Ethanol Market Overview

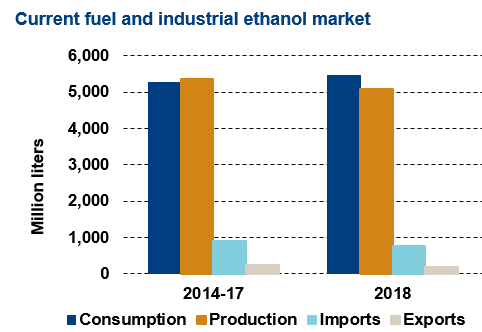

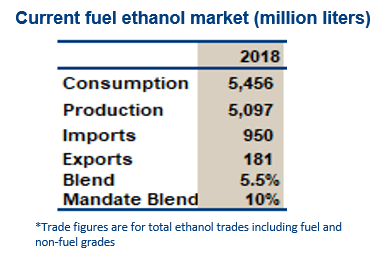

- The EU is the third largest consumer of fuel ethanol globally, using over 5.4 billion liters in 2018.

- Demand is driven by mandates aimed at increasing the use of renewable fuels in transport under the Renewable Energy Directive (RED), which aims to replace 10% of all energy used in transport with renewable energy by 2020, including biodiesel. Each member state has a different policy in place to meet this target. Germany, France and the UK are the largest consumers of ethanol in the bloc, responsible for 62% of total demand.

- The EU is a significant producer of ethanol with a capacity of approximately 8 billion liters across 65 plants and 20 countries. The feedstocks used differ between regions. Wheat and sugarbeet are the main feedstocks in northern Europe while corn is more common in central Europe. Although there are many plants the industry, production is concentrated among a handful of producers; the largest seven companies control 70% of the capacity.

Key Facts

- Mandate:

2018 RED: 10% by 2020 - Consumption:

2018 5.4 billion liters (5.5% blend) - Capacity: 8.0 billion liters

- Ethanol plants: 65 (feedstocks: sugar beet, corn, & wheat)

Policy

- The main driver of EU biofuel demand is the 2009 Renewable Energy Directive (RED). Under the directive each country must ensure that at least 10% of their total consumption of energy in transport comes from renewable sources by 2020. Every member state has formed their own timelines and policy for fulfilment of the mandate. Most countries intend to achieve exactly a 10% fulfilment, while several countries aim to either over-fulfil or under-fulfil the target. Ethanol and biodiesel have been the main sources of renewable energy used to meet the target but other forms of renewable energy, such as hybrid electric cars and biogas, can also contribute towards the target. Ethanol used under the RED must have GHG emission savings of 50% compared to fossil fuels. To qualify for the mandate, biofuels must be certified as sustainable. The most commonly used certification schemes are ISCC and 2BSvs.

- Fulfilment of the RED has been hampered by uncertainty as concerns over the use of food-based biofuels culminated in an amendment to the RED. After lengthy debate, the European Parliament voted to amend the RED in April 2015 to limit the use of food-based biofuels to 7% energy content. Discussions over the inclusion of the impact of indirect land use change (ILUC) in GHG calculations are not resolved.

- In November 2016, the European Commission unveiled its draft proposal for biofuel policy in the period from 2020 to 2030. The main features were: a lower limit on food-based biofuels falling to 3.8% energy content in 2030, a mandatory contribution from advanced biofuels, higher GHG saving requirements and the inclusion of ILUC in calculating GHG emissions. The ethanol industry has strongly opposed this proposal as a declining limit on food-based biofuels will almost certainly reduce ethanol production post-2020.

Trade

- The EU is a net importer of ethanol (both fuel and non-fuel grades). In recent years, the majority of ethanol imports have come from Central and South America. The EU also exports ethanol to surrounding countries in the region (e.g. Norway, Switzerland and Turkey).

- Ethanol imports attract a tariff of €0.192/liter on undenatured ethanol, while denatured ethanol is charged at €0.102/liter. Most countries stipulate that only undenatured ethanol may be used as fuel. Exceptions include the UK, the Netherlands and Sweden.

- The EU has free trade agreements with several countries: Pakistan, Peru, Guatemala, Canada, South Africa and Ukraine.

- In 2013 the European Council applied anti-dumping duties to U.S. ethanol making it uncompetitive in the EU. These duties will expire in February 2018. It has not been confirmed if the duties were renewed for an additional 18 months. If the AD duty is waived, U.S. exports still face a €0.102/liter duty, leaving U.S. ethanol exports at a disadvantage relative to ethanol from duty free origins.

Challenges

- Political support for first generation biofuels has waned.

- The proposal to reduce the limit on crop-based biofuels to 3.8% by 2030 is strongly opposed by the ethanol industry and represents a worst-case scenario for policy. There is a risk that ethanol demand will be lower than forecast.

- The EU demand for fuel is forecast to decline over the next decade. Combined with a cap on crop-based fuels, the overall reduction on the market is significant.

Market Outlook

- The RED II inclusion of crop-based biofuels is still underway. Initially, a reduction from 7 percent to 3.8 percent was proposed, and faced severe opposition from the EU and Brazilian biofuels organizations.

- Some member states are considering replacing blending mandates with GHG mandates. So far Germany is the only country to have made this move but if others follow it will shift demand toward lower GHG fuels.

- The UK’s exit from the EU is underway and the policy is being monitored.

- Supplies of second-generation ethanol are extremely limited as cellulosic ethanol remains unproved at commercial scale.

- By 2020, conventional biofuels (first generation) are projected to grow to 0.34million b/d and account for 4% of gasoline and middle distillate demand.