Ethanol Market Overview

- Fuel ethanol consumption in Canada is driven by a nationwide 5% mandate, some provinces have higher blend rates, and northern provinces are exempt.

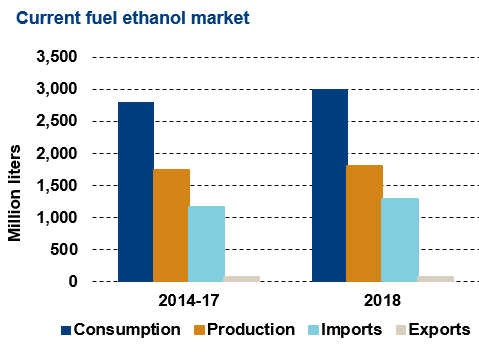

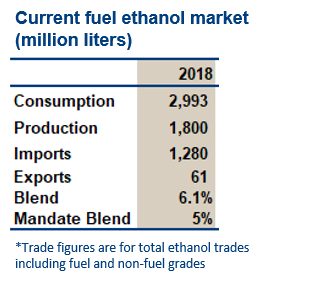

- Consumption in 2018 reached 2.9 billion liters, slightly above the mandated volume. Production is around 1.8 billion liters from 13 plants using grains. There are four cellulosic ethanol plants currently in operation, but output is minimal as most are demonstration or pilot scale facilities.

- Following strong growth between 2005 and 2012 the industry has been stable for several years with demand and output remaining flat. Over this period, the supply gap has been met with imports of around 1.1 billion liters per year from the U.S., equal to around 40% of demand.

Key Facts

- Mandate:

2018 5% (higher in some provinces) - Ethanol consumption:

2018 2.9 billion liters (6.1% blend) - Capacity: 1.8 billion liters

- Ethanol plants: 13 (feedstock: corn & wheat)

- Gasoline consumption forecast:

2022 51.0 billion liters

Policy

- The implementation of a nationwide 5% ethanol mandate was announced under the federal Renewable Fuels Regulations (RFR) on September 1st 2010. The mandate came into effect on December 15th and remains in force today. Some provinces have higher mandates that predate the federal ethanol regulation, which push the average blend above 5% nationwide. All the mandates in place are met.

- As part of its Paris Agreement commitments, and its own climate goals, Canada has set a target to reduce GHG emissions by 30MT by 2030. The Clean Fuel Standard (CFS) is under development to replace the current RFR and is expected to encourage the use of lower carbon fuels and alternative technologies.

- Individual provinces have already made announcements to meet the reductions through increased ethanol use. Ontario has announced plans to move to E10 by 2020 and E15 by 2025. E15 would roughly double Ontario’s current ethanol use.

Trade

- Plants producing ethanol for use in Canada must register with Environment Canada. There is currently no limit on the volume of ethanol imported into the country or regulations on the feedstock or GHG saving required from the fuel. Under the new CFS this is likely to change as the focus will shift to GHG savings.

- Imports of denatured ethanol incur a tariff of 4.92 cents/liter of pure alcohol.

- Canada has a number of free trade agreements including Mexico and the U.S. (under the North American Free Trade Agreement) and the EU. Tariffs on ethanol exports from Canada to the EU were dropped in 2016, however so far this has not impacted trade flows of Canadian ethanol exports to the EU. Any increase in exports are likely to result in higher imports.

- Canada imports around 40% of its total annual consumption, these imports are necessary to meet the mandate as domestic output is not sufficient.

- The vast majority of ethanol imports come from the U.S. Since 2010 the U.S. has been the origin of 99% of all imports.

Ethanol Market Outlook

- Mandates have been left unchanged since 2010. The new CFS is yet to be defined but will see policy shift to focus on GHG savings.

- The government is considering how the existing mandate will work with the new policy mechanism being developed under the CFS.

- One plant is currently undergoing an expansion to increase capacity by 200 mn liters. Depending on the outcome of the CFS, new capacity may come online, especially if incentives are included in the new policy.

- Separate from the CFS, Ontario has proposed an increase of blending to 10% across the province, which accounts for nearly 40% of total gasoline demand in Canada.

Challenges

- Moving to a carbon credit system could see demand for ethanol remain flat or fall in certain provinces.

- The CFS could also see a rise in alternative transport technologies such as electric vehicles.

Market Outlook

- Mandates have been left unchanged since 2010. The new CFS is yet to be defined but will see policy shift to focus on GHG savings.

- The government is considering how the existing mandate will work with the new policy mechanism being developed under the CFS.

- One plant is currently undergoing an expansion to increase capacity by 200 mn liters. Depending on the outcome of the CFS, new capacity may come online, especially if incentives are included in the new policy.

- Separate from the CFS, Ontario has proposed an increase of blending to 10% across the province, which accounts for nearly 40% of total gasoline demand in Canada.