Ethanol, Fuels and Co-Product Pricing

Market Outlook: U.S. ethanol prices were up to end last week, and that trend continued through Tuesday’s trading with nearby CBOT ethanol futures up 1.3 percent from Friday’s close. Midwest wholesale rack ethanol prices were up fractionally to end last week; they continue up this week with prices at 37.24 cents/liter (140.96 cents/gallon) through Tuesday’s trading (+0.4 percent from Friday’s close).

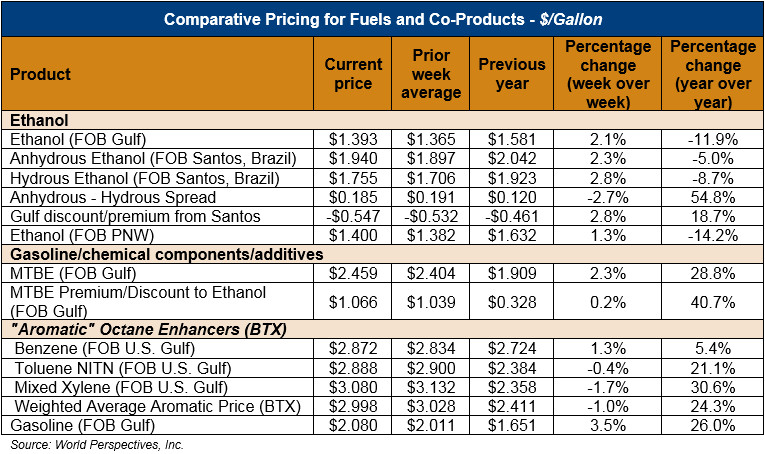

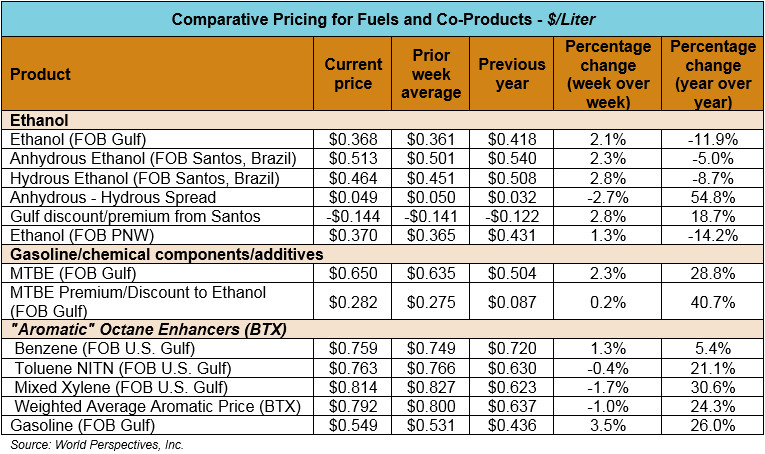

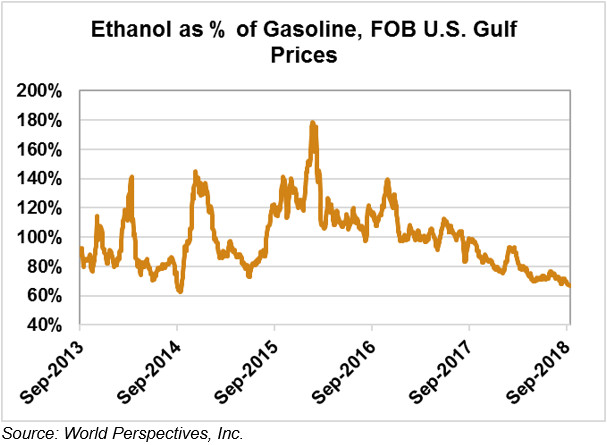

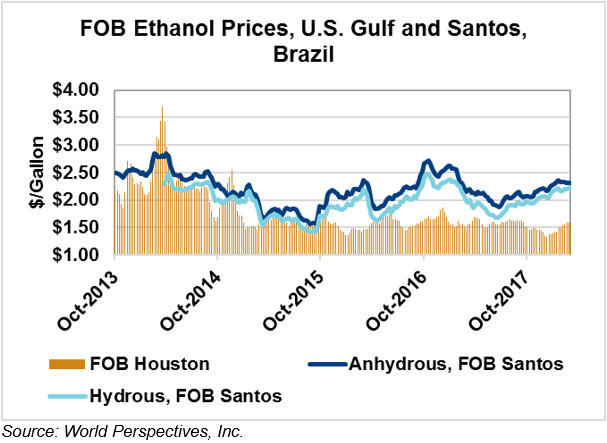

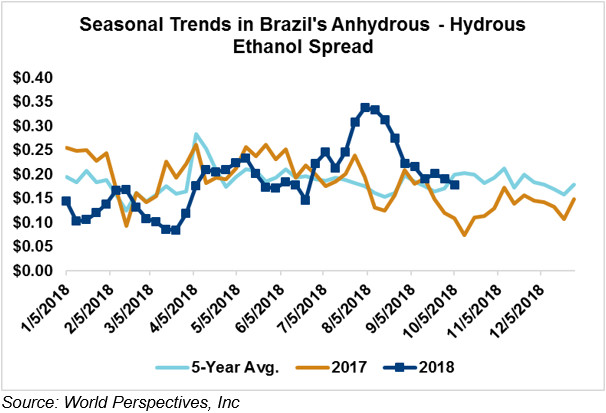

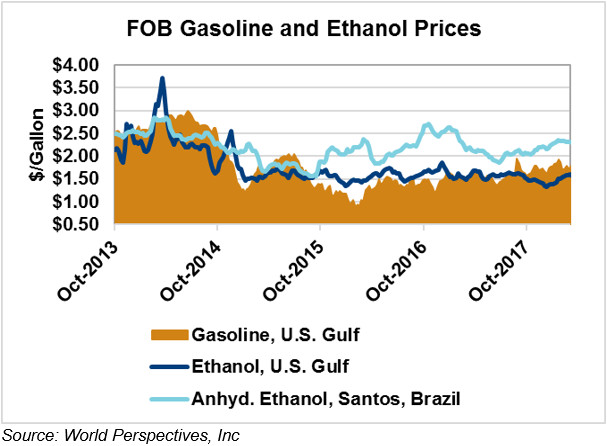

