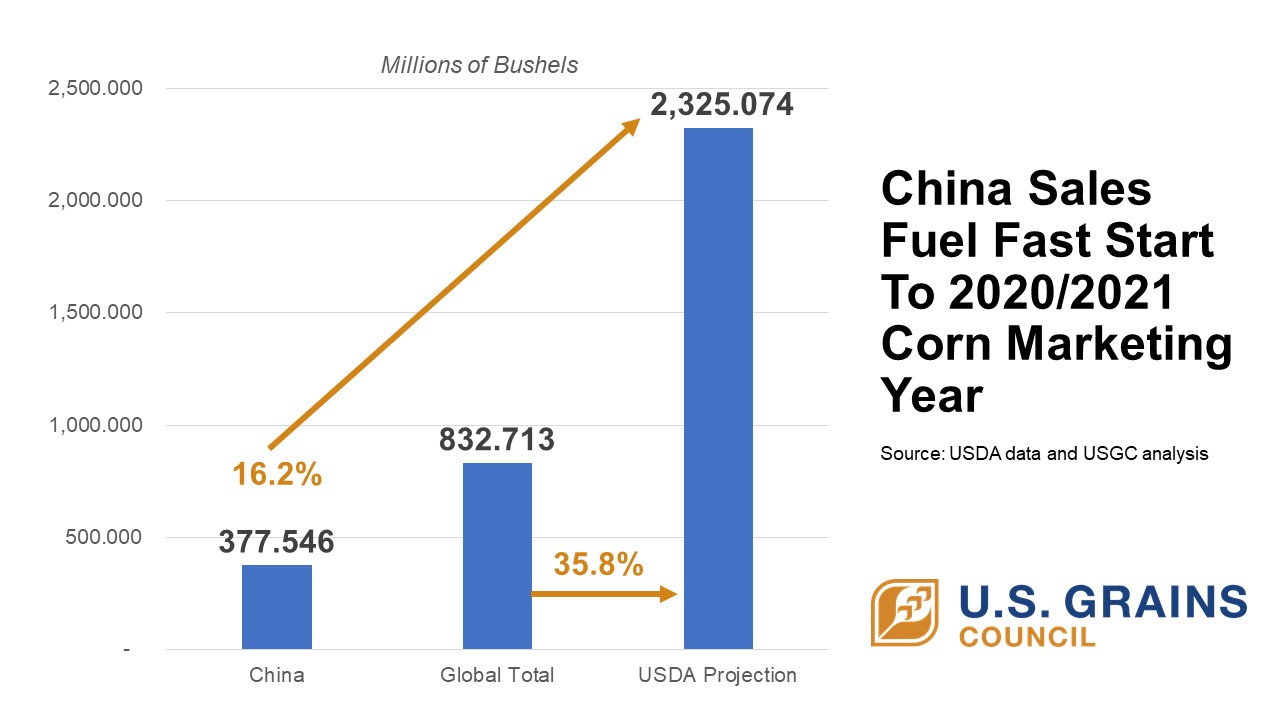

The U.S. corn marketing year began Sept. 1 and already has 832.713 million bushels (21.15 million metric tons) of corn sold on the books, including 377.546 million bushels (9.59 million tons) destined for China alone.

Most of these sales are known as “outstanding sales,” meaning corn contracted but not yet delivered. Total outstanding sales at any point in the marketing year have surpassed 20 million metric tons only a few times since data started being collected in 1990.

Since U.S. corn sales tend to pick up post-harvest, between January and March, having such a significant amount of outstanding sales already in place creates a solid foundation for the new crop year and indicates the potential for large corn sales overall in the coming 12 months.

Such large numbers, particularly from sales to China, are also having a positive impact on price, which is influenced by many supply and demand factors.

About The U.S. Grains Council

The U.S. Grains Council develops export markets for U.S. barley, corn, sorghum and related products including distiller’s dried grains with solubles (DDGS) and ethanol. With full-time presence in 28 locations, the Council operates programs in more than 50 countries and the European Union. The Council believes exports are vital to global economic development and to U.S. agriculture’s profitability. Detailed information about the Council and its programs is online at www.grains.org.