand is reliant on the successful outcome of tenders between OMC’s and producers.

- GOI is focus on increased domestic production thru subsidies to the sugar industry and investments for 2G ethanol production.

Market Outlook

- India will not meet its blending goals by relying exclusively on domestically sourced ethanol.

- Sugar production and molasses supplies are cyclical.

- With gasoline demand growing faster than ethanol production, the blend rate is likely to continue to be below the mandate.