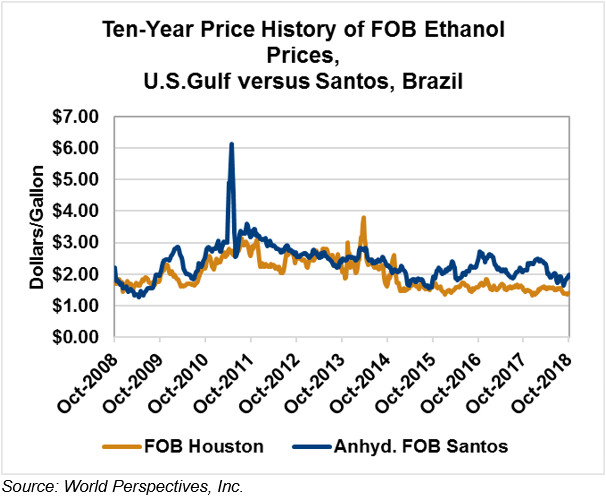

FOB Houston ethanol prices finished last week up 0.8 percent, and prices have jumped through Tuesday’s trading (+2.1 percent from Friday’s close). FOB Houston ethanol prices are quoted at 36.804 cents/liter (139.319 cents/gallon). U.S. ethanol exports totaled over 1 billion gallons through July of this year, putting them on pace for a record 1.77 billion gallons in 2018 – a figure that would surpass 2017’s record of 1.37 billion gallons exported. FOB Santos, Brazil ethanol prices ended last week up 1.6 percent; prices are up 2.3 percent from Friday’s close at 51.253 cents/liter (194.015 cents/gallon) through Tuesday’s trading.

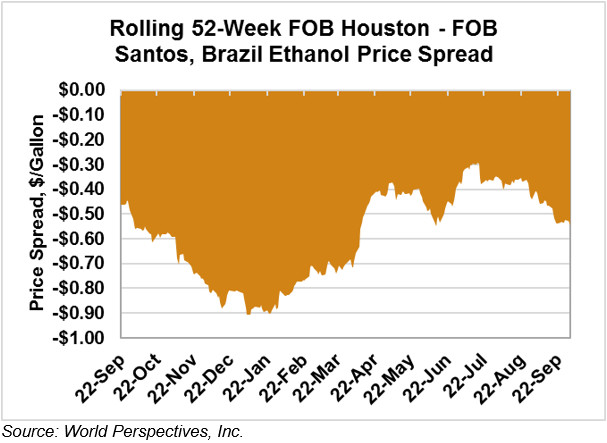

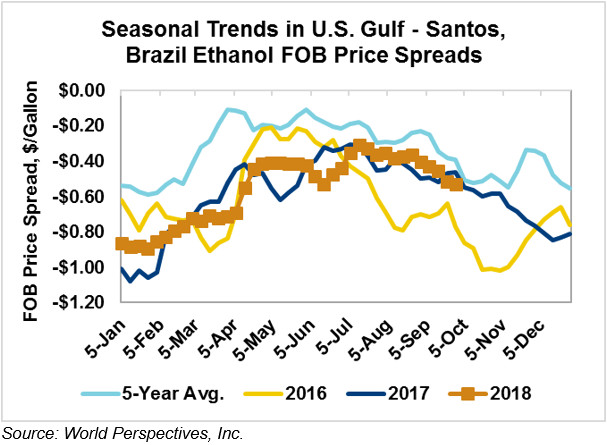

The FOB Gulf-Santos, Brazil spread widened again from last week’s close through Tuesday’s trading and is currently at -14.449 cents/liter (-54.696 cents/gallon).

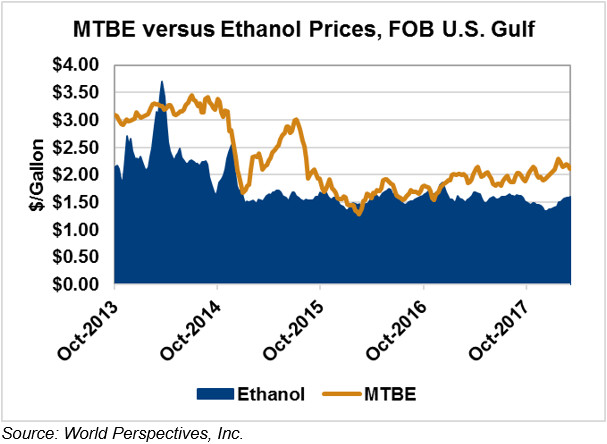

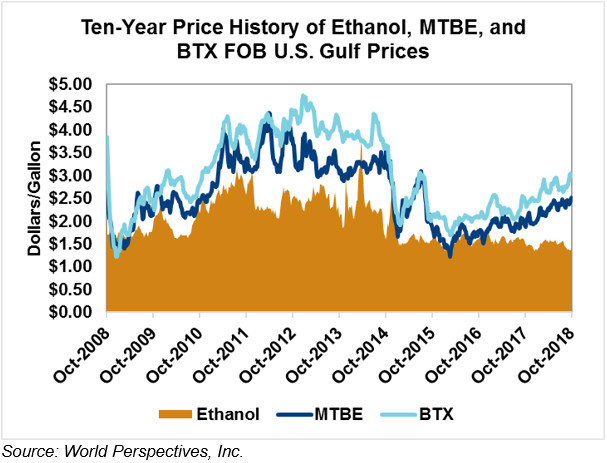

MTBE prices were up slightly to end last week and are up 1.9 percent through early week trading from Friday’s close. MTBE’s premium to FOB Houston ethanol stood at 27.906 cents/liter ($105.63 cents/gallons), widening slightly from last week’s figure.

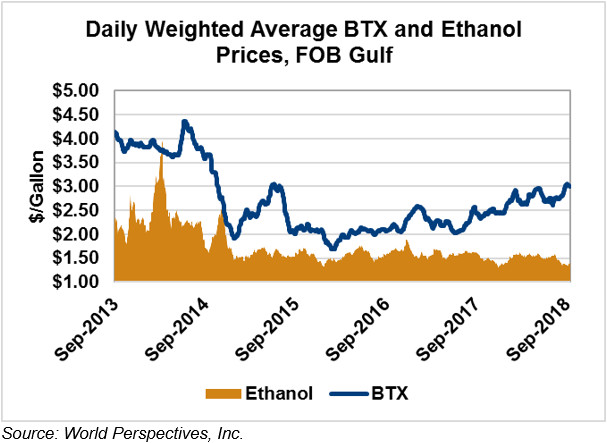

BTX component prices were mixed to end last week and continue mixed through Tuesday’s trading, with Benzene prices up 1.2 percent and Toluene and Xylene prices down 0.5 percent and 1.4 percent, respectively. The estimated weighted average aromatic price is currently 79.30 cents/liter (300.20 cents/gallon), down nearly 1 percent from Friday’s close. The BTX-Houston ethanol spread narrowed, with the weighted average BTX price now 42.499 cents/liter (160.88 cents/gallon) higher than FOB Houston ethanol prices.

Gasoline and petroleum products are up across the board in early week trading, continuing the upward trend of past weeks. WTI and Brent crude oil futures are both up 2.3 percent from Friday’s close through Tuesday’s trading.

Price Database: If you are interested in historical price data, please click here.